Form it 252 Investment Tax Credit for the Financial Services 2022

What is the Form IT 252 Investment Tax Credit For The Financial Services

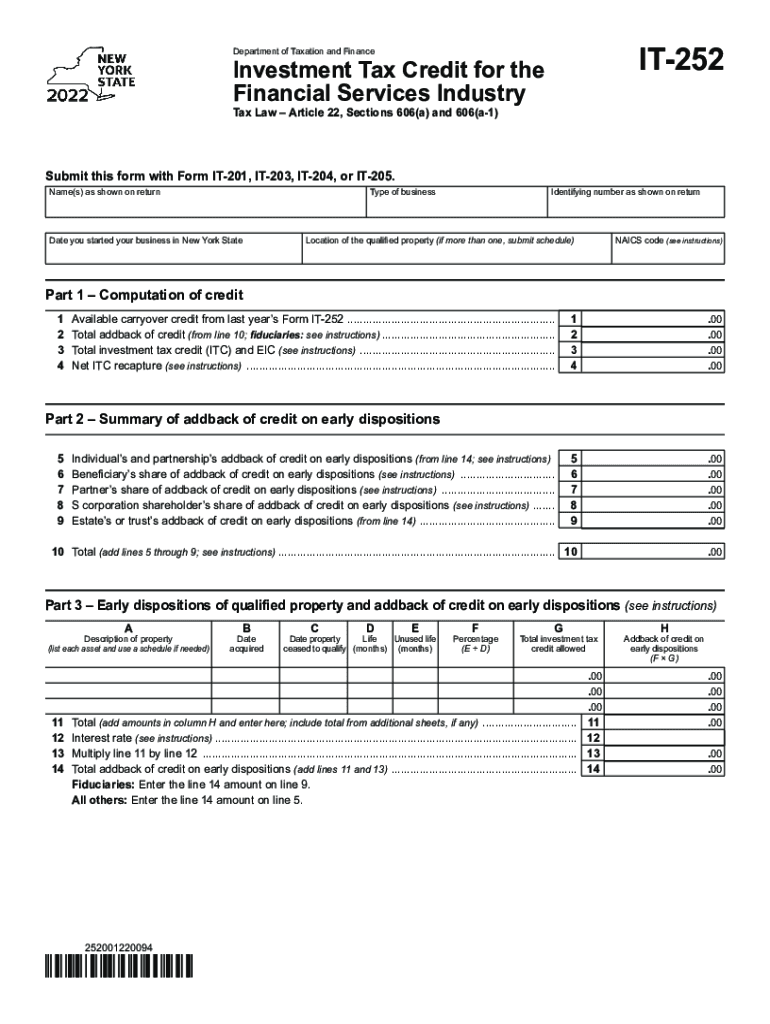

The Form IT 252 is a crucial document used to claim the Investment Tax Credit specifically for financial services. This credit is designed to incentivize businesses in the financial sector to invest in qualified property, thereby stimulating economic growth. By utilizing this form, eligible entities can reduce their tax liability, making it an essential tool for financial service providers looking to enhance their capital investments.

How to use the Form IT 252 Investment Tax Credit For The Financial Services

To effectively use the Form IT 252, businesses must first ensure they meet the eligibility criteria set forth by the IRS. Once eligibility is confirmed, the form should be completed with accurate details regarding the investments made in qualified properties. This includes providing information on the type of property, the amount invested, and any relevant dates. After completing the form, it should be submitted along with the business's tax return to claim the credit.

Steps to complete the Form IT 252 Investment Tax Credit For The Financial Services

Completing the Form IT 252 involves several key steps:

- Gather necessary documentation, including proof of investment and property details.

- Fill out the form with accurate financial information, ensuring all sections are completed.

- Review the form for accuracy and completeness to avoid delays in processing.

- Submit the completed form alongside your tax return by the designated deadline.

Eligibility Criteria

Eligibility for the Form IT 252 is primarily determined by the type of investments made in qualified properties. Generally, businesses must be engaged in financial services and have made significant capital investments to qualify for the credit. Specific criteria include the nature of the property, the amount invested, and compliance with state and federal regulations. It is essential for businesses to review these criteria carefully to ensure they qualify before submitting the form.

Legal use of the Form IT 252 Investment Tax Credit For The Financial Services

The legal use of Form IT 252 is governed by IRS regulations, which outline the requirements for claiming the Investment Tax Credit. To ensure compliance, businesses must adhere to all guidelines regarding eligible property types and investment amounts. Additionally, maintaining accurate records and documentation is vital for substantiating the claim in case of an audit. Utilizing a reliable eSignature solution can further enhance the legality and security of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 252 align with the standard tax return deadlines. Typically, businesses must submit the form by April 15 for the preceding tax year, unless an extension is filed. It is crucial to be aware of these dates to ensure timely submission and avoid penalties. Keeping track of any changes to tax regulations or deadlines is also important for compliance.

Quick guide on how to complete form it 252 investment tax credit for the financial services

Set up Form IT 252 Investment Tax Credit For The Financial Services effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your files swiftly without delays. Manage Form IT 252 Investment Tax Credit For The Financial Services on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Form IT 252 Investment Tax Credit For The Financial Services with ease

- Find Form IT 252 Investment Tax Credit For The Financial Services and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 252 Investment Tax Credit For The Financial Services to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 252 investment tax credit for the financial services

Create this form in 5 minutes!

How to create an eSignature for the form it 252 investment tax credit for the financial services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 'it 252'?

airSlate SignNow is a powerful eSignature solution designed to streamline the document signing process. It 252 denotes an aspect of our platform that enhances the efficiency of digital transactions for businesses, ensuring security and compliance.

-

How does airSlate SignNow pricing work for users interested in 'it 252'?

Our pricing structure for airSlate SignNow is flexible and designed to accommodate various business needs. Users interested in 'it 252' can take advantage of competitive rates that offer access to premium features, ensuring value for money.

-

What key features does airSlate SignNow offer in relation to 'it 252'?

Key features of airSlate SignNow include customizable templates, document tracking, and in-depth analytics. These features are particularly relevant for 'it 252' customers looking for an efficient method to manage documents and enhance productivity.

-

What benefits can businesses gain from using airSlate SignNow for 'it 252'?

By utilizing airSlate SignNow for 'it 252', businesses can signNowly reduce turnaround time on document approvals. This seamless process not only enhances customer satisfaction but also streamlines internal operations, allowing teams to focus on core tasks.

-

Can airSlate SignNow integrate with other software for 'it 252' users?

Yes, airSlate SignNow offers robust integrations with popular software tools tailored for 'it 252' users. This allows for improved workflow automation and seamless data transfer between applications, enhancing overall productivity.

-

Is airSlate SignNow secure for handling sensitive documents related to 'it 252'?

Absolutely, airSlate SignNow prioritizes security and compliance for all documents processed, including those linked to 'it 252'. We implement advanced encryption standards to safeguard your data and ensure you meet regulatory requirements.

-

What kind of support does airSlate SignNow provide for customers interested in 'it 252'?

airSlate SignNow offers comprehensive support for customers navigating 'it 252', including tutorials, live chat, and a dedicated support team. We are committed to ensuring you maximize your use of our features and resolve any inquiries promptly.

Get more for Form IT 252 Investment Tax Credit For The Financial Services

- Demand to produce copy of will from heir to executor or person in possession of will south dakota form

- Tennessee order protection form

- Tennessee petition form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497326548 form

- Bill of sale of automobile and odometer statement tennessee form

- Bill of sale for automobile or vehicle including odometer statement and promissory note tennessee form

- Promissory note in connection with sale of vehicle or automobile tennessee form

- Bill of sale for watercraft or boat tennessee form

Find out other Form IT 252 Investment Tax Credit For The Financial Services

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding