941N Nebraska Income Tax Withholding Return 2020

What is the 941N Nebraska Income Tax Withholding Return

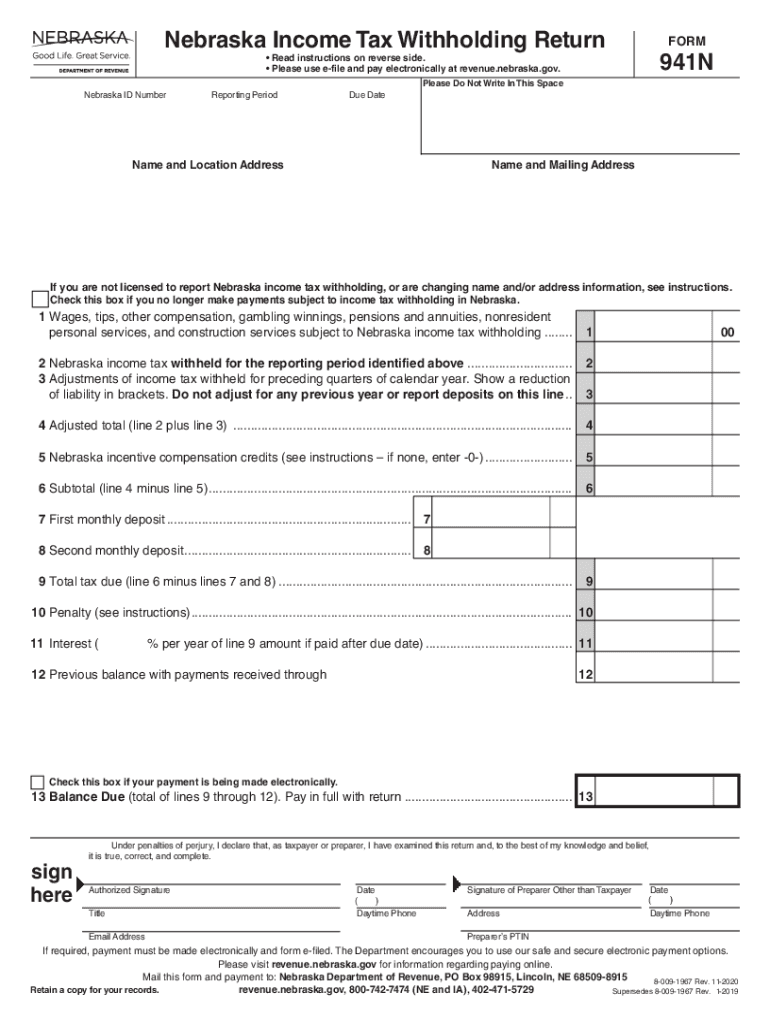

The 941N Nebraska Income Tax Withholding Return is a crucial document for employers in Nebraska. It is used to report income tax withheld from employee wages and to remit those taxes to the state. This form is essential for ensuring compliance with Nebraska tax laws and for maintaining accurate records of tax obligations. Employers must file this form quarterly, reflecting the amount of state income tax withheld during the reporting period. Understanding this form helps employers avoid penalties and ensures that they meet their tax responsibilities.

Steps to complete the 941N Nebraska Income Tax Withholding Return

Completing the 941N form involves several key steps:

- Gather necessary information, including total wages paid, the amount of state income tax withheld, and employee details.

- Access the fillable Nebraska 941N form online, ensuring you have the most current version.

- Fill in the required fields accurately, including your business information and the total withholding amounts.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Submit the form electronically or print it for mailing, depending on your preferred submission method.

Legal use of the 941N Nebraska Income Tax Withholding Return

The 941N form is legally binding when filled out correctly and submitted in compliance with Nebraska state tax regulations. Employers must ensure that all information provided is accurate and truthful to avoid potential legal issues. The form serves as an official record of tax withheld and must be retained for audit purposes. Using a reliable digital platform, such as signNow, can enhance the legal validity of the document by providing secure electronic signatures and maintaining compliance with relevant eSignature laws.

Filing Deadlines / Important Dates

Employers in Nebraska must adhere to specific deadlines for filing the 941N form. The form is due on the last day of the month following the end of each quarter. For example:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Missing these deadlines can result in penalties and interest on unpaid taxes, making timely filing essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the 941N Nebraska Income Tax Withholding Return. The form can be submitted:

- Online through the Nebraska Department of Revenue’s website, which allows for quick processing and confirmation.

- By mail, sending the completed form to the designated address provided by the Nebraska Department of Revenue.

- In-person at local tax offices, where employers can receive assistance if needed.

Choosing the right submission method can streamline the filing process and ensure that the form is received on time.

Key elements of the 941N Nebraska Income Tax Withholding Return

The 941N form includes several key elements that employers must complete accurately:

- Employer identification information, including name, address, and federal employer identification number (FEIN).

- Total wages paid to employees during the reporting period.

- Total state income tax withheld from employee wages.

- Signature of the employer or authorized representative, affirming the accuracy of the information provided.

Each of these elements is vital for ensuring the form is processed correctly and that the employer remains compliant with state tax regulations.

Quick guide on how to complete 941n nebraska income tax withholding return

Effortlessly prepare 941N Nebraska Income Tax Withholding Return on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents rapidly without delays. Handle 941N Nebraska Income Tax Withholding Return on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related tasks today.

How to edit and eSign 941N Nebraska Income Tax Withholding Return with ease

- Locate 941N Nebraska Income Tax Withholding Return and select Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign 941N Nebraska Income Tax Withholding Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 941n nebraska income tax withholding return

Create this form in 5 minutes!

How to create an eSignature for the 941n nebraska income tax withholding return

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the purpose of filing a 941n?

The purpose of filing a 941n is to report the income tax withheld from employee wages, alongside Social Security and Medicare taxes. This form is crucial for businesses to comply with tax regulations and ensure accurate tax reporting. By using airSlate SignNow, you can easily eSign and submit your file 941n securely.

-

How can airSlate SignNow help me with my file 941n?

airSlate SignNow simplifies the process of completing and eSigning your file 941n. Our platform enables you to upload the form, fill it out electronically, and send it for signatures without any hassle. This saves you time and ensures that your filings are submitted accurately and promptly.

-

What are the pricing options for using airSlate SignNow for file 941n?

airSlate SignNow offers flexible pricing plans designed to suit various business needs. You can choose from monthly or annual subscriptions depending on your usage requirements. Each plan allows you to manage documents and eSign your file 941n efficiently, providing excellent value for your investment.

-

Is airSlate SignNow secure for filing documents like 941n?

Yes, airSlate SignNow prioritizes the security of your documents, including the file 941n. We employ advanced encryption methods and secure cloud storage to protect your sensitive information. You can trust that your documents are safe and compliance-ready when you use our platform.

-

Can I integrate airSlate SignNow with other tools for managing my file 941n?

Absolutely! airSlate SignNow offers integrations with various popular business software, enabling you to streamline your workflow. You can connect our platform with your accounting or payroll systems to ensure seamless management of your file 941n and other important documents.

-

How long does it take to get my file 941n processed using airSlate SignNow?

The processing time for your file 941n largely depends on how quickly the required signers complete their part. With airSlate SignNow, you can expedite this process signNowly by sending reminders and tracking signatures in real-time. This ensures your filings are processed without unnecessary delays.

-

What features does airSlate SignNow offer for filing tax forms like 941n?

airSlate SignNow includes features such as document templates, customizable workflows, and mobile access to facilitate filing tax forms like 941n. Additionally, our platform provides audit trails and reporting tools to keep track of your submissions, enhancing your document management capabilities.

Get more for 941N Nebraska Income Tax Withholding Return

- Siding contractor package west virginia form

- Refrigeration contractor package west virginia form

- Drainage contractor package west virginia form

- Tax free exchange package west virginia form

- Landlord tenant sublease package west virginia form

- Buy sell agreement package west virginia form

- Option to purchase package west virginia form

- Amendment of lease package west virginia form

Find out other 941N Nebraska Income Tax Withholding Return

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online