New York Form it 203 GR ATT B Schedule B Yonkers 2024-2026

What is the New York Form IT 203 GR ATT B Schedule B Yonkers

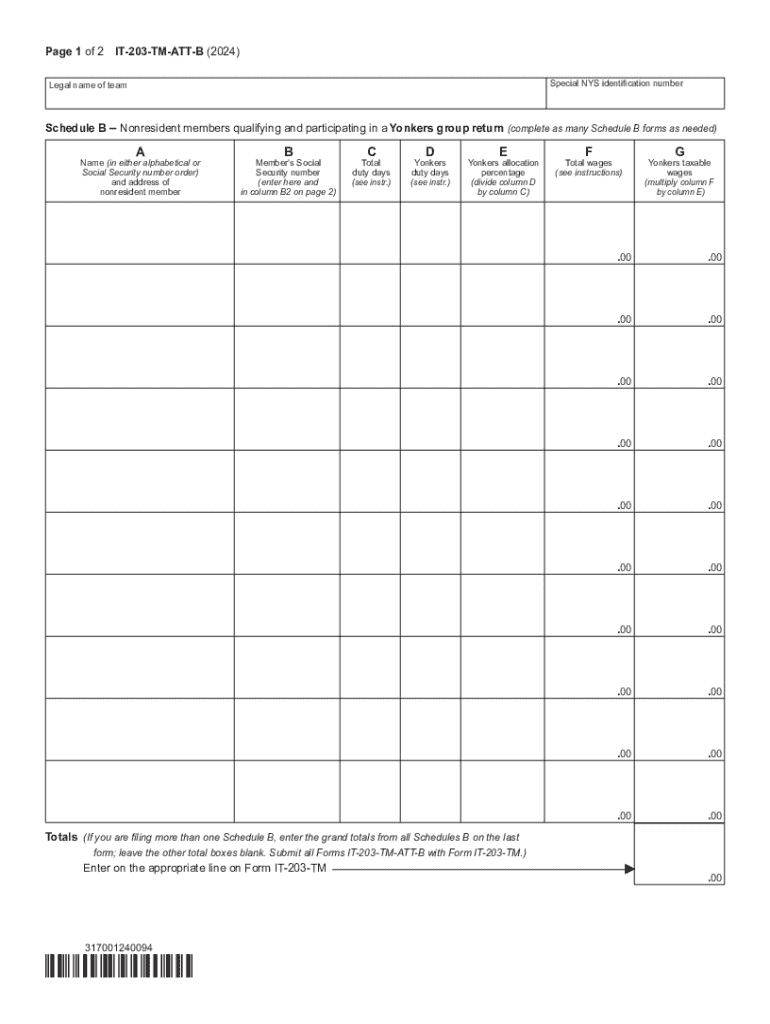

The New York Form IT 203 GR ATT B Schedule B Yonkers is a tax form specifically designed for non-residents of New York who earn income from sources within the state and are required to file a New York State tax return. This form is utilized to report various types of income, deductions, and credits that apply to Yonkers residents and non-residents alike. It plays a crucial role in determining the amount of tax owed or the refund due based on the individual's specific financial situation.

How to use the New York Form IT 203 GR ATT B Schedule B Yonkers

Using the New York Form IT 203 GR ATT B Schedule B Yonkers involves several steps. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all income and deductions are accurately reported. It is important to follow the instructions provided with the form to avoid errors. Once completed, the form must be submitted by the appropriate deadline, along with any required supporting documents to the New York State Department of Taxation and Finance.

Steps to complete the New York Form IT 203 GR ATT B Schedule B Yonkers

Completing the New York Form IT 203 GR ATT B Schedule B Yonkers involves a systematic approach:

- Begin by downloading the form from the New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all income earned from New York sources, including wages, interest, and dividends.

- Claim any applicable deductions, such as business expenses or contributions to retirement accounts.

- Calculate your tax liability based on the provided tax tables or instructions.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified due date, either electronically or via mail.

Key elements of the New York Form IT 203 GR ATT B Schedule B Yonkers

Several key elements are essential when working with the New York Form IT 203 GR ATT B Schedule B Yonkers:

- Income Reporting: Accurate reporting of all income sources is critical.

- Deductions: Identifying and claiming eligible deductions can significantly affect tax liability.

- Filing Status: Ensure that the correct filing status is selected based on your circumstances.

- Tax Credits: Explore available tax credits that may reduce your overall tax burden.

Filing Deadlines / Important Dates

Filing deadlines for the New York Form IT 203 GR ATT B Schedule B Yonkers are crucial for compliance. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or specific requirements that may arise.

Legal use of the New York Form IT 203 GR ATT B Schedule B Yonkers

The legal use of the New York Form IT 203 GR ATT B Schedule B Yonkers is governed by state tax laws. Individuals must file this form if they have income sourced from New York while being a non-resident. Failure to file can result in penalties, interest on unpaid taxes, and potential legal action. It is essential to ensure that the form is filled out correctly and submitted on time to remain compliant with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 203 gr att b schedule b yonkers

Create this form in 5 minutes!

How to create an eSignature for the new york form it 203 gr att b schedule b yonkers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York Form IT 203 GR ATT B Schedule B Yonkers?

New York Form IT 203 GR ATT B Schedule B Yonkers is a tax form used by residents of Yonkers to report their income and calculate their tax liability. This form is essential for ensuring compliance with state tax regulations and can help you maximize your deductions.

-

How can airSlate SignNow help with New York Form IT 203 GR ATT B Schedule B Yonkers?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending New York Form IT 203 GR ATT B Schedule B Yonkers. Our solution streamlines the process, making it faster and more efficient to manage your tax documents.

-

What are the pricing options for using airSlate SignNow for New York Form IT 203 GR ATT B Schedule B Yonkers?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise, you can find a cost-effective solution to manage your New York Form IT 203 GR ATT B Schedule B Yonkers and other documents.

-

Are there any features specifically designed for New York Form IT 203 GR ATT B Schedule B Yonkers?

Yes, airSlate SignNow includes features that simplify the completion and submission of New York Form IT 203 GR ATT B Schedule B Yonkers. These features include customizable templates, automated reminders, and secure storage for your documents.

-

What benefits does airSlate SignNow offer for managing New York Form IT 203 GR ATT B Schedule B Yonkers?

Using airSlate SignNow for New York Form IT 203 GR ATT B Schedule B Yonkers provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and are easily accessible when needed.

-

Can I integrate airSlate SignNow with other software for New York Form IT 203 GR ATT B Schedule B Yonkers?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your New York Form IT 203 GR ATT B Schedule B Yonkers alongside your existing tools. This integration helps streamline your workflow and improve productivity.

-

Is airSlate SignNow compliant with New York tax regulations for Form IT 203 GR ATT B Schedule B Yonkers?

Yes, airSlate SignNow is designed to comply with New York tax regulations, ensuring that your New York Form IT 203 GR ATT B Schedule B Yonkers is processed correctly. Our platform is regularly updated to reflect any changes in tax laws, providing peace of mind for our users.

Get more for New York Form IT 203 GR ATT B Schedule B Yonkers

Find out other New York Form IT 203 GR ATT B Schedule B Yonkers

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word