Form 941n Nebraska 2019

What is the Form 941n Nebraska

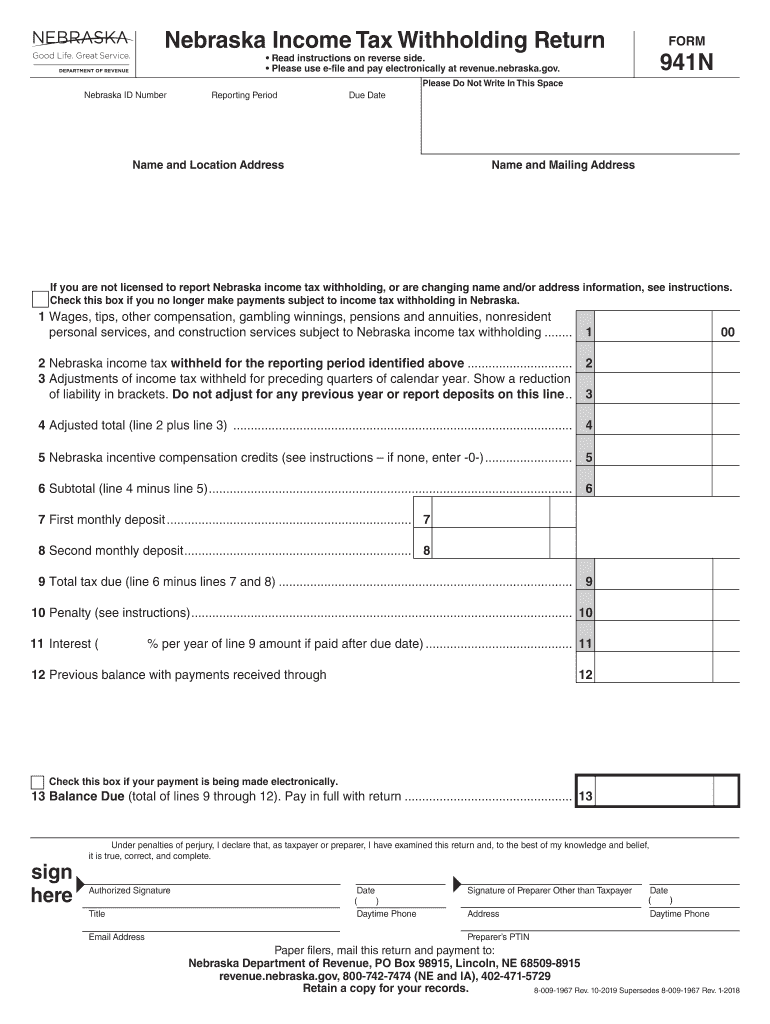

The Form 941n Nebraska is a state-specific withholding tax form used by employers in Nebraska to report income tax withheld from employee wages. This form is essential for businesses to comply with state tax regulations and ensure proper reporting to the Nebraska Department of Revenue. The 941n form captures critical information such as the total wages paid, the amount of Nebraska state withholding, and any adjustments that may be necessary for the reporting period.

How to use the Form 941n Nebraska

Using the Form 941n Nebraska involves several steps to ensure accurate reporting of state withholding taxes. Employers must first gather all relevant payroll information for the reporting period, including total wages paid and the amount withheld for state taxes. Once the data is compiled, employers can fill out the form, ensuring that all required fields are completed accurately. After completing the form, it should be submitted according to the state guidelines, either electronically or via mail, depending on the employer's preference and the specific requirements set forth by the Nebraska Department of Revenue.

Steps to complete the Form 941n Nebraska

Completing the Form 941n Nebraska requires careful attention to detail. Here are the steps to follow:

- Gather payroll records for the reporting period, including total wages and withholdings.

- Fill in the employer's information, including name, address, and identification number.

- Report total wages paid to employees during the period in the designated section.

- Calculate and enter the total amount of Nebraska state withholding.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form electronically or by mail, following the submission guidelines provided by the Nebraska Department of Revenue.

Legal use of the Form 941n Nebraska

The legal use of the Form 941n Nebraska is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the required deadlines. Employers are responsible for ensuring that the information provided is correct, as inaccuracies can lead to penalties or audits. Additionally, using a reliable electronic signature solution, such as signNow, can enhance the legal validity of the form by providing a secure and compliant method for signing and submitting documents.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941n Nebraska to avoid penalties. Typically, the form is due on a quarterly basis, with specific due dates for each quarter. For example, the first quarter's form is usually due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31 of the following year. It is crucial for employers to mark these dates on their calendars to ensure timely submission and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 941n Nebraska can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online Submission: Employers can file the form electronically through the Nebraska Department of Revenue's online portal, which is often the quickest and most efficient method.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Nebraska Department of Revenue.

- In-Person Submission: Employers may also choose to submit the form in person at designated state offices, although this method is less common.

Quick guide on how to complete ne dor 941n 2019

Effortlessly prepare Form 941n Nebraska on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 941n Nebraska on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Form 941n Nebraska with ease

- Locate Form 941n Nebraska and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight essential sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all information and then click the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 941n Nebraska and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ne dor 941n 2019

Create this form in 5 minutes!

How to create an eSignature for the ne dor 941n 2019

How to make an eSignature for your Ne Dor 941n 2019 online

How to make an electronic signature for your Ne Dor 941n 2019 in Google Chrome

How to generate an eSignature for signing the Ne Dor 941n 2019 in Gmail

How to make an eSignature for the Ne Dor 941n 2019 right from your smart phone

How to make an electronic signature for the Ne Dor 941n 2019 on iOS devices

How to make an eSignature for the Ne Dor 941n 2019 on Android devices

People also ask

-

What is the 941n Nebraska form used for?

The 941n Nebraska form is used by employers to report wages and taxes withheld for employees in Nebraska. It's essential for ensuring compliance with state tax regulations and provides valuable information to the Nebraska Department of Revenue. By using airSlate SignNow, you can easily fill out and eSign the 941n Nebraska form, streamlining your payroll process.

-

How can airSlate SignNow help with filing the 941n Nebraska?

airSlate SignNow can simplify the process of filing the 941n Nebraska by allowing you to complete and eSign the document digitally. This saves time and reduces the chances of errors that can occur with paper forms. Furthermore, you can securely store and manage your completed forms with ease.

-

Is airSlate SignNow cost-effective for small businesses in Nebraska?

Yes, airSlate SignNow offers competitive pricing tailored for small businesses, making it a cost-effective solution. With its easy-to-use platform, small businesses in Nebraska can manage their document signing needs without breaking the bank. The ability to streamline processes also contributes to cost savings over time.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides various features such as customizable templates, unlimited signatures, and real-time tracking of document status. This is particularly beneficial for businesses in Nebraska dealing with the 941n form, as it ensures that everything stays organized and is easily accessible. Additionally, you can invite others to sign documents effortlessly.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers seamless integrations with various popular applications, enhancing your workflow efficiency. Businesses in Nebraska can integrate it with accounting software, CRMs, and other tools, making the management of the 941n Nebraska form even easier and more efficient.

-

What are the security measures in place for using airSlate SignNow?

Security is a top priority for airSlate SignNow, which incorporates advanced encryption and compliance standards to protect your sensitive documents. When handling forms like the 941n Nebraska, you can trust that your information is safe and secure. This allows you to focus on your business without worrying about data bsignNowes.

-

Is there support available if I have questions about the 941n Nebraska form?

Yes, airSlate SignNow offers dedicated customer support to help you with any questions, including those related to the 941n Nebraska form. Whether you need guidance on completing the form or resolving a technical issue, you can rely on their responsive support team for assistance. This ensures that you have the help you need whenever you need it.

Get more for Form 941n Nebraska

- Application for public marriage record los angeles form

- Blank marriage application form

- State of minnesota marriage license fillable form

- Philippines affidavit legal form

- County of imperial marriage license application and information co imperial ca

- Vi marriage form

- Metis pedigree charts form

- Form int 3 savings ampamp loan association building ampamp loan association tax return 794877513

Find out other Form 941n Nebraska

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity