Allocations of Tax CreditsAllocations of Tax CreditsForm it 203, Nonresident and Part Year Resident Income Tax Form it 203, Nonr 2020

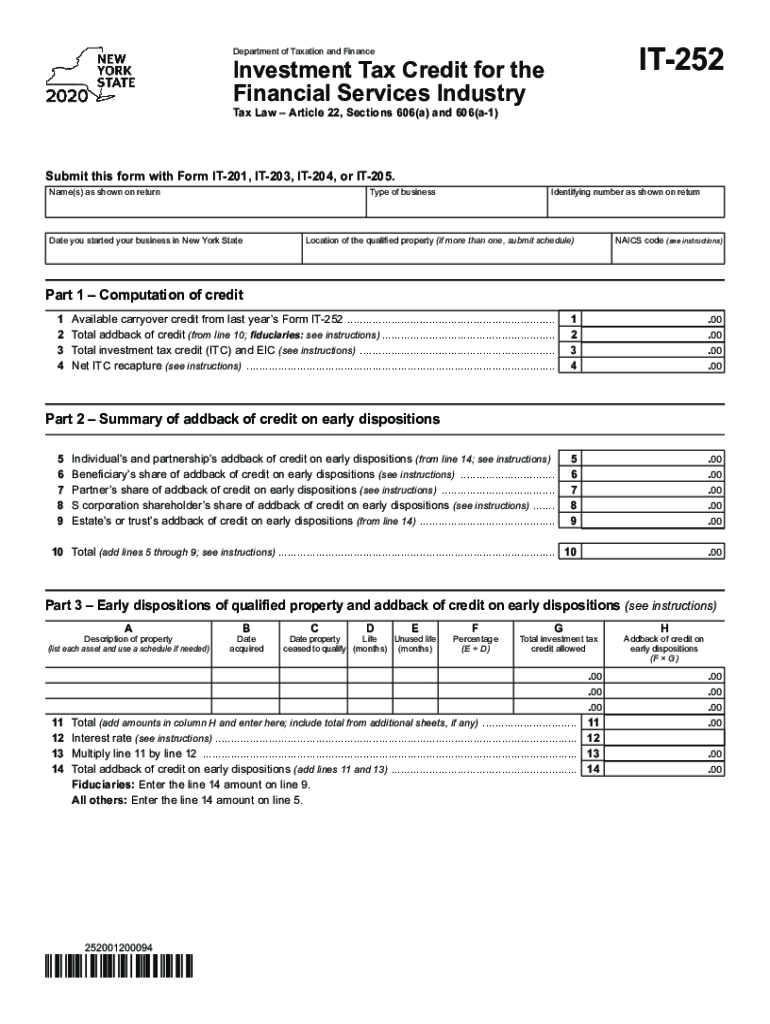

Understanding the 252 Tax Form

The 252 tax form is a document used by businesses and individuals in New York to report allocations of tax credits. This form is essential for nonresidents and part-year residents who have earned income in New York State. It ensures that taxpayers can accurately reflect their tax obligations and claim any applicable credits. Understanding the purpose and requirements of this form is crucial for compliance with New York taxation laws.

Steps to Complete the 252 Tax Form

Completing the 252 tax form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and previous tax returns. Next, fill out the form by entering your personal information, income details, and any applicable tax credits. It's important to double-check all entries for accuracy, as errors can lead to delays or penalties. Once completed, review the form carefully before submission.

Legal Use of the 252 Tax Form

The 252 tax form is legally binding when filled out correctly and submitted on time. It is important to follow the guidelines set forth by the New York State Department of Taxation and Finance. Using this form properly can help avoid legal issues, such as audits or penalties for non-compliance. Ensure that all signatures are included and that the form is submitted according to the specified deadlines.

Filing Deadlines for the 252 Tax Form

Filing deadlines for the 252 tax form are critical to avoid penalties. Typically, the form must be submitted by the same deadline as your annual tax return. For most taxpayers, this is April fifteenth of the following year. However, if you are a part-year resident or nonresident, be sure to verify any specific deadlines that may apply to your situation.

Required Documents for the 252 Tax Form

To complete the 252 tax form, you will need several documents, including:

- Income statements (W-2s, 1099s)

- Previous tax returns

- Documentation of any tax credits you wish to claim

- Identification information (Social Security number or ITIN)

Having these documents ready will streamline the process and help ensure that your form is accurate and complete.

Examples of Using the 252 Tax Form

Examples of situations where the 252 tax form may be used include:

- A nonresident who worked in New York for part of the year and earned income.

- A part-year resident who moved to New York and needs to report income earned while living there.

- Taxpayers claiming specific tax credits related to their income or residency status.

Understanding these scenarios can help taxpayers determine if they need to file this form.

Quick guide on how to complete allocations of tax creditsallocations of tax creditsform it 203 nonresident and part year resident income tax form it 203

Prepare Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr effortlessly on any device

Online document management has become widely accepted by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and eSign your paperwork promptly without hindrances. Manage Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr across any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr with ease

- Find Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct allocations of tax creditsallocations of tax creditsform it 203 nonresident and part year resident income tax form it 203

Create this form in 5 minutes!

How to create an eSignature for the allocations of tax creditsallocations of tax creditsform it 203 nonresident and part year resident income tax form it 203

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the 252 tax form and who needs it?

The 252 tax form is a specific form used by certain businesses to report financial information to the IRS. Typically, this form is required for businesses that meet specific income thresholds or operate within particular sectors. Understanding the 252 tax form is crucial for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow simplify the process of managing the 252 tax form?

airSlate SignNow streamlines the process of managing the 252 tax form by allowing users to eSign, edit, and share important documents securely. With an intuitive interface, businesses can easily gather necessary signatures, ensuring that their 252 tax forms are completed and submitted efficiently. This saves time and reduces the risk of errors.

-

Are there any integration options for submitting the 252 tax form through airSlate SignNow?

Yes, airSlate SignNow offers various integration options to enhance your document management process. Users can integrate with popular accounting software to directly access and submit the 252 tax form, ensuring a seamless workflow. This integration allows for automatic data import and reduces manual entry errors.

-

What is the pricing structure for using airSlate SignNow for 252 tax form management?

airSlate SignNow provides flexible pricing plans to accommodate the needs of different businesses. The pricing considers features like eSigning and document storage, making it cost-effective for managing the 252 tax form. Interested users can explore various subscription models based on their organizational requirements.

-

Can multiple users collaborate on the 252 tax form using airSlate SignNow?

Absolutely! airSlate SignNow enables multiple users to collaborate effectively on the 252 tax form. Teams can work together in real-time, making edits, adding comments, and ensuring that all necessary signatures are obtained before submission. Collaboration tools greatly enhance efficiency and accuracy.

-

What security features does airSlate SignNow offer for the 252 tax form?

airSlate SignNow prioritizes security with advanced features such as encryption and secure cloud storage for your 252 tax forms. Users can be assured that their sensitive information is protected against unauthorized access, ensuring compliance with legal standards. These security measures instill confidence in the handling of important documents.

-

How does airSlate SignNow help ensure compliance when using the 252 tax form?

airSlate SignNow helps ensure compliance with the 252 tax form by providing templates and guidelines based on current IRS regulations. With reminders and tracking features, users can stay informed about deadlines and compliance requirements. This proactive approach minimizes the risk of errors and penalties.

Get more for Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr

- Oakland county friend of the court form

- Revocable living trusts everything you need to know form

- This form is approved by the illinois supreme eformscom

- Petition for change of name by parent form ca402

- Missouri voter registration form new employee information request

- In the circuit court of missouri in re available for form

- Kansas and missouri estate planning revocable living trusts form

- Bidtaylorauctioncom form

Find out other Allocations Of Tax CreditsAllocations Of Tax CreditsForm IT 203, Nonresident And Part Year Resident Income Tax Form IT 203, Nonr

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document