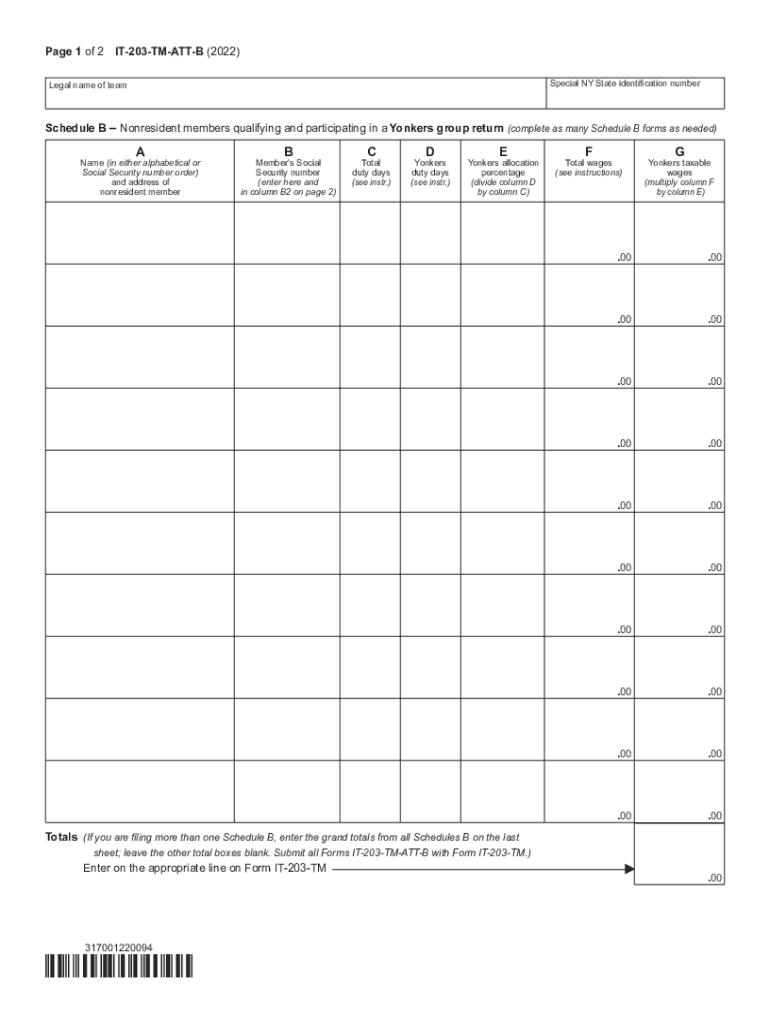

Form it 203 TM ATT B Schedule B Group Return for Nonresident Athletic Team Members Tax Year 2022

Understanding the IT 201 Tax Return

The IT 201 tax return is a crucial document for individuals who need to report their income and calculate their tax liability in New York State. This form is primarily used by residents to declare their income from various sources, including wages, salaries, and other earnings. It is essential for ensuring compliance with state tax laws and for determining eligibility for certain credits and deductions.

Steps to Complete the IT 201 Tax Return

Filling out the IT 201 tax return involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and other income statements.

- Complete the personal information section, including your name, address, and Social Security number.

- Report your income by entering figures from your documents into the appropriate sections of the form.

- Calculate your total tax liability using the provided tax tables or software.

- Claim any deductions or credits for which you may be eligible, such as the standard deduction or itemized deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines for the IT 201 Tax Return

It is important to be aware of the filing deadlines associated with the IT 201 tax return. Typically, the deadline for filing this form is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time can file for an extension, but it is crucial to pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents for the IT 201 Tax Return

To complete the IT 201 tax return accurately, you will need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or property taxes

- Proof of any tax credits you plan to claim

Having these documents ready will streamline the filing process and help ensure that you do not miss any important information.

Legal Use of the IT 201 Tax Return

The IT 201 tax return is legally binding once it is signed and submitted to the New York State Department of Taxation and Finance. It is essential to provide accurate information, as any discrepancies can lead to audits or penalties. Using electronic filing methods can enhance the security and efficiency of the submission process, ensuring compliance with state regulations.

Digital vs. Paper Version of the IT 201 Tax Return

Taxpayers have the option to file the IT 201 tax return either digitally or on paper. The digital version often provides a quicker processing time and immediate confirmation of receipt. Additionally, electronic filing typically includes built-in checks for errors, reducing the likelihood of mistakes. However, some individuals may prefer the paper version for its tangible nature. Regardless of the method chosen, ensuring that the form is completed accurately is paramount.

Quick guide on how to complete form it 203 tm att b schedule b group return for nonresident athletic team members tax year 2022

Complete Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year on any platform with airSlate SignNow mobile applications for Android or iOS and simplify any document-related tasks today.

The most efficient way to modify and eSign Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year with ease

- Locate Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm att b schedule b group return for nonresident athletic team members tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att b schedule b group return for nonresident athletic team members tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 201 tax return, and who needs to file it?

The it 201 tax return is a New Jersey state income tax form that must be filed by residents earning income. If you are a resident of New Jersey and have earned income during the tax year, you will need to submit this form to report your earnings and calculate your tax obligation. It is essential for ensuring compliance with state tax laws.

-

How can airSlate SignNow help in preparing my it 201 tax return?

airSlate SignNow streamlines the document signing process, making it easy for you to prepare your it 201 tax return. With our platform, you can quickly and securely send, sign, and manage all documents related to your tax return. This enhances efficiency and ensures all parties have access to necessary documents.

-

Is airSlate SignNow cost-effective for sending documents related to it 201 tax return?

Yes, airSlate SignNow offers a cost-effective solution for sending documents, including those related to your it 201 tax return. Our pricing plans are designed to fit various business needs, ensuring you can manage your documents efficiently without breaking the bank. Investing in our services can save you time and money during tax season.

-

What features does airSlate SignNow provide for eSigning my it 201 tax return?

airSlate SignNow includes several features for eSigning your it 201 tax return, such as customizable templates, drag-and-drop signing, and real-time tracking. These tools make it easy for you to sign documents securely and ensure they are executed accurately and efficiently. Plus, all documents are stored securely for future reference.

-

Can I integrate airSlate SignNow with my existing accounting software for my it 201 tax return?

Absolutely! airSlate SignNow can be integrated with various accounting software solutions, making it easier to manage your it 201 tax return documentation. This integration facilitates a seamless workflow by allowing you to send and sign tax-related documents directly within your accounting platform, enhancing productivity.

-

What benefits do I gain from using airSlate SignNow for my it 201 tax return?

Using airSlate SignNow for your it 201 tax return offers numerous benefits, including enhanced efficiency and security. Our platform allows you to minimize paperwork, ensuring faster processing times for your tax documents. Additionally, you can have peace of mind knowing that your documents are safe and easily accessible when needed.

-

How secure is airSlate SignNow for handling my it 201 tax return documents?

airSlate SignNow places a high priority on security, utilizing industry-standard encryption to protect your it 201 tax return documents. Our platform complies with necessary regulations, ensuring that your sensitive information remains confidential. Regular security audits and updates provide peace of mind that your data is safeguarded.

Get more for Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year

Find out other Form IT 203 TM ATT B Schedule B Group Return For Nonresident Athletic Team Members Tax Year

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template