Income Tax Credit Forms Current Year Tax NY Gov 2023

Understanding the Income Tax Credit Forms

The Income Tax Credit Forms are essential for individuals seeking to claim various tax credits on their federal tax returns. These forms help taxpayers determine their eligibility for credits such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. Understanding these forms is crucial for maximizing potential refunds and ensuring compliance with tax regulations.

Steps to Complete the Income Tax Credit Forms

Completing the Income Tax Credit Forms involves several key steps:

- Gather necessary documents: Collect your W-2 forms, 1099s, and any other relevant income documentation.

- Determine eligibility: Review the eligibility criteria for the specific tax credits you wish to claim.

- Fill out the forms: Carefully complete the forms, ensuring all information is accurate and complete.

- Review and double-check: Before submission, review the forms for any errors or omissions.

- Submit the forms: Choose your preferred submission method—online, by mail, or in person.

Eligibility Criteria for the Income Tax Credit Forms

Eligibility for the Income Tax Credit Forms varies depending on the specific credit being claimed. Generally, factors such as income level, filing status, and number of dependents play a significant role. For instance, to qualify for the Earned Income Tax Credit, your earned income must fall below a certain threshold, and you must meet specific residency and age requirements. It is essential to review the guidelines for each credit to ensure that you meet all necessary criteria.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for taxpayers. The deadline for submitting the Income Tax Credit Forms typically aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers may qualify for extensions, but it is important to file the necessary forms by the original deadline to avoid penalties.

Form Submission Methods

There are several methods for submitting the Income Tax Credit Forms, providing flexibility based on individual preferences:

- Online: Many taxpayers choose to file electronically using tax preparation software, which often simplifies the process.

- By mail: Completed forms can be printed and sent to the appropriate IRS address. Ensure that you use the correct mailing address based on your location.

- In person: Some individuals may prefer to submit their forms in person at designated IRS offices or authorized locations.

Key Elements of the Income Tax Credit Forms

When filling out the Income Tax Credit Forms, it is important to include key elements such as:

- Personal information: Include your name, Social Security number, and filing status.

- Income details: Report all sources of income accurately, including wages, self-employment income, and investment earnings.

- Dependent information: List any dependents you are claiming, as this can affect your eligibility for certain credits.

- Tax credits claimed: Clearly indicate which tax credits you are applying for on the form.

IRS Guidelines for Completing the Forms

The IRS provides comprehensive guidelines for completing the Income Tax Credit Forms. These guidelines include detailed instructions on how to fill out each section of the form, what documentation is required, and how to calculate your credits. It is advisable to refer to the IRS website or the instructions accompanying the forms for the most accurate and up-to-date information. Following these guidelines closely can help prevent errors and ensure a smooth filing process.

Quick guide on how to complete income tax credit forms current year tax ny gov

Effortlessly Prepare Income Tax Credit Forms current Year Tax NY gov on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Income Tax Credit Forms current Year Tax NY gov on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Income Tax Credit Forms current Year Tax NY gov with Ease

- Find Income Tax Credit Forms current Year Tax NY gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Income Tax Credit Forms current Year Tax NY gov to ensure smooth communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax credit forms current year tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the income tax credit forms current year tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

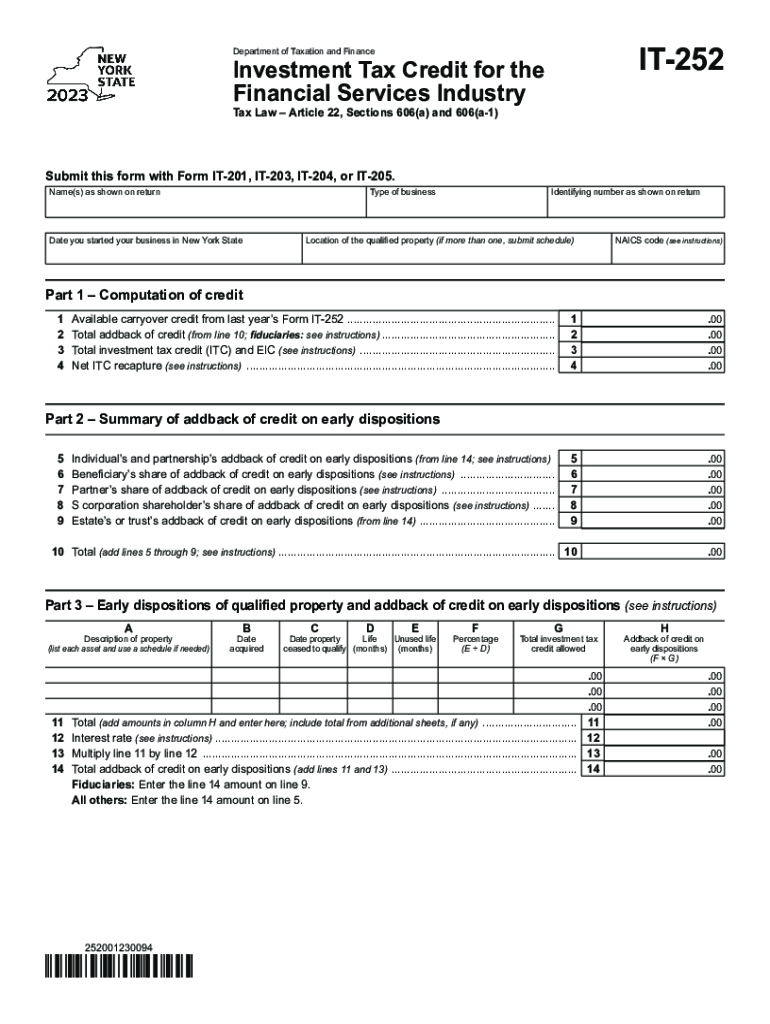

What is the 252 tax, and how does it relate to airSlate SignNow?

The 252 tax is a tax-related formality that business owners must comply with for specific transactions. airSlate SignNow streamlines the process of sending and eSigning documents associated with the 252 tax, reducing administrative burdens and ensuring compliance.

-

How much does airSlate SignNow cost for handling 252 tax documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs for handling 252 tax documents, you can choose a plan that provides necessary features at a cost-effective rate.

-

What features does airSlate SignNow offer for managing 252 tax documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automatic reminders that specifically cater to 252 tax documents. These tools simplify document management and make compliance easier for your business.

-

Can airSlate SignNow help with 252 tax compliance?

Yes, airSlate SignNow aids in maintaining 252 tax compliance by providing legally binding eSignatures and a detailed audit trail. This ensures that all your documents meet regulatory standards, giving you peace of mind.

-

Are there integrations available for airSlate SignNow to support 252 tax processing?

airSlate SignNow offers various integrations with popular accounting and tax software, making it easier to manage 252 tax documents seamlessly. These integrations enhance workflow efficiency and ensure that all necessary data is accurately captured.

-

How does airSlate SignNow enhance the efficiency of filing 252 tax forms?

By digitizing the document signing process with airSlate SignNow, businesses can file 252 tax forms faster and more accurately. The platform simplifies collaboration, allowing multiple parties to sign documents without delays.

-

Is airSlate SignNow suitable for businesses of all sizes that deal with 252 tax?

Absolutely! airSlate SignNow is designed to support businesses of all sizes in managing 252 tax documents. Whether you're a small startup or a large enterprise, our solution adapts to your unique needs.

Get more for Income Tax Credit Forms current Year Tax NY gov

- Signature verification form nyc gov nyc

- 21 final default judgment of divorce final default judgment of divorce form

- 2848 form

- Nj workers compensation adjournment form

- Patient follow up sheet form

- Florida certificate of fetal death form

- Software maintenance and support agreement template form

- Software project agreement template form

Find out other Income Tax Credit Forms current Year Tax NY gov

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself