Form 3805Q Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations Corporations 2024-2026

Understanding Form 3805Q for Net Operating Loss Computation

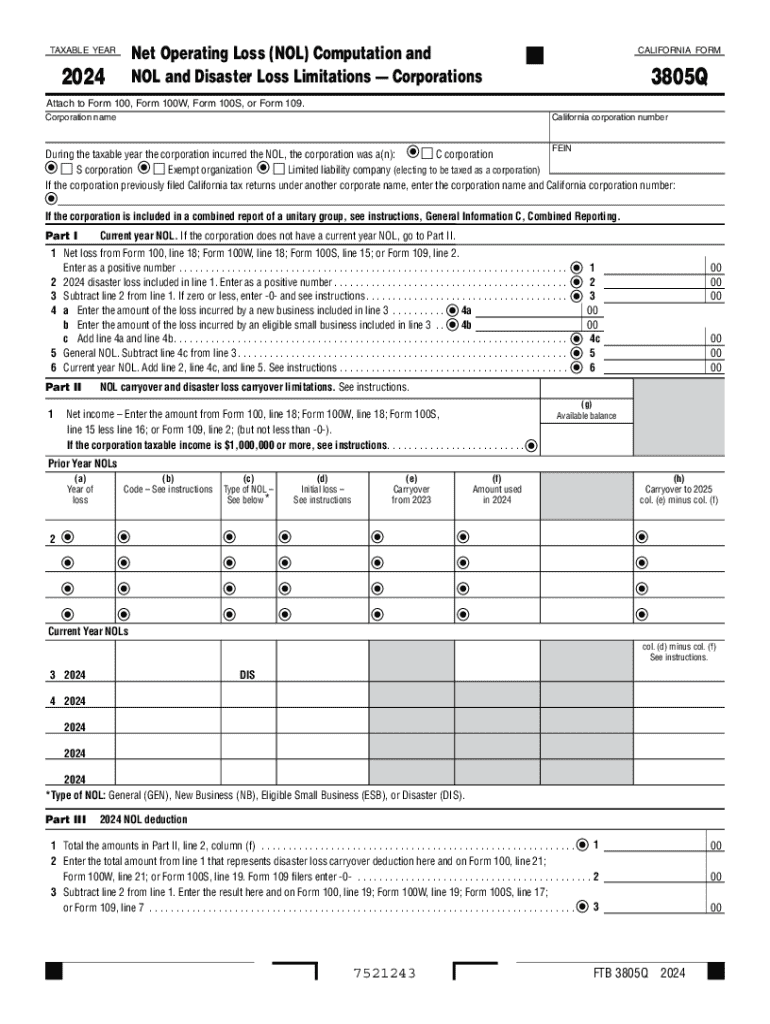

The Form 3805Q is utilized by corporations to compute net operating losses (NOL) and to apply for disaster loss limitations. This form is essential for businesses that have experienced financial setbacks, allowing them to offset taxable income in future years. The NOL can be carried forward or back to reduce tax liabilities, providing significant relief during challenging financial periods.

Steps for Completing Form 3805Q

Completing the Form 3805Q involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate the net operating loss by determining total income and allowable deductions.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the form for completeness before submission.

Each of these steps is crucial to ensure compliance with IRS regulations and to maximize potential tax benefits.

Legal Use of Form 3805Q

Form 3805Q is legally recognized for corporations to report their net operating losses. It is important for businesses to understand the legal implications of filing this form. Accurate reporting can prevent penalties and ensure that corporations remain in good standing with tax authorities. Misuse or inaccuracies in the form can lead to audits or additional tax liabilities.

Examples of Using Form 3805Q

Businesses can benefit from Form 3805Q in various scenarios. For instance, a corporation that incurred significant losses due to unforeseen circumstances, such as natural disasters, can use this form to carry those losses forward to offset future profits. This can lead to substantial tax savings. Additionally, companies that have fluctuating revenues can strategically use the NOL to balance out income across different tax years.

Filing Deadlines for Form 3805Q

Corporations must be aware of the filing deadlines associated with Form 3805Q. Typically, the form should be submitted along with the corporation's tax return for the year in which the loss occurred. It is crucial to adhere to these deadlines to ensure that the losses can be applied to future tax liabilities effectively. Missing the deadline can result in the loss of the opportunity to utilize the NOL.

Eligibility Criteria for Form 3805Q

To qualify for using Form 3805Q, corporations must meet specific eligibility criteria. Generally, the corporation must be subject to U.S. taxation and must have incurred a net operating loss during the tax year. Additionally, the losses must be properly documented and calculated according to IRS guidelines. Understanding these criteria is vital for businesses seeking to leverage their losses for tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct form 3805q net operating loss nol computation and nol and disaster loss limitations corporations

Create this form in 5 minutes!

How to create an eSignature for the form 3805q net operating loss nol computation and nol and disaster loss limitations corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 3805q and how does it benefit my business?

The 2024 3805q is a powerful tool offered by airSlate SignNow that streamlines the process of sending and eSigning documents. By utilizing this solution, businesses can enhance their workflow efficiency, reduce turnaround times, and ensure secure document handling. This ultimately leads to improved productivity and customer satisfaction.

-

How much does the 2024 3805q cost?

The pricing for the 2024 3805q varies based on the specific features and number of users required. airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring that you can find a cost-effective solution that meets your needs. For detailed pricing information, it's best to visit our website or contact our sales team.

-

What features are included in the 2024 3805q?

The 2024 3805q includes a range of features designed to simplify document management, such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and offers integrations with popular applications, making it a versatile choice for any business. These features help streamline your document workflows effectively.

-

Can the 2024 3805q integrate with other software?

Yes, the 2024 3805q seamlessly integrates with various software applications, including CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to enhance their existing workflows and improve overall efficiency. By connecting with your favorite tools, airSlate SignNow ensures a smooth document management experience.

-

Is the 2024 3805q secure for sensitive documents?

Absolutely! The 2024 3805q prioritizes security by employing advanced encryption methods and compliance with industry standards. This ensures that your sensitive documents are protected throughout the signing process. With airSlate SignNow, you can confidently manage and eSign documents without compromising security.

-

How easy is it to use the 2024 3805q?

The 2024 3805q is designed with user-friendliness in mind, making it accessible for everyone, regardless of technical expertise. The intuitive interface allows users to quickly navigate through the document sending and signing process. With minimal training, your team can start leveraging the benefits of airSlate SignNow right away.

-

What are the benefits of using the 2024 3805q for remote teams?

The 2024 3805q is particularly beneficial for remote teams as it enables them to collaborate on documents from anywhere in the world. With features like real-time updates and electronic signatures, teams can work together efficiently without the need for physical meetings. This flexibility enhances productivity and ensures that projects stay on track.

Get more for Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Corporations

- Boehringer ingelheim patient assistance printable renewal forms

- Fm 043 instructions form

- Form a2 202765151

- Pag ibig fund pagibigfund gov form

- Hospital tengku ampuan rahimah klang htar form

- Fillable online application to travel out of province bcsoccer net form

- Fillable online bcspl application to travel out of province fax form

- Application to travel out of province bc soccer form

Find out other Form 3805Q Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Corporations

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online