Name of Eligible Taxpayer 2018

What is the Name of Eligible Taxpayer?

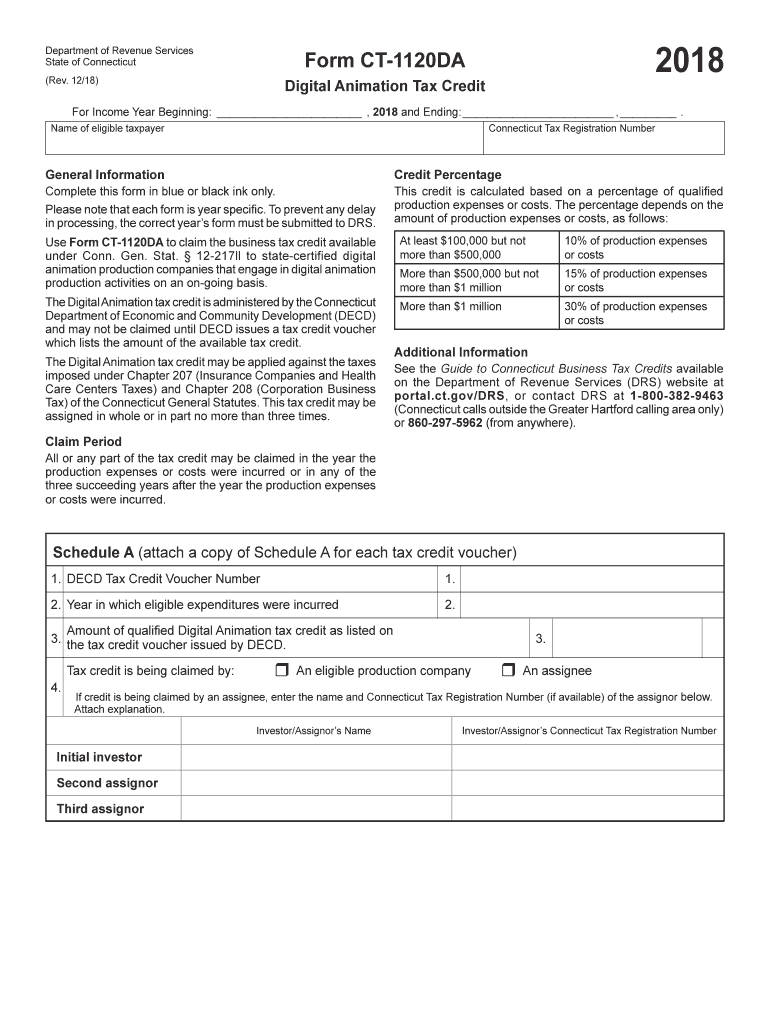

The Name of Eligible Taxpayer refers to the specific designation used in tax documentation, particularly for the Connecticut CT-1120 DA form. This form is essential for businesses operating in Connecticut, allowing them to report their income and calculate their tax obligations accurately. The Name of Eligible Taxpayer is crucial as it identifies the entity responsible for filing, ensuring that all tax liabilities are correctly attributed. Understanding this designation helps businesses maintain compliance with state tax laws.

Steps to Complete the Name of Eligible Taxpayer

Completing the Name of Eligible Taxpayer on the Connecticut CT-1120 DA form involves several key steps:

- Gather necessary information, including the legal name of the business, address, and tax identification number.

- Access the form online or obtain a physical copy from the Connecticut Department of Revenue Services.

- Fill out the form accurately, ensuring that the Name of Eligible Taxpayer is clearly stated in the designated area.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or via mail, following the specified guidelines for filing.

Legal Use of the Name of Eligible Taxpayer

The legal use of the Name of Eligible Taxpayer is governed by state tax regulations. It is essential for the Name of Eligible Taxpayer to match the legal name registered with the state to avoid discrepancies. This alignment ensures that the business is recognized as the entity responsible for tax obligations. Using an incorrect name can lead to complications, including penalties or delays in processing tax returns. Therefore, verifying the legal name before submission is crucial for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Connecticut CT-1120 DA form are critical for businesses to adhere to in order to avoid penalties. Generally, the form must be filed annually, with specific due dates set by the Connecticut Department of Revenue Services. It is advisable to check the official state announcements for any updates or changes to these deadlines. Marking these important dates on a calendar can help ensure timely submission and compliance with state tax laws.

Required Documents

To complete the Connecticut CT-1120 DA form, businesses need to gather several required documents:

- Federal tax return information, including the IRS Form 1120.

- Financial statements, such as balance sheets and income statements.

- Documentation of any tax credits or deductions applicable to the business.

- Proof of any estimated tax payments made during the year.

Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is accurately reported.

Form Submission Methods

The Connecticut CT-1120 DA form can be submitted through various methods to accommodate different preferences:

- Online Submission: Businesses can file the form electronically through the Connecticut Department of Revenue Services website, which is often the fastest method.

- Mail: The form can be printed and mailed to the appropriate address provided by the state, ensuring it is postmarked by the deadline.

- In-Person: Some businesses may choose to deliver the form in person at designated state offices, which can provide immediate confirmation of receipt.

Choosing the right submission method can help ensure that the form is filed correctly and on time.

Quick guide on how to complete name of eligible taxpayer

Your assistance manual on how to prepare your Name Of Eligible Taxpayer

If you’re looking to find out how to complete and submit your Name Of Eligible Taxpayer, here are some brief pointers on simplifying the tax filing process.

To begin, all you need to do is set up your airSlate SignNow profile to transform your handling of documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, while also revisiting to amend responses as needed. Enhance your tax management experience with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to achieve your Name Of Eligible Taxpayer in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Browse our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your Name Of Eligible Taxpayer in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that submitting on paper can result in increased return errors and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct name of eligible taxpayer

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

Can a final year student of B.Tech fill the form of SSC SI CAPF?

Yes, if your final semester result is declared on or before 1 august 2018.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

What do we have to fill in the W-8BEN column of upwork(check image) for a person outside US ?

Thanks for the A2A.Freelancers must be at least 18 years old to work on Upwork per the User Agreement. You can learn more in the article Eligibility to Join on Upwork. Since you are 17, you will need to wait to sign up for Upwork. We hope you join us when you turn 18.When you turn 18 and are eligible to join Upwork, you must use your real name in accordance with the User Agreement. This includes filling out the W-8BEN truthfully (see the conditions next to the checkbox in the screenshot you posted). W-8BEN is an official IRS form used to confirm you’re not a U.S. taxpayer and that Upwork is not required to withhold taxes from your earnings. For record-keeping purposes, Upwork requires a Form W-8BEN for all non-U.S. taxpayers paid on Upwork. You can learn more here: What is the Form W-8BEN?Also, once you are eligible to join and have done your first job, your Upwork name and the name on your payment method must match in order to receive your funds, so you cannot use someone else’s account.In order to succeed on Upwork, freelancers should know their obligations and follow the User Agreement. Take a look at this help article for details on the most common violations (and how to avoid them): Freelancer Violations and Account Holds.

-

How should I fill out the JEE Mains form if my Aadhaar card has the incorrect spelling of my name?

See, if your board marksheet name and aadhaar card name doesn't matches then only the issue arrises. So, you need to make your aadhaar name get corrected first. It take a small procedure doing that which is easy. Afterwords fill your jee main application form.HOPE IT HELPS! !ALL THE BEST! !

-

Are 3rd year graduation students eligible to fill out the entrance exam form of B.Ed and Masters of BHU?

Heyy… Yes, why not. Generally many 3rd year graduation students fill forms of different universities and colleges for higher level courses for their continuation of education.One thing which should be kept in mind is that your final result of the present course should be out and you must have passed with the aggregate marks required for the applied form.Good luck. ☺

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the name of eligible taxpayer

How to make an eSignature for your Name Of Eligible Taxpayer online

How to generate an electronic signature for the Name Of Eligible Taxpayer in Google Chrome

How to generate an eSignature for putting it on the Name Of Eligible Taxpayer in Gmail

How to make an electronic signature for the Name Of Eligible Taxpayer straight from your mobile device

How to generate an electronic signature for the Name Of Eligible Taxpayer on iOS

How to create an electronic signature for the Name Of Eligible Taxpayer on Android

People also ask

-

What is the Connecticut CT1120 DA form?

The Connecticut CT1120 DA form is a tax document used by corporations to declare income and calculate taxes owed in the state of Connecticut. It is essential for ensuring compliance with state tax regulations and properly reporting corporate financial activity.

-

How can airSlate SignNow help with submitting the Connecticut CT1120 DA?

airSlate SignNow provides an efficient way to eSign and submit the Connecticut CT1120 DA form electronically. By using our platform, businesses can streamline their tax submission process, ensuring that the form is completed, signed, and submitted with minimal hassle.

-

What are the benefits of using airSlate SignNow for the Connecticut CT1120 DA?

Using airSlate SignNow for the Connecticut CT1120 DA offers several benefits, including faster processing times, reduced paperwork, and improved accuracy. Our platform is designed to enhance efficiency, giving businesses peace of mind when handling important documents like tax forms.

-

Is airSlate SignNow cost-effective for managing the Connecticut CT1120 DA?

Yes, airSlate SignNow is a cost-effective solution for managing the Connecticut CT1120 DA and other important documents. Our competitive pricing plans ensure that businesses of all sizes can afford the tools they need for seamless document management and eSigning.

-

Can I integrate airSlate SignNow with other software for filing the Connecticut CT1120 DA?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage and file the Connecticut CT1120 DA efficiently. Whether you use accounting software or other tools, our platform offers the flexibility needed for your business operations.

-

What features does airSlate SignNow offer for the Connecticut CT1120 DA submission?

airSlate SignNow offers features such as eSigning, document templates, and secure storage to facilitate the submission of the Connecticut CT1120 DA. These tools simplify the process, making it quicker and more organized for users to handle their tax documents.

-

How does airSlate SignNow ensure the security of the Connecticut CT1120 DA documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and secure access controls to protect the Connecticut CT1120 DA documents and other sensitive information, ensuring compliance with data protection regulations and safeguarding your business data.

Get more for Name Of Eligible Taxpayer

Find out other Name Of Eligible Taxpayer

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF