Form it 217 Claim for Farmers' School Tax Credit Tax Year 2024-2026

What is the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

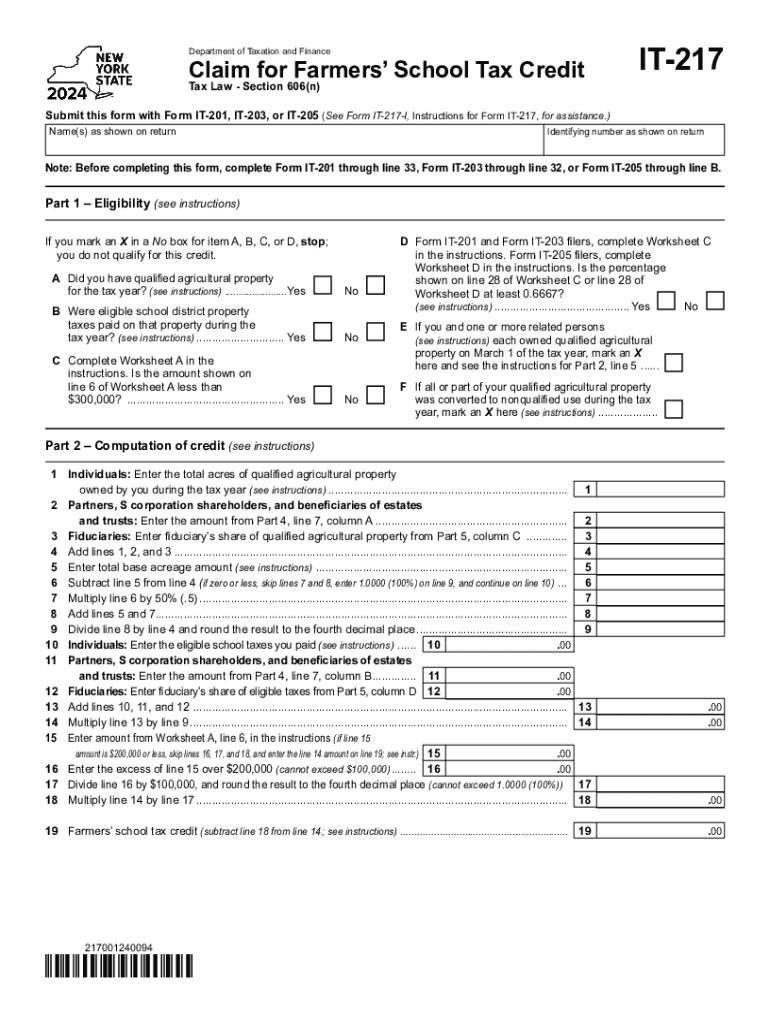

The IT 217 Claim is a specific form used by farmers in New York State to claim a school tax credit. This credit is designed to provide financial relief to eligible farmers by reducing their school tax liability. The form is particularly relevant for those who operate agricultural businesses and meet certain criteria established by the state. Understanding the purpose of this form is essential for farmers looking to benefit from the available tax credits related to their agricultural activities.

How to use the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

Using the IT 217 Claim involves several straightforward steps. First, farmers must gather necessary information regarding their property and tax liabilities. This includes details about the agricultural land they operate, the school district in which the property is located, and any relevant income information. Once this information is compiled, farmers can fill out the form accurately, ensuring all sections are completed. After completing the form, it should be submitted to the appropriate tax authority for processing.

Steps to complete the Form IT 217 Claim For Farmers' School Tax Credit Tax Year

Completing the IT 217 Claim requires careful attention to detail. Here are the essential steps:

- Obtain the form from the New York State Department of Taxation and Finance website or a local tax office.

- Fill in your personal information, including your name, address, and the school district.

- Provide details about your agricultural operation, including the type of farming and the acreage involved.

- Calculate your school tax liability and the amount of credit you are eligible to claim.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the IT 217 Claim, farmers must meet specific eligibility criteria set forth by New York State. Generally, applicants must be engaged in agricultural production on land that is primarily used for farming. Additionally, the property must be located within a school district that participates in the program. It is crucial for farmers to verify their eligibility before submitting the claim to avoid potential delays or denials.

Required Documents

When submitting the IT 217 Claim, certain documents may be required to support the application. These documents typically include:

- Proof of ownership or lease of the agricultural property.

- Documentation of school tax payments made during the tax year.

- Any additional records that demonstrate eligibility for the credit, such as income statements or agricultural production records.

Filing Deadlines / Important Dates

It is essential for farmers to be aware of the filing deadlines associated with the IT 217 Claim. Generally, the form must be submitted by a specific date each year to ensure consideration for the current tax year. Missing the deadline may result in the inability to claim the credit for that year. Farmers should check the New York State Department of Taxation and Finance for the exact dates relevant to their claims.

Create this form in 5 minutes or less

Find and fill out the correct form it 217 claim for farmers school tax credit tax year 772088888

Create this form in 5 minutes!

How to create an eSignature for the form it 217 claim for farmers school tax credit tax year 772088888

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IT 217 claim?

An IT 217 claim is a specific type of tax claim that allows businesses to recover certain expenses related to their operations. Understanding how to properly file an IT 217 claim can help maximize your tax benefits and ensure compliance with regulations.

-

How can airSlate SignNow help with IT 217 claims?

airSlate SignNow streamlines the process of preparing and submitting IT 217 claims by allowing users to easily create, send, and eSign necessary documents. This efficiency reduces the time spent on paperwork and helps ensure that your claims are submitted accurately and on time.

-

What features does airSlate SignNow offer for managing IT 217 claims?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IT 217 claims. These tools help users maintain organization and ensure that all necessary documentation is readily available.

-

Is airSlate SignNow cost-effective for filing IT 217 claims?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file IT 217 claims. With competitive pricing plans, it provides a budget-friendly option for companies of all sizes to manage their document workflows efficiently.

-

Can I integrate airSlate SignNow with other software for IT 217 claims?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage IT 217 claims. This integration allows for a smoother workflow and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for IT 217 claims?

Using airSlate SignNow for IT 217 claims offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. The platform's user-friendly interface makes it easy for businesses to navigate the claims process with confidence.

-

How secure is airSlate SignNow for handling IT 217 claims?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to IT 217 claims. Users can trust that their documents are safe and secure throughout the signing process.

Get more for Form IT 217 Claim For Farmers' School Tax Credit Tax Year

- 1 2 2 lab determining longitude and latitude form

- Backward classes certificate form

- Nsa guest player form

- Loan declaration format

- Jdf 1317 cost form

- 15 south main street bel air md 21014 form

- Rental licensingbaltimore city department of housing form

- Sale financing settlement or lease of other real estate form

Find out other Form IT 217 Claim For Farmers' School Tax Credit Tax Year

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word