Changes to the Net Operating Loss Carryover and Loosening of 2020

Understanding Changes to the Net Operating Loss Carryover

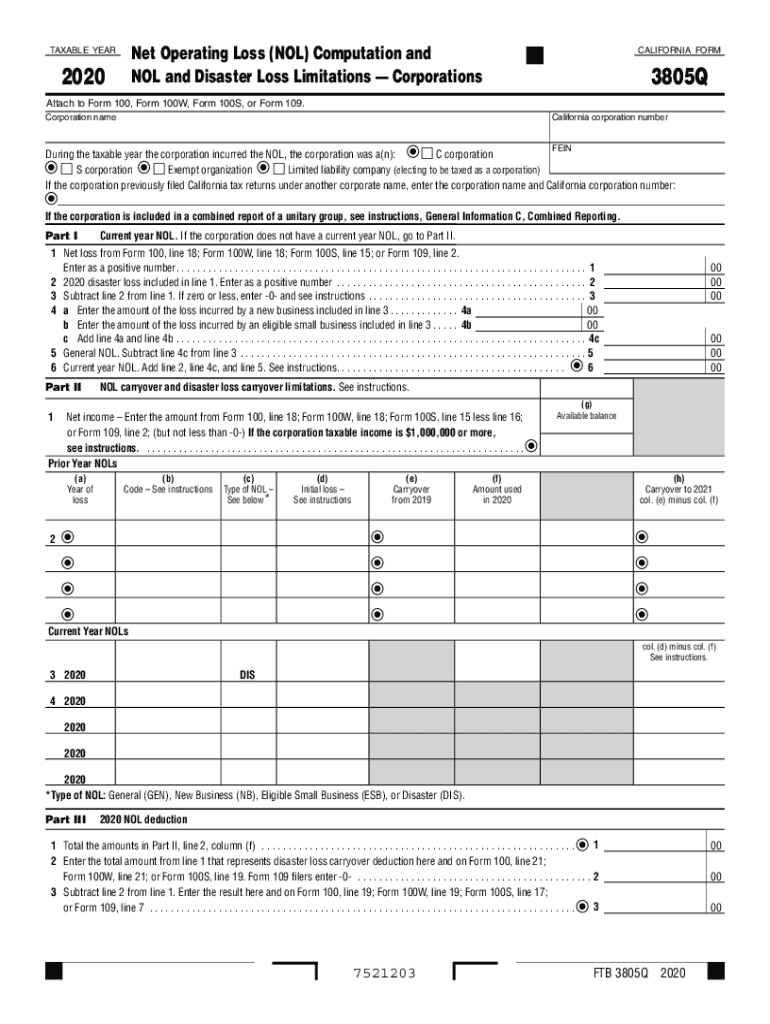

The 3805q form addresses significant updates regarding the net operating loss (NOL) carryover provisions. These changes allow businesses to utilize losses from prior years to offset taxable income in current or future years, enhancing cash flow and financial stability. The revisions may include adjustments to the percentage of income that can be offset, as well as the duration for which losses can be carried forward. Understanding these changes is essential for businesses looking to optimize their tax strategies.

Steps to Complete the 3805q Form

Completing the 3805q form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, follow these steps:

- Fill out the identification section with your business details.

- Calculate your net operating loss for the year based on your financial records.

- Apply the new carryover rules to determine how much of your NOL can be utilized.

- Complete any additional sections as required by the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using the 3805q Form

To utilize the 3805q form, businesses must meet specific eligibility criteria. Generally, these criteria include:

- Operating as a corporation or partnership in California.

- Experiencing a net operating loss during the tax year in question.

- Complying with state tax regulations and maintaining proper documentation.

Ensuring that your business meets these criteria is crucial for leveraging the benefits of the NOL carryover provisions.

Filing Deadlines for the 3805q Form

Timely filing of the 3805q form is essential to avoid penalties and ensure compliance. The typical deadline for submitting this form aligns with the annual tax return due date for your business entity. For most corporations, this is generally the fifteenth day of the third month following the end of the tax year. It is advisable to check for any specific extensions or changes that may apply to your situation.

Legal Use of the 3805q Form

The 3805q form is legally recognized for reporting net operating losses and is essential for compliance with California tax laws. To ensure its legal validity, businesses must adhere to the guidelines set forth by the California Franchise Tax Board (FTB) and maintain accurate records supporting their claims. Utilizing a reliable electronic signature tool can further enhance the legal standing of the submitted form.

Form Submission Methods for the 3805q

Businesses have several options for submitting the 3805q form. These methods include:

- Online submission through the California Franchise Tax Board's e-file system.

- Mailing a paper copy of the completed form to the appropriate FTB address.

- In-person submission at designated FTB offices.

Choosing the right submission method can help streamline the filing process and ensure timely processing of your form.

Quick guide on how to complete changes to the net operating loss carryover and loosening of

Prepare Changes To The Net Operating Loss Carryover And Loosening Of effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Changes To The Net Operating Loss Carryover And Loosening Of on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Changes To The Net Operating Loss Carryover And Loosening Of with ease

- Obtain Changes To The Net Operating Loss Carryover And Loosening Of and then click Get Form to begin.

- Use the tools we supply to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your adjustments.

- Select how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Changes To The Net Operating Loss Carryover And Loosening Of and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct changes to the net operating loss carryover and loosening of

Create this form in 5 minutes!

How to create an eSignature for the changes to the net operating loss carryover and loosening of

The way to make an e-signature for your PDF in the online mode

The way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 3805q?

airSlate SignNow is a robust eSigning solution that allows businesses to send and sign documents digitally. By leveraging features related to the 3805q functionality, users can streamline their document processing needs efficiently.

-

How much does airSlate SignNow cost when using the 3805q feature?

The pricing for airSlate SignNow varies based on the plan selected, but it is designed to be cost-effective. When utilizing features related to the 3805q, users can access premium functionalities that enhance their eSigning experience without breaking the budget.

-

What key features does airSlate SignNow provide with the 3805q functionality?

With the 3805q feature, airSlate SignNow offers capabilities such as document templates, in-person signing, and advanced tracking. These features ensure that users can manage their eSigning tasks efficiently and effectively.

-

How can the 3805q improve my business operations?

Implementing the 3805q capabilities of airSlate SignNow can signNowly improve business operations by reducing paperwork and speeding up the signing process. This results in faster turnaround times and improved client satisfaction.

-

Is airSlate SignNow compatible with other software solutions in relation to 3805q?

Yes, airSlate SignNow is highly integrative and can work seamlessly with various software solutions. When using the 3805q feature, users can integrate with CRM systems, cloud storage services, and more to enhance their workflow.

-

What types of documents can I eSign using the 3805q capabilities?

You can eSign a wide variety of documents with airSlate SignNow utilizing the 3805q functionality. This includes contracts, legal agreements, and any documents that require a digital signature, making it a versatile solution.

-

How secure is airSlate SignNow in relation to 3805q and document management?

airSlate SignNow prioritizes security, employing encryption and other security measures to protect documents. When using features related to the 3805q, users can trust that their sensitive information remains safe throughout the signing process.

Get more for Changes To The Net Operating Loss Carryover And Loosening Of

Find out other Changes To The Net Operating Loss Carryover And Loosening Of

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form