Instructions for Form 945 IRS 2022

Filing Deadlines / Important Dates

For Virginia state taxes in 2025, the due date for individual income tax returns is typically May 1. This date is crucial for taxpayers to remember, as it marks the end of the tax season for filing state income tax returns. If May 1 falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to keep track of these dates to avoid any penalties or interest on unpaid taxes.

Required Documents

When preparing to file your Virginia state taxes, you will need several key documents. These typically include:

- Your W-2 forms from employers, which report your annual wages and the taxes withheld.

- Any 1099 forms if you have income from freelance work or other sources.

- Documentation for any deductions or credits you plan to claim, such as receipts for charitable contributions or education expenses.

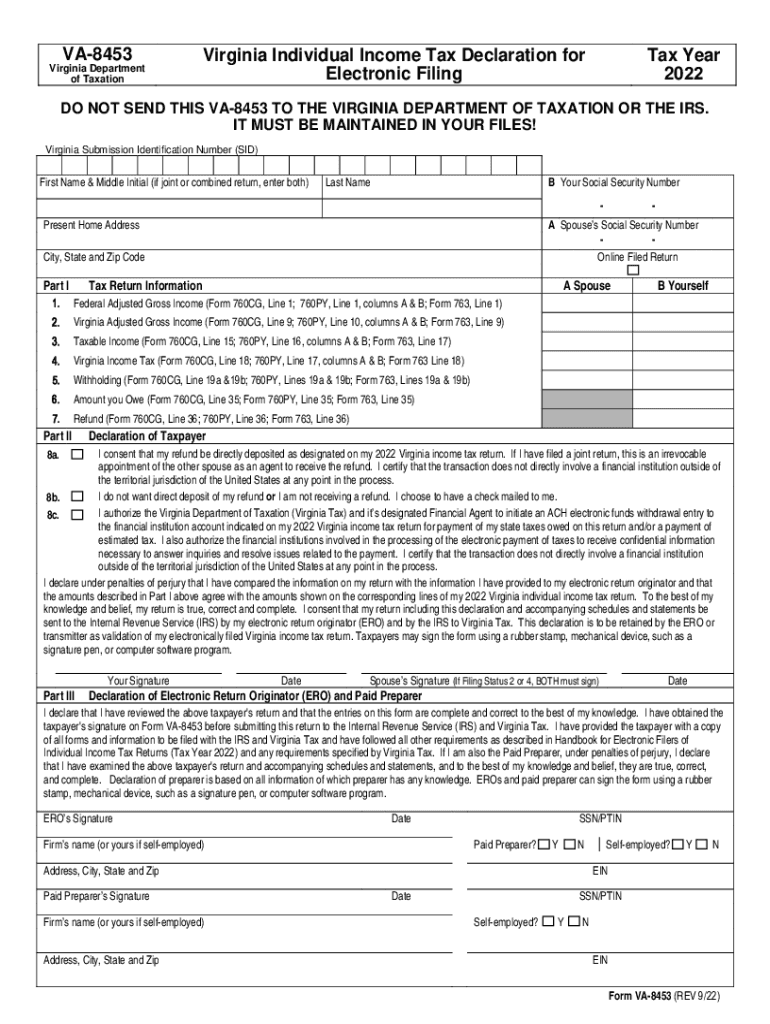

- Form VA-8453, which is used to submit your electronic signature if you file online.

Gathering these documents in advance can streamline the filing process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

Virginia offers multiple methods for submitting your state tax return. You can file your return online using approved e-filing software, which often provides a more efficient and faster processing time. Alternatively, you can mail your completed tax return to the appropriate address based on your location. If you prefer to file in person, you can visit your local Department of Taxation office for assistance. Each method has its advantages, so choose the one that best fits your needs.

Penalties for Non-Compliance

Failure to file your Virginia state taxes on time can result in penalties and interest charges. The penalty for late filing is typically five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest accrues on any unpaid tax from the due date until the tax is paid in full. Understanding these penalties can motivate timely filing and payment to avoid unnecessary costs.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios may impact how you file your Virginia state taxes. For example, self-employed individuals must report their income differently and may need to pay estimated taxes throughout the year. Retirees may have specific deductions related to pension income or Social Security benefits. Students may qualify for education-related credits or deductions. Understanding your specific situation can help you navigate the filing process more effectively.

Quick guide on how to complete 2022 instructions for form 945 irs

Complete Instructions For Form 945 IRS effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 945 IRS across any platform using airSlate SignNow mobile applications for Android or iOS and simplify any document-related tasks today.

The easiest method to alter and eSign Instructions For Form 945 IRS seamlessly

- Find Instructions For Form 945 IRS and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 945 IRS and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 945 irs

Create this form in 5 minutes!

How to create an eSignature for the 2022 instructions for form 945 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the state income tax rate in Virginia?

The state income tax rate in Virginia varies based on income levels, ranging from 2% to 5.75%. Understanding these rates is crucial for effective tax planning. Utilizing airSlate SignNow can help you manage tax-related documents efficiently to ensure compliance with Virginia tax laws.

-

How can airSlate SignNow assist with state income tax-related documents?

airSlate SignNow allows businesses to easily send and eSign tax-related documents, ensuring that you have all necessary documentation for state income tax Virginia. This streamlined process saves time and reduces the risk of errors, enabling you to focus on your financial strategies.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for your tax compliance needs offers clarity and convenience when dealing with state income tax Virginia. Its features help you ensure all documents are signed and filed on time, minimizing penalties and enhancing overall compliance with state regulations.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including eSigning and document management, which can be particularly valuable for addressing state income tax Virginia. This trial gives you the opportunity to see how the tool simplifies your document processes.

-

Can airSlate SignNow integrate with accounting software for state income tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage documents required for state income tax Virginia. This integration helps you maintain up-to-date records and supports efficient tax preparation.

-

What types of documents can I eSign in relation to state income tax Virginia?

You can eSign various documents related to state income tax Virginia using airSlate SignNow, including tax forms, contracts, and agreements. This capability ensures that all necessary paperwork is secure and legally binding, accelerating your business operations.

-

How does airSlate SignNow improve document security for tax-related files?

airSlate SignNow enhances document security through encryption and authentication methods, which are critical for safeguarding sensitive information related to state income tax Virginia. With these features, you can confidently manage and share your tax documents without compromising security.

Get more for Instructions For Form 945 IRS

Find out other Instructions For Form 945 IRS

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease