Estate and Transfer Tax Department of Taxation Hawaii Gov 2020

Understanding the Estate and Transfer Tax in Hawaii

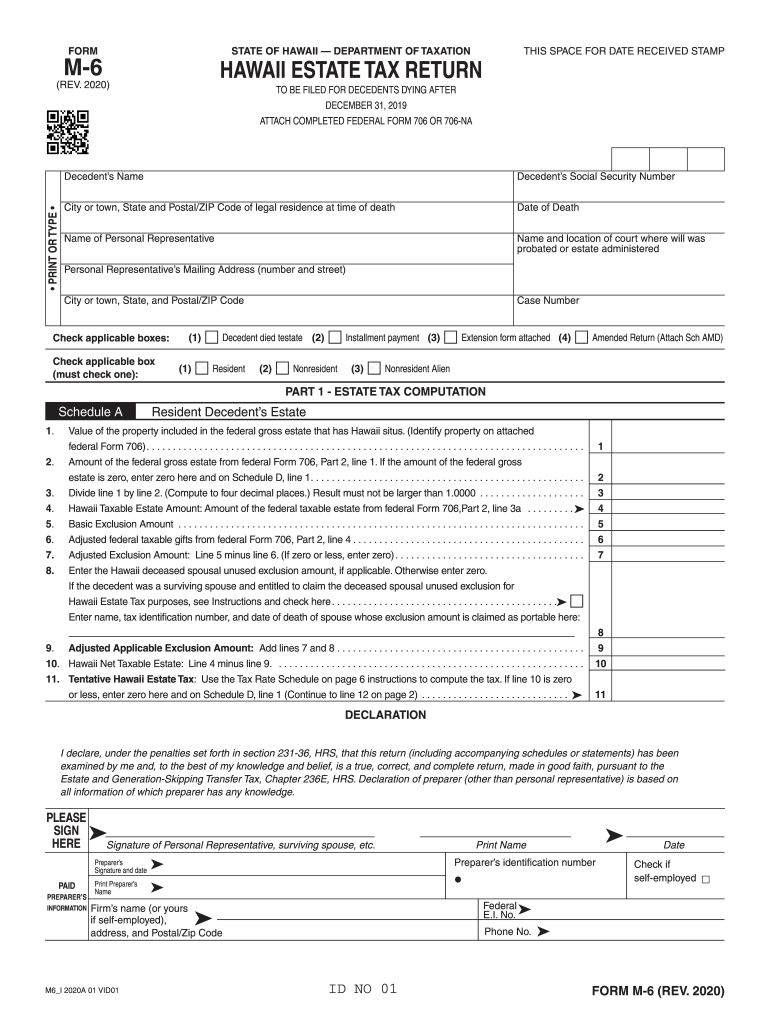

The Estate and Transfer Tax in Hawaii is a tax levied on the transfer of property upon a person's death. This tax is applicable to estates that exceed a certain value threshold, which varies based on the current regulations. The Department of Taxation in Hawaii oversees the collection and enforcement of this tax. Understanding this tax is crucial for estate planning and ensuring compliance with state laws.

Steps to Complete the Estate and Transfer Tax Form

Completing the Estate and Transfer Tax form involves several key steps:

- Gather all necessary documentation, including property valuations and beneficiary information.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Department of Taxation, either online or by mail, as per the guidelines provided.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Estate and Transfer Tax in Hawaii. Generally, the form must be filed within nine months of the decedent's date of death. Missing this deadline can result in penalties and interest on the unpaid tax. Keeping track of important dates ensures compliance and helps avoid unnecessary complications.

Required Documents for Filing

When filing the Estate and Transfer Tax form, several documents are required to support your submission:

- Death certificate of the decedent.

- Property appraisals to determine the value of the estate.

- Information on debts and liabilities associated with the estate.

- Details of beneficiaries and their respective shares.

Legal Use of the Estate and Transfer Tax Form

The Estate and Transfer Tax form serves a legal purpose in documenting the transfer of assets upon death. It is essential for ensuring that the estate is settled according to state laws and that taxes are properly assessed and paid. Utilizing this form correctly helps protect the interests of the estate and its beneficiaries.

Penalties for Non-Compliance

Failure to comply with the Estate and Transfer Tax regulations can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to adhere to all filing requirements and deadlines to avoid these consequences and ensure a smooth estate settlement process.

Quick guide on how to complete estate and transfer tax department of taxation hawaiigov

Effortlessly prepare Estate And Transfer Tax Department Of Taxation Hawaii gov on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly replacement for traditional printed and signed papers, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Handle Estate And Transfer Tax Department Of Taxation Hawaii gov on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Estate And Transfer Tax Department Of Taxation Hawaii gov with ease

- Find Estate And Transfer Tax Department Of Taxation Hawaii gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Estate And Transfer Tax Department Of Taxation Hawaii gov to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estate and transfer tax department of taxation hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the estate and transfer tax department of taxation hawaiigov

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is form m 6?

Form M 6 is a specific document used in various business processes. With airSlate SignNow, you can easily create, edit, and eSign Form M 6 to streamline your documentation process and enhance efficiency.

-

How does airSlate SignNow support form m 6?

airSlate SignNow provides a comprehensive platform to manage Form M 6 efficiently. You can upload, fill out, and send this form for electronic signatures, making it a secure and fast way to handle your paperwork.

-

What are the pricing options for using airSlate SignNow for form m 6?

airSlate SignNow offers competitive pricing plans tailored to meet different business needs. These plans include features specifically for managing documents like Form M 6, ensuring you get the best value for your investment in document management.

-

Can form m 6 be integrated with other software?

Yes, airSlate SignNow supports integrations with various applications to enhance your workflow. You can seamlessly connect Form M 6 with tools like CRM systems or project management applications to ensure all your processes are aligned.

-

What are the benefits of using airSlate SignNow for form m 6?

Using airSlate SignNow for Form M 6 offers numerous benefits, including improved efficiency, enhanced security, and reduced turnaround times. This cloud-based solution helps you manage your documentation effortlessly, allowing you to focus on more critical business activities.

-

Is eSigning form m 6 legally binding?

Absolutely, eSigning Form M 6 through airSlate SignNow is legally binding. The platform complies with all necessary regulations, ensuring that your signed documents hold up in any legal context.

-

How does airSlate SignNow ensure the security of my form m 6 documents?

airSlate SignNow implements robust security measures to protect your Form M 6 documents. This includes encryption, secure cloud storage, and customizable access controls, ensuring that your sensitive information remains confidential.

Get more for Estate And Transfer Tax Department Of Taxation Hawaii gov

Find out other Estate And Transfer Tax Department Of Taxation Hawaii gov

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement