State Net Operating Loss ProvisionsTax Foundation 2022

Understanding the State Net Operating Loss Provisions

The State Net Operating Loss (NOL) provisions allow businesses to carry forward losses to offset future taxable income. This can be crucial for companies that experience fluctuations in revenue. Under these provisions, businesses can reduce their state tax liabilities in profitable years by utilizing losses incurred in previous years. Understanding these provisions is essential for effective tax planning and compliance.

Steps to Complete the State Net Operating Loss Provisions

Completing the State Net Operating Loss provisions involves several key steps:

- Determine the amount of net operating loss for the year.

- Review state-specific regulations to understand carryforward and carryback options.

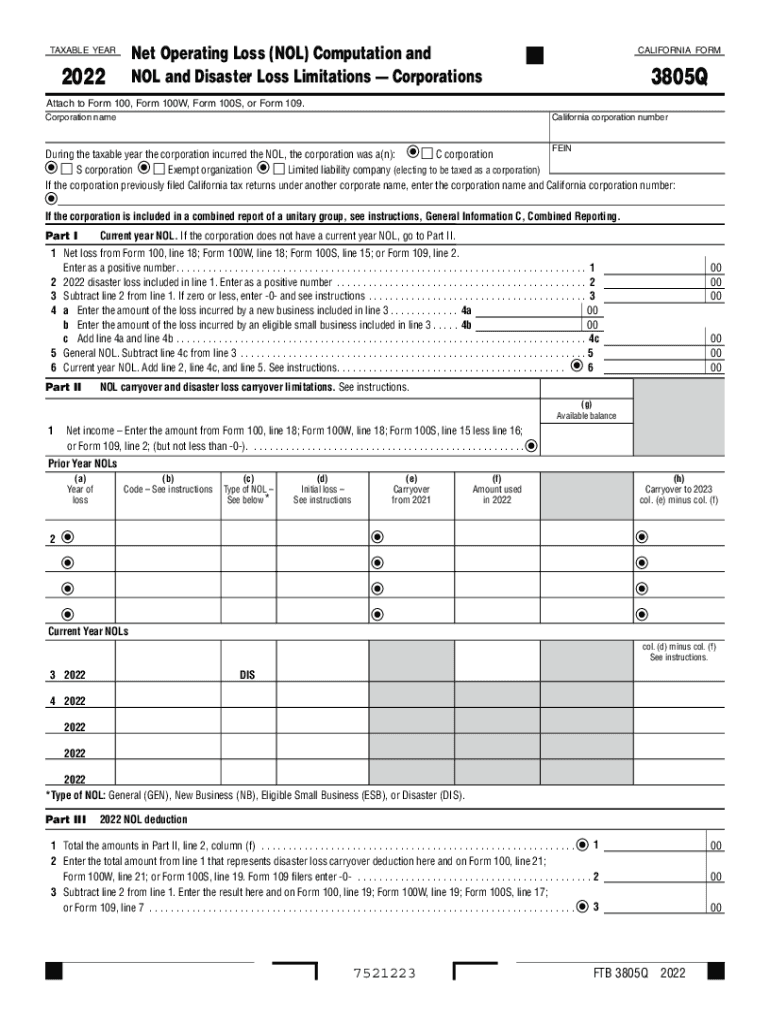

- Complete the necessary forms, such as the form 3805Q current year code, accurately reflecting the NOL.

- Attach supporting documentation that verifies the loss claimed.

- File the forms with the appropriate state tax authority by the specified deadline.

Eligibility Criteria for State Net Operating Loss Provisions

To qualify for the State Net Operating Loss provisions, businesses must meet certain criteria:

- Be a registered entity within the state.

- Have incurred a net operating loss during the tax year.

- Follow state-specific guidelines regarding the calculation of NOL.

- File tax returns accurately and on time to maintain eligibility.

Key Elements of the State Net Operating Loss Provisions

Understanding the key elements of the State Net Operating Loss provisions is vital for effective tax management:

- Carryforward Period: The duration for which losses can be carried forward varies by state.

- Limitations: Some states impose limitations on the amount of NOL that can be utilized in a given year.

- Documentation: Accurate records must be maintained to substantiate claims of net operating losses.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for compliance. Typically, the deadlines for submitting forms related to the State Net Operating Loss provisions align with the state tax return deadlines. Businesses should be aware of:

- The annual tax return due date.

- Any extensions that may apply for filing.

- Specific dates for submitting amendments if needed.

Penalties for Non-Compliance

Failure to comply with the State Net Operating Loss provisions can lead to significant penalties. These may include:

- Fines for late filing or inaccurate reporting.

- Loss of eligibility to carry forward losses in subsequent years.

- Increased scrutiny from state tax authorities, leading to audits.

Quick guide on how to complete state net operating loss provisionstax foundation

Effortlessly Prepare State Net Operating Loss ProvisionsTax Foundation on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without hindrances. Manage State Net Operating Loss ProvisionsTax Foundation on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Edit and Electronically Sign State Net Operating Loss ProvisionsTax Foundation with Ease

- Obtain State Net Operating Loss ProvisionsTax Foundation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign State Net Operating Loss ProvisionsTax Foundation and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state net operating loss provisionstax foundation

Create this form in 5 minutes!

How to create an eSignature for the state net operating loss provisionstax foundation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 3805q current year code?

The form 3805q current year code is a tax form specific to California that allows certain tax credits for businesses and individuals. It is essential to understand this code as it helps taxpayers claim the tax benefits accurately when filing their returns. Properly utilizing the form 3805q current year code can result in signNow savings.

-

How does airSlate SignNow assist with the form 3805q current year code?

airSlate SignNow simplifies the process of completing and eSigning critical documents like the form 3805q current year code. Our platform provides templates and customizable forms, ensuring that you can efficiently manage your tax documentation with ease. Using airSlate SignNow helps streamline your filing process.

-

Is there a cost associated with using airSlate SignNow for the form 3805q current year code?

Yes, there is a subscription cost associated with airSlate SignNow, but we offer several pricing tiers to meet different business needs. Our pricing packages are designed to provide excellent value for those needing to manage forms like the form 3805q current year code. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the form 3805q current year code?

airSlate SignNow offers a range of features including document templates, eSignature capabilities, and team collaboration tools that are perfect for managing the form 3805q current year code. Users can easily customize their documents, track signing progress, and set reminders for deadlines. These features contribute to a smooth workflow when dealing with tax forms.

-

Can I integrate airSlate SignNow with other software to assist with the form 3805q current year code?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems, facilitating better organization when handling the form 3805q current year code. This integration enables users to pull data from other platforms to populate forms, reducing repetitive tasks and errors. Automation ensures you can focus on filing without hassle.

-

What are the benefits of using airSlate SignNow for the form 3805q current year code?

Using airSlate SignNow for the form 3805q current year code offers numerous benefits such as enhanced efficiency, reduced paperwork, and secure document management. Our platform ensures compliance and saves time by allowing users to manage their tax filings digitally. Moreover, the integration of eSignatures promotes faster approvals and processing.

-

Is there customer support available for questions about the form 3805q current year code?

Absolutely, airSlate SignNow provides robust customer support for any inquiries regarding the form 3805q current year code. Our dedicated support team is available to help you navigate the features of our platform and ensure you’re utilizing it to its fullest potential. You can signNow out via chat, email, or phone.

Get more for State Net Operating Loss ProvisionsTax Foundation

- Warranty deed from individual to husband and wife minnesota form

- Minnesota transfer death form

- Quitclaim deed from corporation to husband and wife minnesota form

- Warranty deed from corporation to husband and wife minnesota form

- Quitclaim deed from corporation to individual minnesota form

- Mn warranty deed 497311896 form

- Quitclaim deed from corporation to llc minnesota form

- Quitclaim deed from corporation to corporation minnesota form

Find out other State Net Operating Loss ProvisionsTax Foundation

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement