Form it 217 Fillable Claim for Farmers' School Tax Credit 2022

What is the Form IT 217 Fillable Claim For Farmers' School Tax Credit

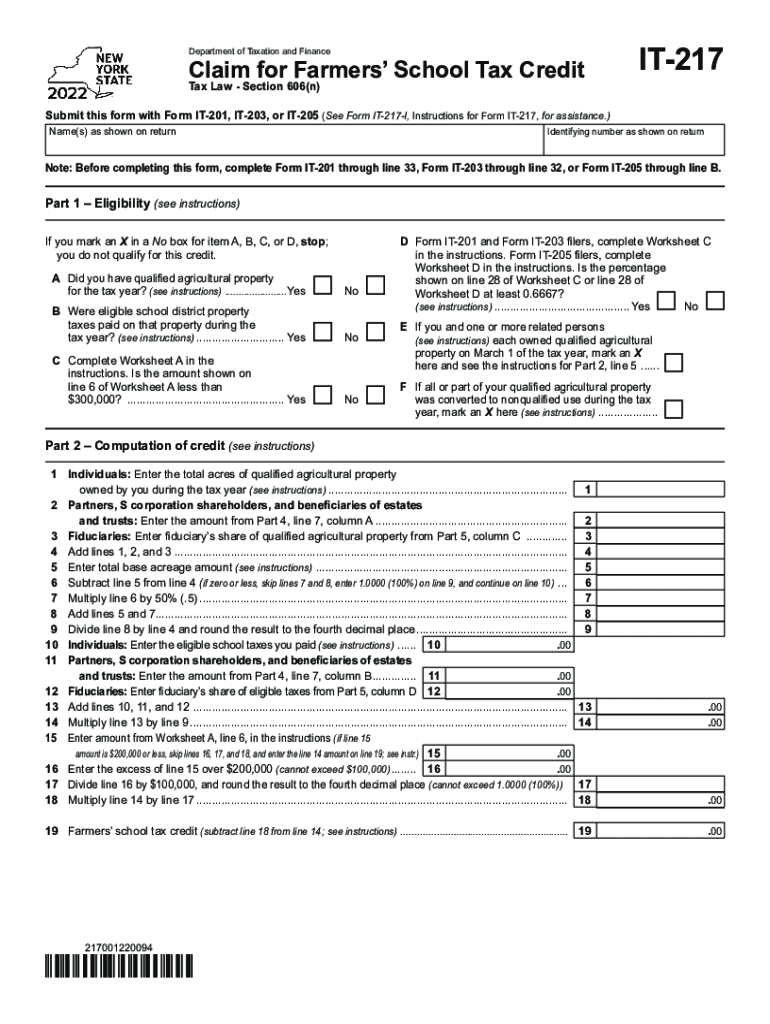

The Form IT 217 is a fillable document designed for farmers in the United States to claim a school tax credit. This credit is aimed at reducing the financial burden on agricultural producers by providing a tax benefit related to local school funding. The form is specifically tailored for individuals or entities engaged in farming operations, allowing them to report eligible expenses and claim the corresponding credit. Understanding the purpose and requirements of the IT 217 form is essential for farmers seeking to maximize their tax benefits.

Steps to Complete the Form IT 217 Fillable Claim For Farmers' School Tax Credit

Completing the Form IT 217 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of eligible expenses related to school taxes. Next, fill out the form by providing your personal information, including your name, address, and tax identification number. Carefully report your eligible expenses in the designated sections, ensuring that all figures are accurate and supported by documentation. After completing the form, review it thoroughly for any errors before submission. This attention to detail helps avoid potential delays or issues with your claim.

Legal Use of the Form IT 217 Fillable Claim For Farmers' School Tax Credit

The legal use of the Form IT 217 is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed accurately and submitted in accordance with state tax laws. It is crucial to adhere to the guidelines set forth by the relevant tax authorities, as improper use or submission of the form may result in penalties or denial of the claim. Utilizing a reliable eSignature solution can further enhance the legal standing of your submission by providing a secure and verifiable method of signing the document.

Eligibility Criteria for the Form IT 217 Fillable Claim For Farmers' School Tax Credit

To qualify for the tax credit associated with the Form IT 217, applicants must meet specific eligibility criteria. Generally, the claimant must be actively engaged in farming and have incurred eligible school tax expenses. The credit is typically available to individuals or business entities, such as partnerships or corporations, that operate within the agricultural sector. It is important to review the detailed eligibility requirements outlined by the state tax authority to ensure compliance and maximize potential benefits.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 217 can be submitted through various methods, providing flexibility for farmers. Options typically include online submission via the state tax authority's website, mailing a physical copy of the form, or delivering it in person to the appropriate tax office. Each submission method may have different processing times and requirements, so it is advisable to choose the method that best suits your needs while ensuring compliance with any deadlines.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial when submitting the Form IT 217. Each tax year may have specific dates by which the form must be submitted to qualify for the credit. Typically, the deadline aligns with the general tax filing deadline for individuals and businesses. It is essential to stay informed about these important dates to avoid missing out on potential tax benefits. Keeping a calendar of relevant deadlines can help ensure timely submission and compliance.

Quick guide on how to complete form it 217 fillable claim for farmers school tax credit

Manage Form IT 217 Fillable Claim For Farmers' School Tax Credit easily on any device

Digital document management has gained traction among companies and individuals. It offers an excellent environmentally friendly replacement for traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly and without interruptions. Manage Form IT 217 Fillable Claim For Farmers' School Tax Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign Form IT 217 Fillable Claim For Farmers' School Tax Credit effortlessly

- Find Form IT 217 Fillable Claim For Farmers' School Tax Credit and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important portions of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Form IT 217 Fillable Claim For Farmers' School Tax Credit and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 217 fillable claim for farmers school tax credit

Create this form in 5 minutes!

How to create an eSignature for the form it 217 fillable claim for farmers school tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 217?

airSlate SignNow is a leading e-signature solution that facilitates the electronic signing and sending of documents. It leverages the capabilities of it 217 to streamline workflows, ensuring that users can efficiently manage document signing processes.

-

How much does airSlate SignNow cost for users interested in it 217?

airSlate SignNow offers competitive pricing plans that cater to various business needs. For those focusing on it 217, subscription options allow for cost-effective solutions, ensuring you only pay for the features necessary for your organization.

-

What features make airSlate SignNow ideal for businesses dealing with it 217?

One of the standout features of airSlate SignNow is its intuitive interface, which simplifies document management. By integrating it 217 functionalities, users can expedite the signing process, reducing turnaround times signNowly.

-

How can it 217 integrations enhance my experience with airSlate SignNow?

Integrating it 217 with airSlate SignNow allows businesses to sync their document workflows seamlessly. This interoperability ensures that signed documents can easily flow into your existing systems, boosting productivity and efficiency.

-

Is airSlate SignNow secure for managing documents related to it 217?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to protect all documents, including those related to it 217. Users can trust that their data is secure while utilizing the e-signature platform.

-

What are the benefits of using airSlate SignNow for it 217 workflows?

The benefits of using airSlate SignNow for it 217 workflows include increased efficiency, reduced paper usage, and improved compliance. Businesses will find that electronic signing saves time and resources, allowing for faster decision-making.

-

Can airSlate SignNow be used on mobile devices for it 217?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing users to manage their it 217 document signing anytime, anywhere. This flexibility helps businesses maintain productivity on the go.

Get more for Form IT 217 Fillable Claim For Farmers' School Tax Credit

- Tn deed trust form

- Tennessee transfer form

- Tn disclaimer 497326693 form

- Notice of lien by remote contractor individual tennessee form

- Quitclaim deed by two individuals to llc tennessee form

- Deed two one 497326697 form

- Warranty deed from two individuals to llc tennessee form

- Notice lien contractor form

Find out other Form IT 217 Fillable Claim For Farmers' School Tax Credit

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form