Form 3805Q Net Operating Loss NOL Computation and NOL and Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO 2019

Understanding Form 3805Q for Net Operating Loss Computation

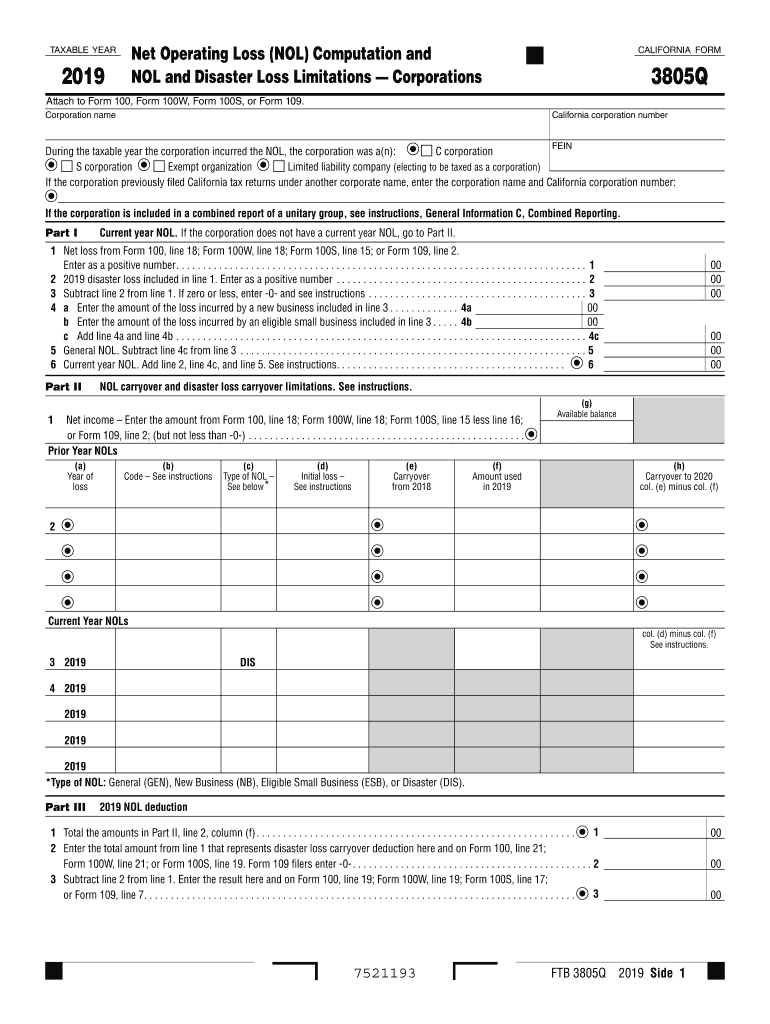

The Form 3805Q is essential for corporations in California to compute net operating losses (NOL) and disaster loss limitations. This form allows businesses to report their losses, which can be carried forward to offset taxable income in future years. Understanding the purpose of this form is crucial for effective tax planning and compliance.

Steps to Complete Form 3805Q

Completing the Form 3805Q involves several key steps:

- Gather financial statements and records of losses incurred.

- Fill out the identification section, including the corporation's name and tax ID.

- Calculate the net operating loss using the provided worksheets.

- Report any disaster losses separately, if applicable.

- Review the completed form for accuracy before submission.

Legal Use of Form 3805Q

The legal validity of the Form 3805Q hinges on its proper completion and adherence to state tax laws. Corporations must ensure that the information reported is accurate and substantiated by appropriate documentation. This form is recognized by the California Franchise Tax Board, making it a critical component of corporate tax compliance.

Obtaining Form 3805Q

Corporations can obtain the Form 3805Q from the California Franchise Tax Board's website or through authorized tax professionals. It is important to ensure that the most current version of the form is used to comply with the latest tax regulations.

Filing Deadlines for Form 3805Q

Timely filing of the Form 3805Q is crucial to avoid penalties. Corporations should be aware of the specific deadlines, which typically align with the corporate tax return due dates. Extensions may be available, but they must be filed appropriately to ensure compliance.

Key Elements of Form 3805Q

Several key elements are vital for completing the Form 3805Q:

- Identification of the corporation and tax year.

- Calculation of the net operating loss.

- Documentation of any disaster losses.

- Signature and date to validate the submission.

Quick guide on how to complete 2019 form 3805q net operating loss nol computation and nol and disaster loss limitationscorporations 2019 form 3805q net

Effortlessly Prepare Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Handle Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO with Ease

- Obtain Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and then select the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 3805q net operating loss nol computation and nol and disaster loss limitationscorporations 2019 form 3805q net

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 3805q net operating loss nol computation and nol and disaster loss limitationscorporations 2019 form 3805q net

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What are the CA Form 3805Q instructions?

The CA Form 3805Q instructions guide California taxpayers on how to complete the form for claiming a credit for taxes paid to other jurisdictions. Understanding these instructions is crucial to ensure compliance with state regulations and to accurately report your income. Our resources at airSlate SignNow can help simplify filling out this form.

-

How can airSlate SignNow assist with CA Form 3805Q?

airSlate SignNow provides a user-friendly platform that allows you to electronically sign and send CA Form 3805Q with ease. This not only saves time but also enhances the accuracy of your submissions. Our solution ensures that you follow the CA Form 3805Q instructions correctly while streamlining your document process.

-

Is there a cost associated with using airSlate SignNow for CA Form 3805Q?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there are subscription plans to choose from based on your needs. These plans provide you with the tools necessary to manage forms like the CA Form 3805Q efficiently. By using our platform, you can save both time and money in handling your tax documents.

-

What features does airSlate SignNow offer for managing CA Form 3805Q?

airSlate SignNow offers a variety of features for managing the CA Form 3805Q, including electronic signatures, customizable templates, and integration options with popular software. These features ensure that you can complete the CA Form 3805Q instructions efficiently and securely. With airSlate SignNow, you'll benefit from enhanced workflow and document tracking.

-

Can I integrate airSlate SignNow with other applications for CA Form 3805Q?

Absolutely! airSlate SignNow seamlessly integrates with several applications and systems, making it easy to manage documents associated with the CA Form 3805Q. This integration allows you to streamline your workflow and access all your necessary documents in one place. By following the CA Form 3805Q instructions on our platform, you can enhance your productivity.

-

How secure is airSlate SignNow when handling CA Form 3805Q?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your documents, including the CA Form 3805Q. You can confidently manage sensitive tax information, knowing that it meets industry standards for security and compliance.

-

What support does airSlate SignNow provide for CA Form 3805Q users?

airSlate SignNow offers comprehensive customer support to help you with any questions or issues regarding the CA Form 3805Q. Our support team is knowledgeable about the CA Form 3805Q instructions and can guide you through the process. Whether you need assistance with technical issues or have questions about the features, we are here to help.

Get more for Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO

Find out other Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss LimitationsCorporations Form 3805Q Net Operating Loss NO

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors