Form it 252 Investment Tax Credit for the Financial Services Industry Tax Year 2024-2026

What is the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

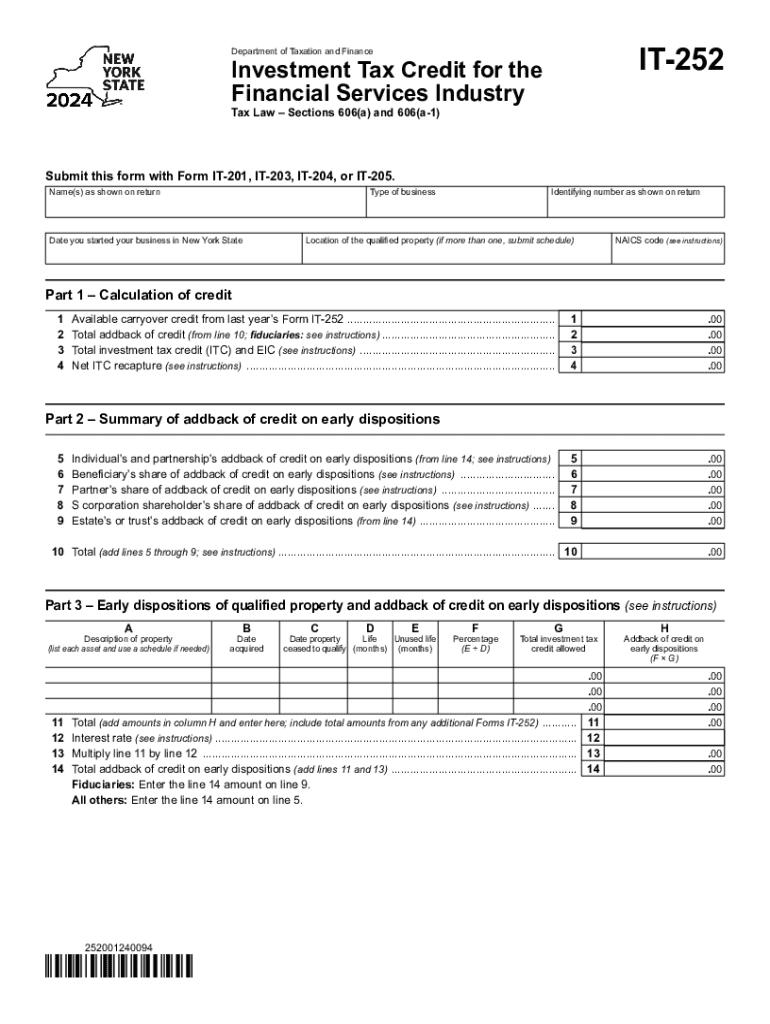

The Form IT 252 is a crucial document for businesses in the financial services industry seeking to claim investment tax credits. This form allows eligible entities to report their investments in qualified property, which can lead to significant tax savings. The investment tax credit aims to encourage capital investment in specific sectors, providing financial incentives to improve operational capabilities and stimulate growth within the industry. Understanding the purpose of this form is essential for maximizing potential tax benefits.

How to use the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

Using the Form IT 252 involves several steps to ensure accurate reporting and compliance with IRS regulations. First, businesses must determine their eligibility based on the type of investments made. Next, gather all necessary documentation, including details about the property acquired and associated costs. The completed form should be submitted with the business's tax return, ensuring that all information is accurate and complete to avoid delays or penalties. Businesses may also benefit from consulting with a tax professional to navigate the complexities of tax credits effectively.

Steps to complete the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

Completing the Form IT 252 requires careful attention to detail. Follow these steps:

- Review eligibility criteria to confirm that your business qualifies for the investment tax credit.

- Collect documentation related to your investments, including invoices and purchase agreements.

- Fill out the form, providing accurate information regarding the type and cost of the qualified property.

- Double-check all entries for accuracy to ensure compliance with IRS guidelines.

- Submit the completed form along with your tax return by the designated deadline.

Eligibility Criteria

To qualify for the Form IT 252 investment tax credit, businesses must meet specific criteria set by the IRS. Eligible entities typically include corporations, partnerships, and sole proprietorships engaged in the financial services sector. The investments must be in qualified property, which may include machinery, equipment, or other tangible assets used in the business. Additionally, the property must be acquired for use in the United States, and the investment should meet minimum cost thresholds established by tax regulations.

Required Documents

When preparing to submit the Form IT 252, businesses should gather several key documents to support their claims. These may include:

- Invoices or receipts for the purchase of qualified property.

- Contracts or agreements detailing the terms of the investment.

- Financial statements that demonstrate the impact of the investment on the business.

- Any previous tax filings that may relate to the investment tax credit.

Having these documents ready can facilitate a smoother filing process and ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 252 align with the general tax return deadlines for businesses. Typically, businesses must submit their tax returns by April 15 for calendar year filers. However, if additional time is needed, businesses can apply for an extension. It is essential to be aware of these deadlines to avoid penalties and ensure that all claims for investment tax credits are processed in a timely manner. Keeping track of important dates can help businesses maximize their tax benefits effectively.

Create this form in 5 minutes or less

Find and fill out the correct form it 252 investment tax credit for the financial services industry tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 252 investment tax credit for the financial services industry tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year?

The Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year is a tax incentive designed to encourage investment in the financial services sector. It allows eligible businesses to claim a credit against their tax liability, promoting growth and innovation within the industry. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year?

airSlate SignNow streamlines the process of preparing and submitting the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year. Our platform allows you to easily eSign and send documents, ensuring compliance and accuracy. This efficiency can save you time and reduce the risk of errors in your tax submissions.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features tailored for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features ensure that your Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year is handled efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate the process.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide excellent value, especially when managing important documents like the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year. You can choose a plan that fits your budget while benefiting from our comprehensive features.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage your Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year alongside your other financial documents, streamlining your workflow and enhancing productivity.

-

What are the benefits of using airSlate SignNow for the Form IT 252 Investment Tax Credit?

Using airSlate SignNow for the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind during tax season. Additionally, our easy-to-use interface simplifies the entire process.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. When handling sensitive information like the Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year, we implement strict security measures to protect your data. You can trust that your documents are safe and compliant with industry standards.

Get more for Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

- Employee verification from old employer email form

- Advance settlement form

- Application form the manchester college

- Supplier change request form 69836847

- Firstbank cash concentrator service deposit transfer form

- Form fr77

- Mo ms corporation allocation and apportionment of income schedule 772045260 form

- Small businessshareholder agreement template form

Find out other Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form