941N Nebraska Income Tax Withholding Return 2022-2026

What is the 941N Nebraska Income Tax Withholding Return

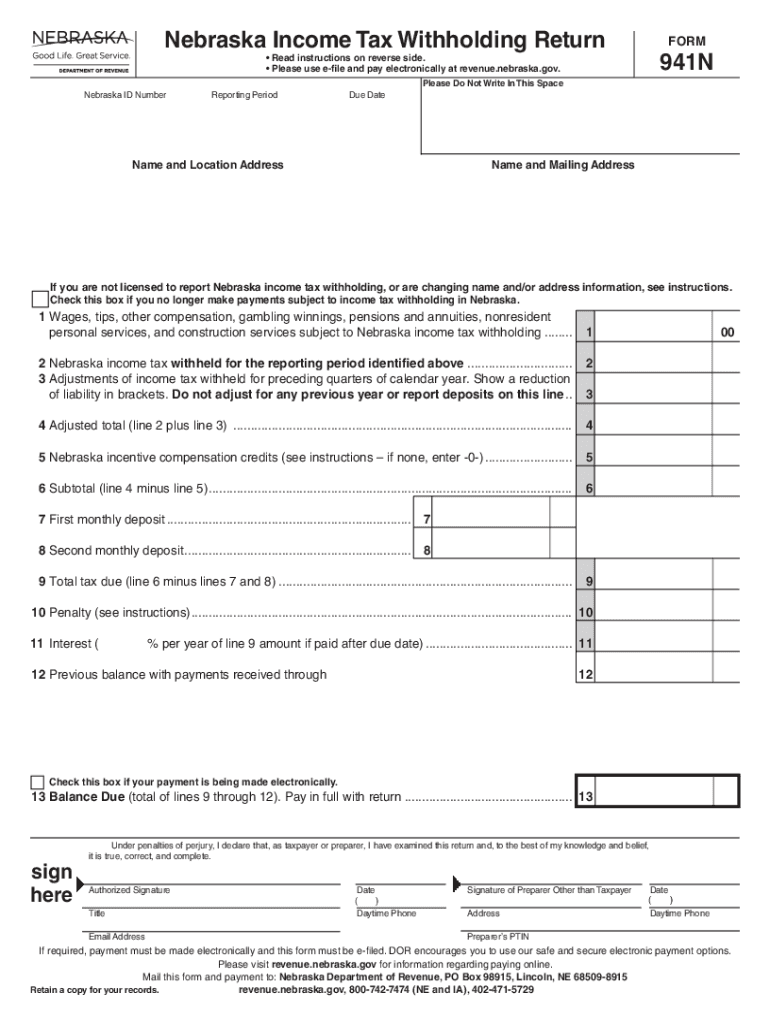

The 941N Nebraska Income Tax Withholding Return is a crucial tax form used by employers in Nebraska to report income tax withheld from employees' wages. This form is specifically designed for businesses that withhold state income tax from their employees' paychecks. It serves as a summary of the total amount withheld during a reporting period and is essential for maintaining compliance with state tax laws.

Employers must file the 941N form quarterly, ensuring that they accurately report the amount of Nebraska income tax withheld. This helps the state monitor tax collections and ensures that employees receive proper credit for the taxes withheld from their wages.

How to use the 941N Nebraska Income Tax Withholding Return

To effectively use the 941N Nebraska Income Tax Withholding Return, employers need to gather all relevant payroll information for the reporting period. This includes total wages paid, the amount withheld for state income taxes, and any adjustments for over- or under-withholding. Once this data is compiled, it can be entered into the appropriate sections of the form.

Employers can complete the form either digitally or on paper. Using digital tools can streamline the process, ensuring accuracy and compliance with state regulations. After filling out the form, it must be submitted to the Nebraska Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the 941N Nebraska Income Tax Withholding Return

Completing the 941N Nebraska Income Tax Withholding Return involves several key steps:

- Gather payroll records for the reporting period, including total wages and tax withheld.

- Access the 941N form, which can be found on the Nebraska Department of Revenue website or through authorized tax software.

- Fill in the employer information, including the name, address, and federal Employer Identification Number (EIN).

- Report the total wages paid and the amount of Nebraska income tax withheld in the designated sections.

- Double-check all entries for accuracy and completeness.

- Submit the completed form electronically or via mail to the Nebraska Department of Revenue by the due date.

Filing Deadlines / Important Dates

Filing deadlines for the 941N Nebraska Income Tax Withholding Return are critical for compliance. The form is due quarterly, with specific deadlines as follows:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Employers should ensure that their forms are submitted by these dates to avoid late fees and penalties.

Required Documents

When preparing to file the 941N Nebraska Income Tax Withholding Return, employers should have the following documents ready:

- Payroll records detailing employee wages and withholdings for the reporting period.

- Previous 941N forms, if applicable, for reference and consistency.

- Any relevant tax identification numbers, such as the federal Employer Identification Number (EIN).

- Documentation of any adjustments made to withholdings during the period.

Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to file the 941N Nebraska Income Tax Withholding Return on time can result in significant penalties for employers. These penalties may include:

- Late filing penalties, which can accumulate based on how late the form is submitted.

- Interest on any unpaid tax amounts, which accrues until the balance is paid in full.

- Potential legal consequences for continued non-compliance, which may include audits or additional fines.

Employers are encouraged to stay informed about their filing obligations to avoid these penalties and maintain good standing with the Nebraska Department of Revenue.

Quick guide on how to complete 941n nebraska income tax withholding return 627499286

Complete 941N Nebraska Income Tax Withholding Return effortlessly on any device

Online document management has gained immense traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents since you can easily locate the right template and securely store it online. airSlate SignNow provides all the features necessary to create, edit, and eSign your documents swiftly and without holdups. Manage 941N Nebraska Income Tax Withholding Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 941N Nebraska Income Tax Withholding Return without hassle

- Locate 941N Nebraska Income Tax Withholding Return and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management necessities in just a few clicks from the device of your choosing. Modify and eSign 941N Nebraska Income Tax Withholding Return and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941n nebraska income tax withholding return 627499286

Create this form in 5 minutes!

How to create an eSignature for the 941n nebraska income tax withholding return 627499286

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with Nebraska revenue?

airSlate SignNow is an electronic signature solution that helps businesses streamline their document signing processes. By using SignNow, companies operating in Nebraska can enhance their workflow efficiency, ultimately contributing to improved Nebraska revenue through faster transactions.

-

How does airSlate SignNow integrate with existing systems to optimize Nebraska revenue?

airSlate SignNow integrates seamlessly with popular business applications such as CRM and document management systems. This integration allows businesses in Nebraska to automate their workflows, leading to increased efficiency and ultimately higher Nebraska revenue.

-

What are the key features of airSlate SignNow that benefit Nebraska businesses?

Key features of airSlate SignNow include electronic signatures, customizable templates, and advanced analytics. These tools empower Nebraska businesses to manage their documents more effectively, reduce turnaround times, and positively impact their Nebraska revenue.

-

Is airSlate SignNow a cost-effective solution for managing Nebraska revenue processes?

Yes, airSlate SignNow offers a range of pricing plans that cater to various business sizes and needs, making it a cost-effective choice. By reducing the time and costs associated with document management, Nebraska companies can directly enhance their overall Nebraska revenue.

-

Can airSlate SignNow help ensure compliance with Nebraska laws?

Absolutely! airSlate SignNow is designed to meet legal requirements for electronic signatures in Nebraska. Utilizing SignNow helps businesses ensure they remain compliant, which is crucial for maintaining trust and optimizing Nebraska revenue.

-

What support does airSlate SignNow offer to Nebraska businesses using their platform?

airSlate SignNow provides robust customer support via various channels including chat, email, and phone. This support ensures that Nebraska businesses have the assistance they need to maximize their use of the platform, aiding their efforts to enhance Nebraska revenue.

-

How does airSlate SignNow enhance customer experience for Nebraska businesses?

By facilitating quick and easy document signing, airSlate SignNow signNowly improves the customer experience. This enhanced experience can lead to increased satisfaction and repeat business, thus boosting Nebraska revenue for local companies.

Get more for 941N Nebraska Income Tax Withholding Return

- Agreement between buyer seller contract form

- Educational religious charitable form

- Confidentiality agreements noncompetition in employment form

- Restricted endowment to religious institution form

- Agreement between owner and construction manager for services in overseeing a construction project form

- Advertising opportunity sample letter form

- Request production documents form

- Appointment resolution 497328650 form

Find out other 941N Nebraska Income Tax Withholding Return

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online