Lamont Unveils $45M Tax Cut for CT's Working Poor 2023

Key elements of the 2013 CT 1120DA animation

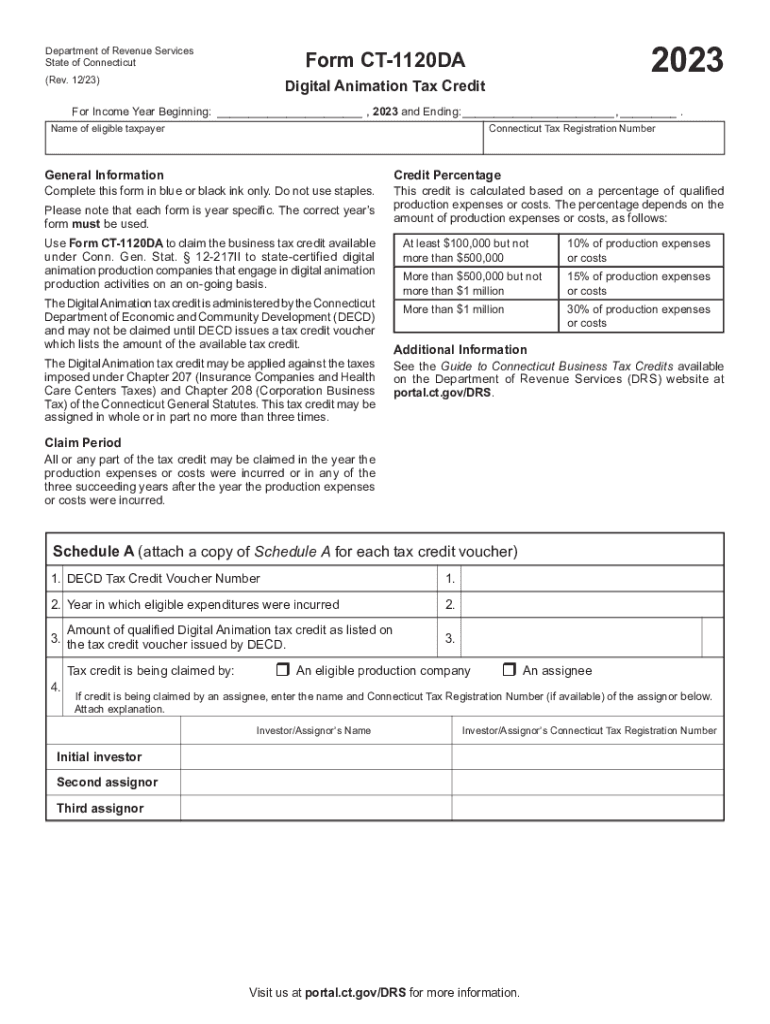

The 2013 CT 1120DA animation is a crucial document for Connecticut businesses, particularly those seeking to claim tax credits. This form is designed to assist businesses in reporting the Connecticut Animation Tax Credit, which is aimed at encouraging growth in the animation industry. The key elements of this form include:

- Identification Information: Businesses must provide their legal name, address, and federal employer identification number (FEIN).

- Credit Calculation: The form guides users through calculating the total credit amount based on eligible expenses related to animation production.

- Documentation Requirements: Businesses must attach supporting documentation to substantiate their claims, including production budgets and payroll records.

- Signature Requirement: The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Steps to complete the 2013 CT 1120DA animation

Completing the 2013 CT 1120DA animation requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather all necessary documentation, including financial records and production details.

- Fill out the identification section with the business's legal name, address, and FEIN.

- Calculate the credit amount based on eligible expenses, ensuring all calculations are accurate.

- Attach required supporting documents that validate your credit claim.

- Review the completed form for accuracy and completeness.

- Sign the form in the designated area.

- Submit the form by the specified deadline, either online or by mail.

Eligibility Criteria for the 2013 CT 1120DA animation

To qualify for the Connecticut Animation Tax Credit, businesses must meet specific eligibility criteria. These criteria include:

- The business must be engaged in producing animation content.

- Eligible expenses must be incurred within the tax year for which the credit is claimed.

- The business must maintain a physical presence in Connecticut.

- All claims must adhere to the guidelines set forth by the Connecticut Department of Revenue Services.

Required Documents for the 2013 CT 1120DA animation

When filing the 2013 CT 1120DA animation, businesses must include various documents to support their claims. Required documents typically include:

- Production budgets detailing all expenses related to animation projects.

- Payroll records for employees directly involved in the animation production.

- Invoices and receipts for services and materials used in the production process.

- Any additional documentation requested by the Connecticut Department of Revenue Services.

Filing Deadlines for the 2013 CT 1120DA animation

Timely submission of the 2013 CT 1120DA animation is essential for businesses to secure their tax credits. The filing deadlines are as follows:

- The form must be submitted by the due date of the business's income tax return.

- Extensions may be available, but businesses should verify specific eligibility requirements with the Connecticut Department of Revenue Services.

Form Submission Methods for the 2013 CT 1120DA animation

Businesses have several options for submitting the 2013 CT 1120DA animation. These methods include:

- Online Submission: Businesses can file electronically through the Connecticut Department of Revenue Services website.

- Mail Submission: Completed forms can be mailed to the designated address provided by the state.

- In-Person Submission: Businesses may also choose to deliver their forms directly to a local Department of Revenue Services office.

Quick guide on how to complete lamont unveils 45m tax cut for cts working poor

Complete Lamont Unveils $45M Tax Cut For CT's Working Poor effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers a splendid eco-friendly substitute to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Lamont Unveils $45M Tax Cut For CT's Working Poor on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign Lamont Unveils $45M Tax Cut For CT's Working Poor without any hassle

- Locate Lamont Unveils $45M Tax Cut For CT's Working Poor and select Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your alterations.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from a device of your choice. Revise and electronically sign Lamont Unveils $45M Tax Cut For CT's Working Poor and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lamont unveils 45m tax cut for cts working poor

Create this form in 5 minutes!

How to create an eSignature for the lamont unveils 45m tax cut for cts working poor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2013 ct 1120da animation and why is it important?

The 2013 ct 1120da animation is a visual representation of the Connecticut corporate tax return process, designed to simplify understanding for users. By utilizing this animation, businesses can gain clarity on filing requirements and timelines, which is crucial for compliance. It serves as an educational tool to ensure accurate submissions.

-

How does airSlate SignNow facilitate the eSigning of the 2013 ct 1120da animation?

airSlate SignNow offers an intuitive platform for electronically signing documents, including the 2013 ct 1120da animation. With its user-friendly interface, users can complete and sign these forms efficiently, saving time and reducing the complexity associated with traditional methods. This enhances the overall filing experience.

-

What are the pricing options for using airSlate SignNow with the 2013 ct 1120da animation?

airSlate SignNow provides flexible pricing plans tailored to meet diverse business needs when working with the 2013 ct 1120da animation. Users can choose from various subscription models that cater to individuals or larger teams, ensuring affordability and scalability. The cost-effectiveness makes it an attractive option for businesses.

-

Can I integrate airSlate SignNow with other software for the 2013 ct 1120da animation?

Yes, airSlate SignNow supports seamless integrations with numerous popular software applications. This makes it easy to incorporate the 2013 ct 1120da animation into your existing workflow, enhancing productivity and collaboration. Users can connect with accounting, CRM, and document management tools to streamline processes.

-

What features does airSlate SignNow offer for managing the 2013 ct 1120da animation?

airSlate SignNow includes powerful features like document templates, customizable workflows, and real-time tracking specifically for managing the 2013 ct 1120da animation. These tools facilitate efficient document handling, allowing users to prepare and review their filings with ease. Enhanced security features also protect sensitive information.

-

How can airSlate SignNow improve the efficiency of filing the 2013 ct 1120da animation?

By using airSlate SignNow, businesses can drastically reduce the time spent on paperwork associated with the 2013 ct 1120da animation. The platform automates signature collection, document routing, and reminders, ensuring timely submissions. This efficiency minimizes the risk of errors and enhances the overall filing experience.

-

Is airSlate SignNow user-friendly for those unfamiliar with the 2013 ct 1120da animation?

Absolutely, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the 2013 ct 1120da animation. The straightforward navigation and helpful tutorials guide users through the process step by step. This empowers users to complete their forms without extensive training.

Get more for Lamont Unveils $45M Tax Cut For CT's Working Poor

- Form 160 fume hood inspection checklist

- Embury application closing dates for 2020 form

- Community education course proposal centralia college centralia form

- Art club application form

- New pta membership form for 2013 2014 nichols elementary pta mynicholspta

- Sequoya elementary school 20132014 student council behavior contract name grade date 1 form

- Major works data sheet form

- Science prefixes and suffixes form

Find out other Lamont Unveils $45M Tax Cut For CT's Working Poor

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed