Form it 252 Investment Tax Credit for the Financial Services Industry Tax Year 2021

What is the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

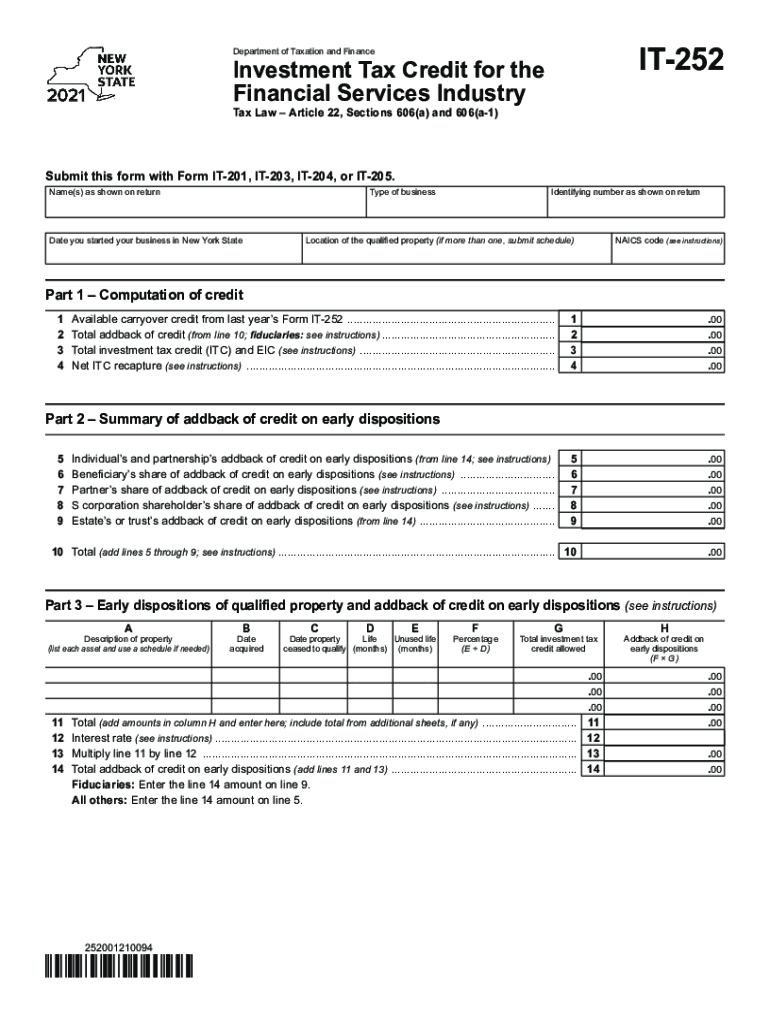

The Form IT 252 is a tax form used by businesses in the financial services industry to claim the Investment Tax Credit. This credit is designed to encourage investment in qualified property and equipment, providing tax relief to eligible organizations. The form is specifically tailored for the tax year 2021 and outlines the necessary information required to substantiate the claim for the credit. Understanding the purpose of this form is crucial for businesses looking to optimize their tax obligations.

How to Use the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

Using the Form IT 252 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records and documentation related to the investments made during the tax year. Next, fill out the form with precise details regarding the qualifying property, including its cost and the date it was placed in service. It is essential to follow the instructions carefully to avoid errors that could delay the processing of the credit. After completing the form, review it for accuracy before submission.

Steps to Complete the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

Completing the Form IT 252 requires attention to detail. Begin by entering your business information, including the name and tax identification number. Next, list each qualifying property, detailing the cost and the date it was acquired. Calculate the credit amount based on the investment made. Ensure that all sections are filled out completely and accurately. Finally, sign and date the form, confirming that the information provided is true and correct.

Eligibility Criteria for the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

To qualify for the Investment Tax Credit using Form IT 252, businesses must meet specific eligibility criteria. The property must be used predominantly in the financial services industry and must be new or used property that has not been previously claimed for the credit. Additionally, the investments must be made within the designated tax year. It is important for businesses to review these criteria carefully to ensure compliance and maximize their potential benefits.

Filing Deadlines / Important Dates for the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

Filing deadlines for the Form IT 252 are crucial to ensure timely processing of the tax credit. Typically, the form must be submitted along with the business's tax return for the corresponding tax year. For the tax year 2021, the general deadline for filing is April 15, 2022, unless an extension has been granted. Businesses should mark their calendars and prepare their documentation well in advance to avoid any last-minute issues.

Required Documents for the Form IT 252 Investment Tax Credit for the Financial Services Industry Tax Year

When filing the Form IT 252, businesses must provide supporting documentation to substantiate their claims. Required documents may include purchase invoices, receipts for qualifying property, and any relevant financial statements that demonstrate the investment made. It is advisable to keep copies of all submitted documents for record-keeping purposes and potential audits.

Quick guide on how to complete form it 252 investment tax credit for the financial services industry tax year 2021

Effortlessly Prepare Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-conscious substitute to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Modify and Electronically Sign Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year with Ease

- Obtain Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, SMS, or invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Alter and electronically sign Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year while ensuring excellent communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 252 investment tax credit for the financial services industry tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 252 investment tax credit for the financial services industry tax year 2021

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 252?

airSlate SignNow is a digital platform that empowers businesses to send and eSign documents efficiently. It 252 refers to the capabilities that enhance your workflow, enabling seamless document management and eSigning processes. With airSlate SignNow, you can streamline your document handling like never before.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the features you need for an optimal experience. It 252 offers flexible plans that cater to different business sizes and requirements, ensuring you only pay for what you use. Check the airSlate SignNow website for detailed pricing information.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features designed to simplify document workflows, including customizable eSignature options, template creation, and automated workflows. With it 252, you can also integrate your documents with other applications, ensuring a smooth operation across your business processes.

-

How can airSlate SignNow improve my business efficiency?

By using airSlate SignNow, businesses can signNowly decrease turnaround times for document signing and approvals. The it 252 features promote efficient document tracking and management, saving valuable time for employees and enhancing overall productivity. This leads to faster decision-making and better service delivery.

-

Does airSlate SignNow support mobile signing?

Yes, airSlate SignNow supports mobile signing, allowing users to eSign documents seamlessly from any device. It 252 ensures that your team can stay productive on the go, making it easy to manage and sign documents from smartphones and tablets. This flexibility enhances efficiency and responsiveness.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow offers integrations with various third-party applications, allowing you to connect your workflows effortlessly. Utilizing it 252 enables smoother operations with tools like CRM systems, cloud storage, and project management software, providing a unified business solution.

-

Is airSlate SignNow secure and compliant?

Yes, airSlate SignNow prioritizes security and compliance, adhering to industry standards to protect your data. It 252 includes features like encryption and audit trails, ensuring that all signed documents are secure and meet legal requirements. You can use airSlate SignNow with confidence knowing your data is protected.

Get more for Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

Find out other Form IT 252 Investment Tax Credit For The Financial Services Industry Tax Year

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT