Form Va 8453 C Where to Mail 2017

What is the Form VA 8453 and Where to Mail It

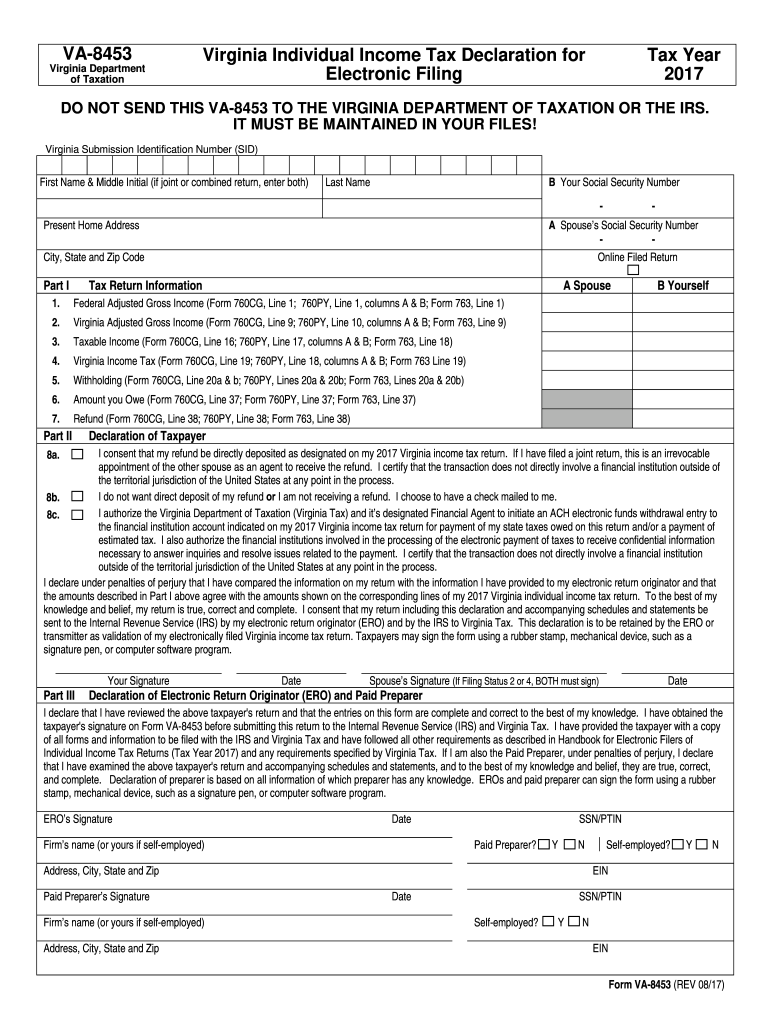

The Form VA 8453 is a crucial document used for filing taxes in the United States. This form serves as a declaration for taxpayers who are submitting their returns electronically. It enables the IRS to verify the authenticity of the eSignature used in the electronic submission of tax returns. To ensure proper processing, it is essential to mail the completed VA 8453 to the designated address provided in the IRS instructions. Typically, this address may vary based on the taxpayer's location and whether they are enclosing a payment.

Steps to Complete the Form VA 8453

Completing the Form VA 8453 involves several straightforward steps. Begin by gathering all necessary documents, including your tax return and any supporting materials. Next, accurately fill out the form, ensuring that all information matches your tax return. Pay special attention to the sections requiring your signature and date. Once completed, review the form for any errors or omissions. Finally, print the form and sign it before mailing it to the appropriate IRS address. This process helps ensure compliance and timely processing of your tax return.

IRS Guidelines for the Form VA 8453

The IRS has established specific guidelines for the use of Form VA 8453. These guidelines include requirements for electronic signatures, the necessity of mailing the form after electronic submission, and deadlines for filing. Taxpayers must ensure that their eSignature is valid and that the form is mailed within the stipulated time frame to avoid penalties. Familiarizing yourself with these guidelines can help streamline the filing process and ensure adherence to IRS regulations.

Filing Deadlines for the Form VA 8453

Filing deadlines for the Form VA 8453 align with the overall tax filing deadlines set by the IRS. Generally, individual taxpayers must file their returns by April 15 each year. If you are requesting an extension, be aware that the VA 8453 must still be submitted according to the extended deadlines. It is crucial to keep track of these dates to avoid late fees or penalties associated with non-compliance.

Required Documents for the Form VA 8453

When preparing to complete the Form VA 8453, several documents are required. These typically include your completed tax return, any W-2 forms, 1099 forms, and documentation supporting deductions or credits claimed. Having these documents ready will facilitate a smoother completion process and ensure that all information is accurate and comprehensive. It is advisable to keep copies of all submitted documents for your records.

Digital vs. Paper Version of the Form VA 8453

Choosing between the digital and paper version of the Form VA 8453 depends on personal preference and filing circumstances. The digital version allows for easier completion and submission, often through tax software. However, some taxpayers may prefer the paper version for its tangible nature. Regardless of the method chosen, it is essential to ensure that the form is filled out correctly and submitted in accordance with IRS guidelines to maintain compliance.

Quick guide on how to complete va 8453 2017 2019 form

Your指南为准备您的Form Va 8453 C Where To Mail

如果您想了解如何创建和发送您的Form Va 8453 C Where To Mail,以下是一些快速的说明,帮助您简化报税流程。

首先,您只需注册您的airSlate SignNow帐户,以改变您在网上处理文档的方式。airSlate SignNow是一个非常用户友好且强大的文档解决方案,允许您轻松修改、起草和完成您的税务文件。使用其编辑器,您可以在文本、复选框和电子签名之间切换,并在需要时返回更改答案。通过先进的PDF编辑、电子签名和直观共享,简化您的税务管理。

请按照以下步骤在几分钟内完成您的Form Va 8453 C Where To Mail:

- 注册您的帐户,几分钟内开始处理PDF。

- 使用我们的目录查找任何IRS税务表格;浏览版本和时间表。

- 点击 获取表格 在我们的编辑器中打开您的Form Va 8453 C Where To Mail。

- 用您的数据(文本、数字、勾选)填写所需的可填字段。

- 使用 签名工具 添加您合法有效的电子签名(如有需要)。

- 检查您的文档并纠正任何错误。

- 保存更改,打印出您的副本,发送给接收者,并将其下载到您的设备。

利用本指南通过airSlate SignNow电子报告您的税务。请注意,纸质提交可能会增加退税错误并延迟退款。当然,在进行电子报税之前,请查看IRS网站以获取您所在州的报税规则。

Create this form in 5 minutes or less

Find and fill out the correct va 8453 2017 2019 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

Create this form in 5 minutes!

How to create an eSignature for the va 8453 2017 2019 form

How to generate an eSignature for your Va 8453 2017 2019 Form in the online mode

How to make an eSignature for the Va 8453 2017 2019 Form in Chrome

How to generate an electronic signature for putting it on the Va 8453 2017 2019 Form in Gmail

How to generate an electronic signature for the Va 8453 2017 2019 Form from your mobile device

How to create an eSignature for the Va 8453 2017 2019 Form on iOS

How to create an eSignature for the Va 8453 2017 2019 Form on Android OS

People also ask

-

What is the form va 8453 and why is it important?

The form va 8453 is a crucial document used for e-filing federal tax returns. It serves as a declaration by the taxpayer that all the information in their tax return is accurate. Understanding the importance of the form va 8453 can ensure compliance and prevent delays in processing your tax filings.

-

How can airSlate SignNow help with the form va 8453?

airSlate SignNow simplifies the signing process for the form va 8453 by allowing users to electronically sign and send documents with ease. This ensures that you can quickly submit your tax documents without the hassle of printing and scanning. By using airSlate SignNow, you can manage the form va 8453 efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for form va 8453?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different needs. Depending on the features and volume of documents you require, you can select a plan that best fits your business. Utilizing airSlate SignNow for the form va 8453 can save you time and money compared to traditional methods.

-

What features does airSlate SignNow offer for managing the form va 8453?

airSlate SignNow includes features like customizable templates, secure storage, and real-time notifications to optimize the management of the form va 8453. These tools enhance efficiency and ensure that all signers are kept informed throughout the process. With airSlate SignNow, handling the form va 8453 becomes a streamlined experience.

-

Can airSlate SignNow integrate with other software for the form va 8453?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage the form va 8453. Popular integrations include CRM systems, cloud storage services, and accounting software, which can help synchronize documents and maintain workflow continuity.

-

What are the benefits of eSigning the form va 8453 with airSlate SignNow?

E-signing the form va 8453 with airSlate SignNow offers speed, convenience, and enhanced security. You can sign documents from any device, reducing turnaround times and improving productivity. Moreover, airSlate SignNow provides bank-level security to protect your sensitive tax information.

-

How does airSlate SignNow ensure the security of the form va 8453?

airSlate SignNow employs advanced encryption and security measures to safeguard the form va 8453 and any other documents you handle. This includes secure servers, user authentication, and audit trails that document all actions taken with your files. Trusting airSlate SignNow means your data is protected every step of the way.

Get more for Form Va 8453 C Where To Mail

- Pathway 3 plan verification packet iblce form

- Tssc building broward schools form

- All wales dnacpr form

- Ohio notice of commencement form 4063752

- Des plaines police department citizens on patrol policy and theiacp form

- Application for state of illinois non resident dealers form

- About us agia agia affinity form

- 231 woodland beach rd lake mills wi 53551 form

Find out other Form Va 8453 C Where To Mail

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document