High Performance Incentive ProgramManufacturing Tax 2022

What is the High Performance Incentive Program Manufacturing Tax

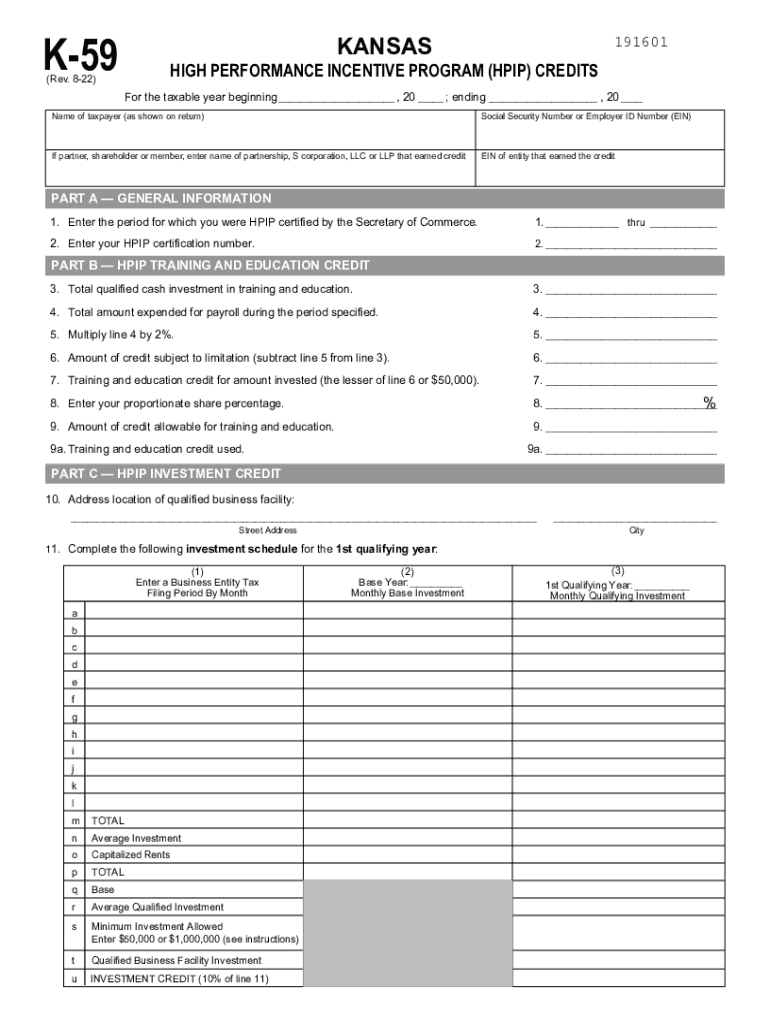

The High Performance Incentive Program Manufacturing Tax is a tax incentive designed to encourage investment in manufacturing facilities and processes in Kansas. This program aims to foster economic growth by providing financial benefits to businesses that meet specific performance criteria. Eligible companies can receive tax credits based on the number of jobs created, the amount of capital invested, and other economic factors. Understanding this tax can help businesses leverage opportunities for savings while contributing to the state's economic development.

Steps to complete the High Performance Incentive Program Manufacturing Tax

Completing the High Performance Incentive Program Manufacturing Tax requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including financial statements and proof of job creation.

- Fill out the Kansas Form K 59 accurately, ensuring all information aligns with the eligibility criteria.

- Review the completed form for any errors or omissions before submission.

- Submit the form to the appropriate state agency, either online or by mail, depending on the submission guidelines.

Following these steps can help ensure that your application is processed smoothly and efficiently.

Eligibility Criteria

To qualify for the High Performance Incentive Program Manufacturing Tax, businesses must meet specific eligibility criteria. These typically include:

- Establishing a manufacturing facility in Kansas.

- Creating a minimum number of new jobs within a specified timeframe.

- Investing a certain amount of capital in the facility or equipment.

It is crucial for businesses to review these criteria thoroughly to determine their eligibility before applying.

Legal use of the High Performance Incentive Program Manufacturing Tax

The legal use of the High Performance Incentive Program Manufacturing Tax involves adhering to state regulations and guidelines. Businesses must ensure compliance with all applicable laws regarding tax credits and incentives. This includes maintaining accurate records of job creation and investments, as well as understanding the reporting requirements set forth by the Kansas Department of Revenue. Non-compliance can result in penalties or the loss of tax benefits.

Form Submission Methods

Businesses have several options for submitting the Kansas Form K 59. These methods include:

- Online submission through the Kansas Department of Revenue website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right method can streamline the process and ensure timely processing of the application.

Key elements of the High Performance Incentive Program Manufacturing Tax

Understanding the key elements of the High Performance Incentive Program Manufacturing Tax is vital for businesses looking to take advantage of this incentive. Important components include:

- The criteria for job creation and capital investment.

- The specific tax credits available based on performance metrics.

- The duration of the benefits and any renewal requirements.

Familiarity with these elements can help businesses maximize their benefits under the program.

Quick guide on how to complete high performance incentive programmanufacturing tax

Effortlessly prepare High Performance Incentive ProgramManufacturing Tax on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage High Performance Incentive ProgramManufacturing Tax on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign High Performance Incentive ProgramManufacturing Tax with ease

- Find High Performance Incentive ProgramManufacturing Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or conceal confidential information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tiring form searches, or errors necessitating the printing of new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and electronically sign High Performance Incentive ProgramManufacturing Tax to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct high performance incentive programmanufacturing tax

Create this form in 5 minutes!

How to create an eSignature for the high performance incentive programmanufacturing tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's k 59 feature?

The k 59 feature in airSlate SignNow streamlines the process of eSigning documents, ensuring that users can send and receive signed documents quickly and efficiently. With intuitive tools and functionalities, k 59 enhances productivity and keeps your workflows running smoothly.

-

How much does airSlate SignNow cost for k 59 users?

Pricing for airSlate SignNow's k 59 solution is competitive and designed to meet the budgetary needs of businesses of all sizes. By offering tiered pricing plans, airSlate SignNow ensures that k 59 users can access top-quality eSigning features without breaking the bank.

-

What benefits does k 59 offer to businesses?

The k 59 feature is designed to provide signNow benefits such as enhanced efficiency, improved document security, and reduced turnaround time for signatures. By leveraging k 59, businesses can enhance their operational workflow, leading to better overall performance.

-

Can I integrate k 59 with other software?

Yes, airSlate SignNow's k 59 feature supports integration with various software applications, making it easy to incorporate into your existing workflow. This flexibility allows businesses to streamline their processes and maximize productivity by connecting k 59 with tools they already use.

-

Is k 59 secure for sensitive documents?

Absolutely. The k 59 feature in airSlate SignNow utilizes robust encryption and security protocols to protect sensitive documents. Users can confidently send and sign important files, knowing that data security is a priority with k 59.

-

What types of documents can be signed using k 59?

With airSlate SignNow's k 59, you can easily sign a wide range of documents, including contracts, agreements, and forms. The versatility of k 59 allows businesses to handle various document types effectively, ensuring seamless eSigning experiences.

-

How does k 59 improve the eSigning process?

K 59 improves the eSigning process by offering a user-friendly interface and advanced features that simplify document management. Users can easily track status, set reminders, and manage signatures efficiently, which enhances the overall eSigning experience.

Get more for High Performance Incentive ProgramManufacturing Tax

- Tn eviction form

- Letter from landlord to tenant returning security deposit less deductions tennessee form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return tennessee form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return tennessee form

- Letter from tenant to landlord containing request for permission to sublease tennessee form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497326775 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent 497326776 form

- Tenant landlord about 497326777 form

Find out other High Performance Incentive ProgramManufacturing Tax

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast