Instructions for Form it 217 Claim for Farmers' School Tax 2021

What is the Instructions For Form IT 217 Claim For Farmers' School Tax

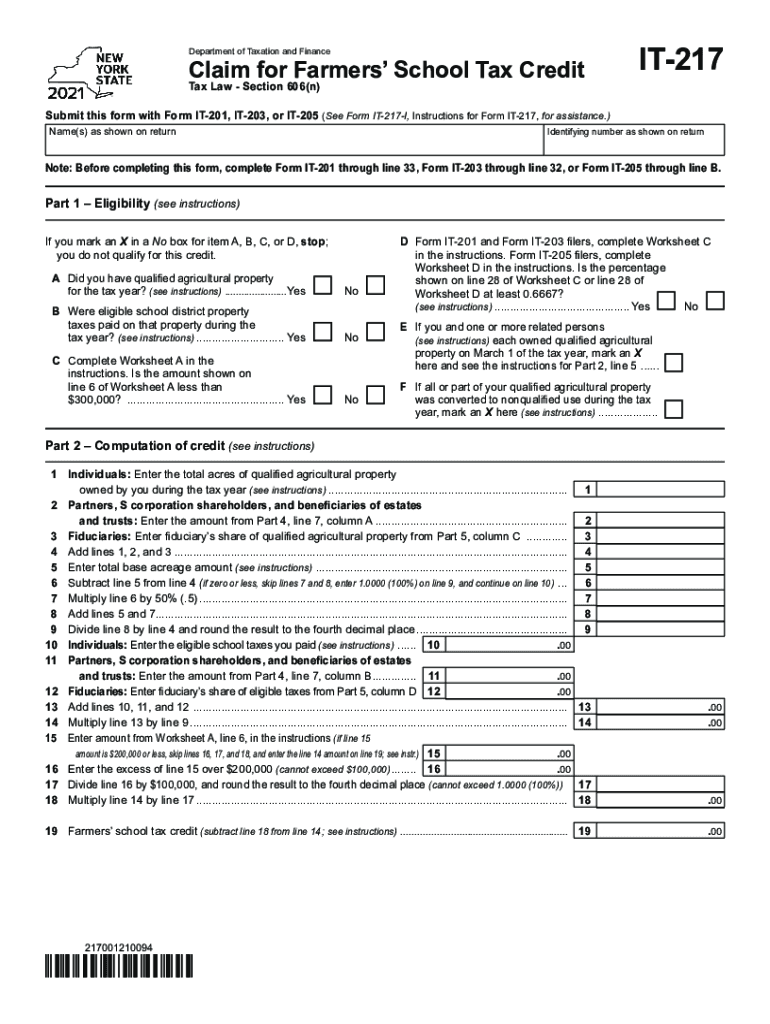

The Instructions for Form IT 217 provide guidance for farmers seeking to claim a school tax exemption in the United States. This form is specifically designed for individuals engaged in agricultural activities who wish to benefit from tax relief associated with educational funding. The instructions detail the eligibility criteria, necessary documentation, and the process for completing the form accurately to ensure compliance with local regulations.

Steps to Complete the Instructions For Form IT 217 Claim For Farmers' School Tax

Completing the Instructions for Form IT 217 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of agricultural activity and any relevant tax records. Next, carefully review the eligibility criteria outlined in the instructions to confirm that you qualify for the exemption. Fill out the form meticulously, ensuring that all required fields are completed. Finally, submit the form by the specified deadline to the appropriate tax authority, either online or by mail, as outlined in the instructions.

Key Elements of the Instructions For Form IT 217 Claim For Farmers' School Tax

The key elements of the Instructions for Form IT 217 include detailed information on eligibility requirements, documentation needed, and specific instructions for filling out each section of the form. Important sections cover the definitions of qualifying agricultural activities, the types of documentation required to substantiate claims, and guidance on how to report income and expenses related to farming. Understanding these elements is crucial for a successful application.

Legal Use of the Instructions For Form IT 217 Claim For Farmers' School Tax

The legal use of the Instructions for Form IT 217 is governed by state tax laws and regulations. Farmers must adhere to these guidelines to ensure that their claims for school tax exemptions are valid. The instructions outline the legal framework that supports the use of the form, including references to relevant tax codes and compliance requirements. Properly following these legal stipulations helps in avoiding penalties and ensures that the claims are processed correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Form IT 217 are critical for ensuring that claims are submitted on time. Typically, these deadlines align with the annual tax filing period, but specific dates can vary by state. It is essential for farmers to be aware of these dates to avoid late submissions, which could result in the denial of claims. The instructions provide a calendar of important dates related to the filing process, including any extensions that may be available.

Eligibility Criteria

The eligibility criteria for completing the Instructions for Form IT 217 are essential for determining who can claim the school tax exemption. Generally, applicants must demonstrate that they are actively engaged in farming and meet specific income thresholds. Additionally, the instructions outline any residency requirements and the types of agricultural activities that qualify for the exemption. Understanding these criteria is vital for ensuring a successful application.

Quick guide on how to complete instructions for form it 217 claim for farmers school tax

Complete Instructions For Form IT 217 Claim For Farmers' School Tax effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form IT 217 Claim For Farmers' School Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Instructions For Form IT 217 Claim For Farmers' School Tax with ease

- Find Instructions For Form IT 217 Claim For Farmers' School Tax and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your document.

- Highlight pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form IT 217 Claim For Farmers' School Tax to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 217 claim for farmers school tax

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 217 claim for farmers school tax

The best way to create an e-signature for your PDF online

The best way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is it 217 and how does airSlate SignNow incorporate it?

It 217 refers to an advanced digital signature solution that complies with legal standards. airSlate SignNow incorporates it 217 to provide users with a secure and efficient way to sign documents electronically, ensuring compliance and trust in every transaction.

-

How much does airSlate SignNow cost for users looking for it 217 features?

Pricing for airSlate SignNow varies based on the plan chosen, but all plans include features relevant to it 217. Expect competitive pricing that ensures you receive powerful eSigning capabilities without compromising your budget.

-

What key features related to it 217 does airSlate SignNow offer?

airSlate SignNow includes a range of features that align with it 217, such as customizable templates, automated workflows, and secure cloud storage. These tools help streamline the signing process while ensuring all parties maintain compliance with legal standards.

-

How can it 217 enhance efficiency for my business?

By implementing it 217 through airSlate SignNow, businesses can signNowly reduce the time spent on document signing processes. This digital approach fosters quicker turnaround times, allowing your team to focus on more critical tasks.

-

Does airSlate SignNow support integrations with other tools while utilizing it 217?

Yes, airSlate SignNow offers numerous integrations with popular applications, making it easy to utilize it 217 alongside your existing workflows. This seamless integration enhances productivity and user experience across platforms.

-

Is it 217 secure for sensitive documents?

Absolutely! airSlate SignNow employs robust security measures to ensure that all documents signed using it 217 are protected. Features like encryption and authentication safeguards provide peace of mind when handling sensitive information.

-

Can I customize templates with it 217 on airSlate SignNow?

Yes, airSlate SignNow allows users to create and customize templates that leverage it 217 functionalities. This feature helps businesses to save time on repeated processes, making document management more efficient.

Get more for Instructions For Form IT 217 Claim For Farmers' School Tax

- Legal last will and testament form for divorced and remarried person with mine yours and ours children california

- Ca legal will 497299661 form

- Written revocation of will california form

- California persons form

- Notice to beneficiaries of being named in will california form

- Estate planning template microsoft word form

- Ca personal information

- Demand to produce copy of will from heir to executor or person in possession of will california form

Find out other Instructions For Form IT 217 Claim For Farmers' School Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors