Department of Revenue Services State of Connecticu 2024-2026

What is the Department of Revenue Services State of Connecticut?

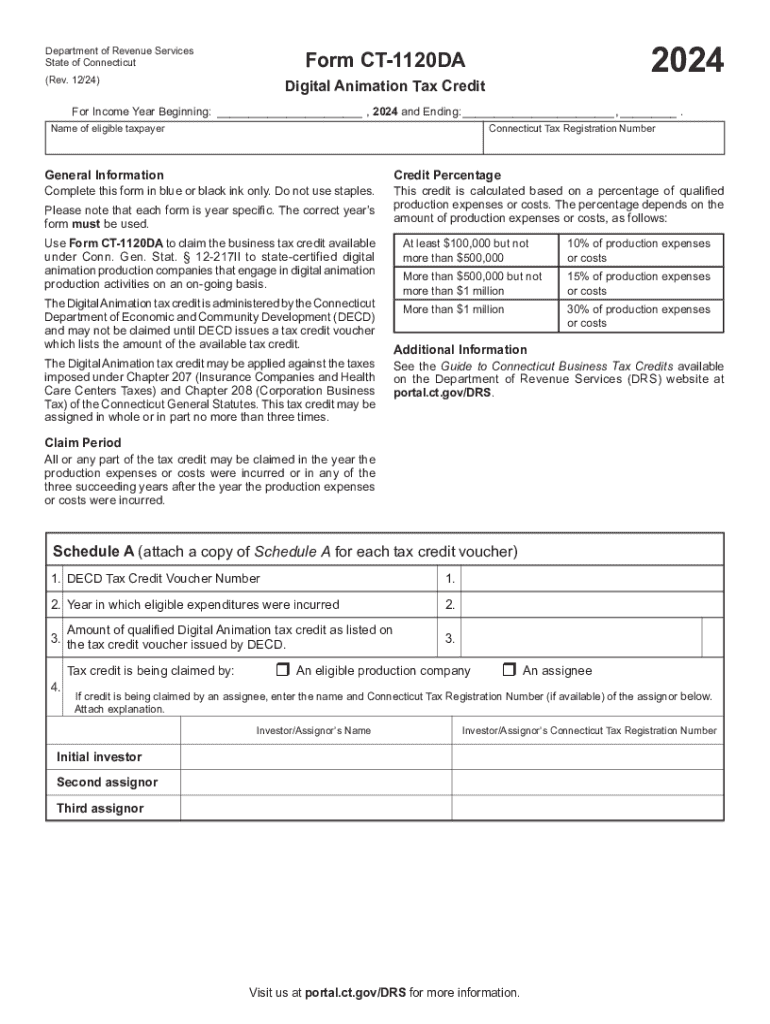

The Department of Revenue Services (DRS) in Connecticut is responsible for administering the state's tax laws and collecting taxes. This agency oversees various tax forms, including the 2012 CT 1120DA tax form, which is specifically designed for corporations to report their income and calculate their tax liability. The DRS ensures compliance with state tax regulations and provides resources to assist taxpayers in fulfilling their obligations.

Steps to complete the 2012 CT 1120DA tax form

Completing the 2012 CT 1120DA tax form involves several key steps:

- Gather necessary information: Collect all financial documents, including income statements, expense records, and previous tax returns.

- Fill out the form: Enter your corporation's details, including name, address, and federal identification number. Report income, deductions, and credits accurately.

- Calculate taxes owed: Use the provided instructions to determine the amount of tax liability based on your reported income.

- Review and sign: Ensure all information is accurate and complete. The form must be signed by an authorized representative of the corporation.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 2012 CT 1120DA tax form. Typically, the form must be submitted by the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties and interest, so timely filing is essential.

Required Documents

When preparing to file the 2012 CT 1120DA tax form, ensure you have the following documents:

- Financial statements, including income statements and balance sheets.

- Records of all business expenses and deductions.

- Previous year’s tax returns, if applicable.

- Any supporting documentation for credits or special deductions claimed.

Form Submission Methods

The 2012 CT 1120DA tax form can be submitted through various methods:

- Online: Some taxpayers may have the option to file electronically through the DRS website or authorized e-filing services.

- By Mail: Print the completed form and send it to the appropriate address provided in the form instructions.

- In-Person: Taxpayers may also deliver the form directly to a DRS office, though this option may vary based on local guidelines.

Penalties for Non-Compliance

Failing to file the 2012 CT 1120DA tax form on time can result in significant penalties. The state may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest will accrue on any unpaid taxes. It is important to understand these consequences to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue services state of connecticu 770473433

Create this form in 5 minutes!

How to create an eSignature for the department of revenue services state of connecticu 770473433

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 ct 1120da tax form?

The 2012 ct 1120da tax form is used by corporations in Connecticut to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately report their financial activities for the year 2012.

-

How can airSlate SignNow help with the 2012 ct 1120da tax filing?

airSlate SignNow simplifies the process of preparing and submitting the 2012 ct 1120da tax form by allowing users to eSign documents securely and efficiently. With our platform, you can easily gather signatures from stakeholders, ensuring that your tax filings are completed on time and without hassle.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution ensures that you can manage your 2012 ct 1120da tax filings without breaking the bank, providing excellent value for the features and benefits included.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing your 2012 ct 1120da tax documents. These tools streamline the filing process and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your 2012 ct 1120da tax filings alongside your financial records. This integration helps ensure that all your data is synchronized and accessible in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your 2012 ct 1120da tax documents offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to focus on your business while we handle the complexities of document management.

-

Is airSlate SignNow compliant with tax regulations?

Absolutely! airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your 2012 ct 1120da tax filings are handled in accordance with state laws. Our commitment to compliance gives you peace of mind when managing your tax documents.

Get more for Department Of Revenue Services State Of Connecticu

Find out other Department Of Revenue Services State Of Connecticu

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free