Fillable Online Fillable Online If You Are Not Licensed to 2021

Understanding Form 941N in Nebraska

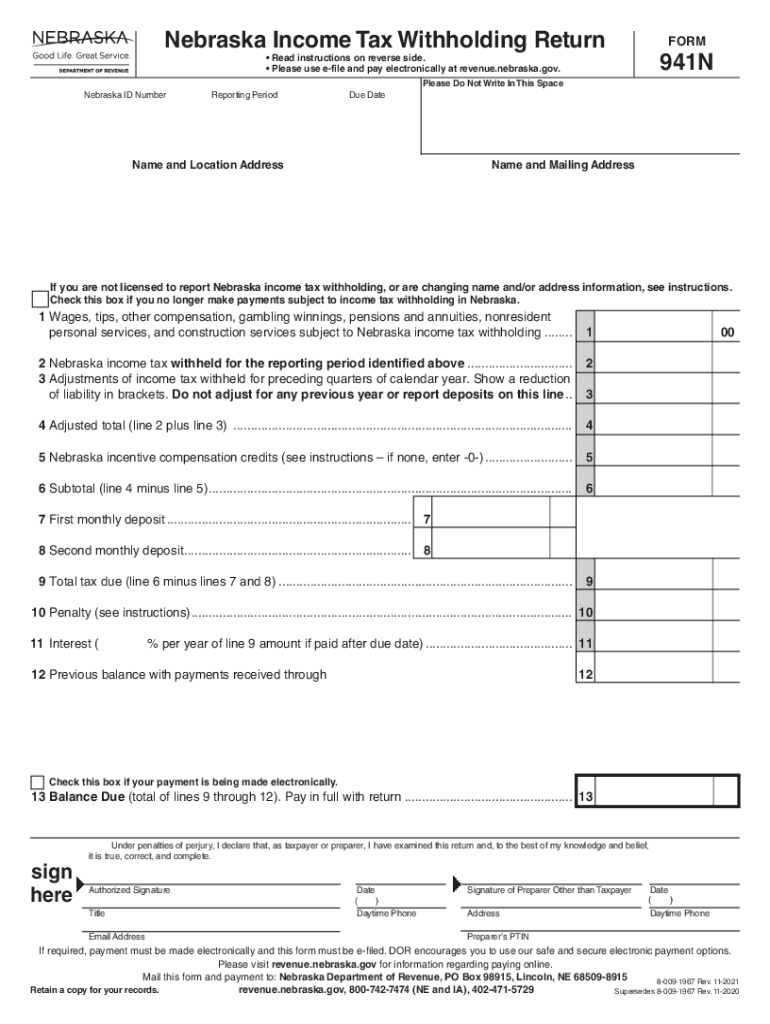

The form 941N is a crucial document used by employers in Nebraska to report income tax withheld from employee wages, along with the employer's share of social security and Medicare taxes. This form is specifically designed for employers who do not have a federal employer identification number (EIN) and are required to report their state withholding. Understanding the purpose and requirements of this form is essential for compliance with Nebraska tax laws.

Steps to Complete the Nebraska Form 941N

Completing the Nebraska form 941N involves several important steps:

- Gather necessary information, including your business name, address, and the total amount of wages paid to employees.

- Calculate the total income tax withheld from employee wages during the reporting period.

- Determine the employer's share of social security and Medicare taxes.

- Fill out the form accurately, ensuring all figures are correct and reflect the total amounts for the reporting period.

- Review the completed form for any errors before submission.

Filing Deadlines for Form 941N

It is important to adhere to the filing deadlines for the 941N Nebraska withholding return. Typically, the form must be filed quarterly, with specific deadlines set by the Nebraska Department of Revenue. These deadlines are usually the last day of the month following the end of each quarter. Employers should mark their calendars to avoid late submissions and potential penalties.

Required Documents for Filing

When preparing to file the form 941N, employers should have the following documents ready:

- Employee wage records for the reporting period.

- Records of income tax withheld from employees.

- Documentation of the employer's share of social security and Medicare taxes.

- Previous filings if applicable, to ensure consistency and accuracy.

Form Submission Methods

The Nebraska 941N can be submitted through various methods. Employers may choose to file online through the Nebraska Department of Revenue's website, or they can submit the form via mail. It is essential to select a method that ensures timely delivery and confirmation of receipt.

Penalties for Non-Compliance

Failure to file the form 941N on time can result in penalties imposed by the Nebraska Department of Revenue. These penalties may include fines based on the amount of tax due and the length of time the form is late. Employers should be aware of these consequences and strive to maintain compliance to avoid unnecessary financial burdens.

Quick guide on how to complete fillable online fillable online if you are not licensed to

Complete Fillable Online Fillable Online If You Are Not Licensed To effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to obtain the correct form and securely store it on the web. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Fillable Online Fillable Online If You Are Not Licensed To on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to edit and eSign Fillable Online Fillable Online If You Are Not Licensed To with ease

- Obtain Fillable Online Fillable Online If You Are Not Licensed To and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online Fillable Online If You Are Not Licensed To and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online fillable online if you are not licensed to

Create this form in 5 minutes!

How to create an eSignature for the fillable online fillable online if you are not licensed to

The best way to create an e-signature for a PDF in the online mode

The best way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 941n Nebraska?

The form 941n Nebraska is an important tax document that employers must file quarterly to report income, withholding, and other payroll taxes. Using the airSlate SignNow platform, you can easily eSign and manage the form 941n Nebraska, ensuring timely and accurate submissions.

-

How can airSlate SignNow help with filing the form 941n Nebraska?

airSlate SignNow simplifies the filing process of the form 941n Nebraska by providing an electronic signature solution that is both user-friendly and efficient. You can quickly fill out your form, eSign it, and send it directly from our platform, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the form 941n Nebraska?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those who need to manage documents like the form 941n Nebraska. Our competitive pricing ensures that you have access to comprehensive features at a cost-effective rate.

-

Can I integrate airSlate SignNow with other tools I use for the form 941n Nebraska?

Absolutely! airSlate SignNow can integrate with various business applications and tools to streamline the process of handling the form 941n Nebraska. This ensures seamless data transfer and efficiency, allowing you to manage your documents from a single platform.

-

What are the benefits of using airSlate SignNow for the form 941n Nebraska?

Using airSlate SignNow for the form 941n Nebraska offers numerous benefits, including enhanced security, compliance, and easy tracking of your document status. It also speeds up the signing process, allowing for quicker filing and reducing the risk of errors.

-

How does airSlate SignNow ensure the security of my form 941n Nebraska?

airSlate SignNow prioritizes the security of your documents, including the form 941n Nebraska, by employing advanced encryption and authentication protocols. Our platform ensures that your sensitive information remains protected throughout the signing process.

-

Can I save templates for the form 941n Nebraska in airSlate SignNow?

Yes, airSlate SignNow allows users to create and save templates for the form 941n Nebraska, making it easier to reuse forms with similar information. This feature enhances efficiency and ensures consistency across all your filings.

Get more for Fillable Online Fillable Online If You Are Not Licensed To

- Ct fiduciary form

- Connecticut partnership llc form

- Quitclaim deed form 497301385

- Connecticut warranty deed form

- Legal last will and testament form for single person with no children connecticut

- Legal last will and testament form for a single person with minor children connecticut

- Legal last will and testament form for single person with adult and minor children connecticut

- Legal last will and testament form for single person with adult children connecticut

Find out other Fillable Online Fillable Online If You Are Not Licensed To

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document