Form CT 1120DA CT Gov 2021

What is the Form CT 1120DA CT gov

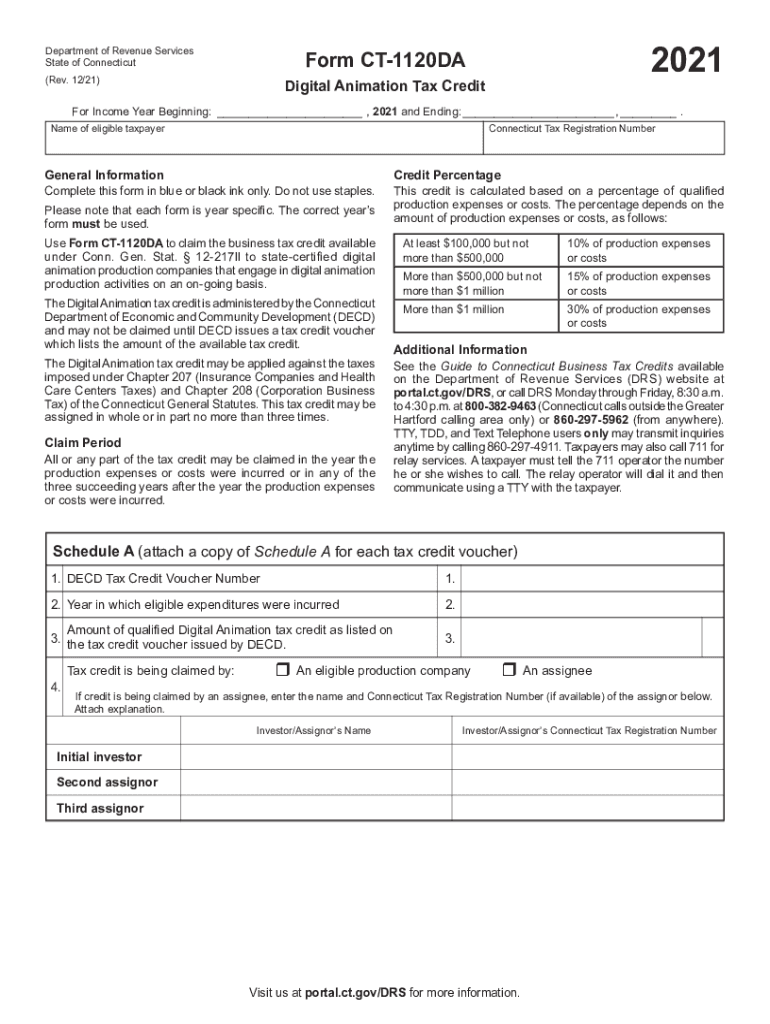

The Form CT 1120DA is a tax form used by corporations in Connecticut to report their income and calculate their tax liability. This form is specifically designed for corporations that are subject to the state's corporate income tax. It allows businesses to declare their income, deductions, and credits, ensuring compliance with state tax regulations. Understanding the purpose and requirements of this form is essential for any corporation operating within Connecticut.

How to obtain the Form CT 1120DA CT gov

The Form CT 1120DA can be obtained directly from the Connecticut Department of Revenue Services (DRS) website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, businesses can contact the DRS office for assistance or visit local tax offices to request a physical copy. Ensuring that you have the correct and most recent version of the form is crucial for accurate filing.

Steps to complete the Form CT 1120DA CT gov

Completing the Form CT 1120DA involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill in the corporation's identifying information, such as name, address, and federal employer identification number (EIN).

- Report total income, including gross receipts and any other income sources.

- Deduct allowable expenses, such as operating costs, to determine taxable income.

- Calculate the tax liability based on the applicable corporate tax rate.

- Review the form for accuracy and completeness before submission.

Legal use of the Form CT 1120DA CT gov

The legal use of the Form CT 1120DA is crucial for ensuring that corporations meet their tax obligations in Connecticut. Properly completed forms are considered legally binding documents that must adhere to state regulations. Failure to accurately report income or pay the correct tax amount can result in penalties and interest charges. Utilizing electronic filing options can enhance the security and efficiency of the submission process, aligning with legal standards for e-signatures.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Form CT 1120DA. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this typically means the form is due by April 15. It is important to stay informed about any changes to deadlines or extensions that may be announced by the Connecticut Department of Revenue Services.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 1120DA can be submitted through various methods to accommodate different preferences. Corporations can file electronically through the Connecticut Department of Revenue Services' online portal, which offers a streamlined process. Alternatively, businesses may choose to mail the completed form to the appropriate address provided by the DRS. In-person submissions are also accepted at designated tax offices. Each method has its own advantages, such as faster processing times for electronic filings.

Quick guide on how to complete form ct 1120da ctgov

Effortlessly Prepare Form CT 1120DA CT gov on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Form CT 1120DA CT gov on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centered process today.

The easiest way to modify and eSign Form CT 1120DA CT gov effortlessly

- Obtain Form CT 1120DA CT gov and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the document or redact sensitive information with specialized tools that airSlate SignNow offers.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form CT 1120DA CT gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1120da ctgov

Create this form in 5 minutes!

People also ask

-

What is Form CT 1120DA CT gov?

Form CT 1120DA CT gov is a tax form used by businesses in Connecticut to report and pay their corporations' income tax. It is essential for any corporation operating within the state to ensure compliance and avoid penalties. Using airSlate SignNow can simplify the eSigning process for this document, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow help with Form CT 1120DA CT gov?

airSlate SignNow streamlines the process of signing and submitting Form CT 1120DA CT gov by providing a user-friendly platform for electronic signatures. This allows businesses to quickly and securely sign their tax documents without the hassle of printing and mailing. With our solution, you can ensure your form is submitted on time and compliance is maintained.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible and cost-effective pricing plans tailored to meet the needs of businesses of all sizes. Whether you're a small business or a large corporation, you can find a plan that accommodates your needs for managing documents like Form CT 1120DA CT gov. Please visit our website for detailed pricing information and to find the best option for you.

-

Are there any features in airSlate SignNow specifically for tax documents?

Yes, airSlate SignNow includes features tailored for handling tax documents, including the ability to add secure electronic signatures, timestamps, and customizable templates for Form CT 1120DA CT gov. These features help businesses streamline document management, ensuring that every tax form is completed accurately and securely.

-

Can I integrate airSlate SignNow with other applications for easier management of Form CT 1120DA CT gov?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Workspace, Salesforce, and more. This allows you to easily manage and send Form CT 1120DA CT gov alongside your other business documents, enhancing efficiency and organization.

-

What are the benefits of using airSlate SignNow for Form CT 1120DA CT gov?

Using airSlate SignNow for Form CT 1120DA CT gov offers numerous benefits, including time savings, enhanced security, and a streamlined process for document handling. You will not only be able to complete and sign your tax form quickly, but you will also have access to tracking features that keep you informed throughout the process.

-

Is airSlate SignNow compliant with regulations for Form CT 1120DA CT gov?

Yes, airSlate SignNow is designed to comply with all necessary regulations regarding eSigning and document handling, including those applicable to Form CT 1120DA CT gov. We ensure that our platform meets federal and state compliance standards, giving you peace of mind when managing your tax forms.

Get more for Form CT 1120DA CT gov

- Hi landlord 497304447 form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497304449 form

- Hawaii violating form

- Hawaii violating 497304451 form

- Hawaii violating 497304452 form

- Business credit application hawaii form

- Individual credit application hawaii form

- Interrogatories to plaintiff for motor vehicle occurrence hawaii form

Find out other Form CT 1120DA CT gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors