Form VA 8453 Virginia Department of Taxation Tax Virginia 2013

What is the Form VA 8453 Virginia Department Of Taxation Tax Virginia

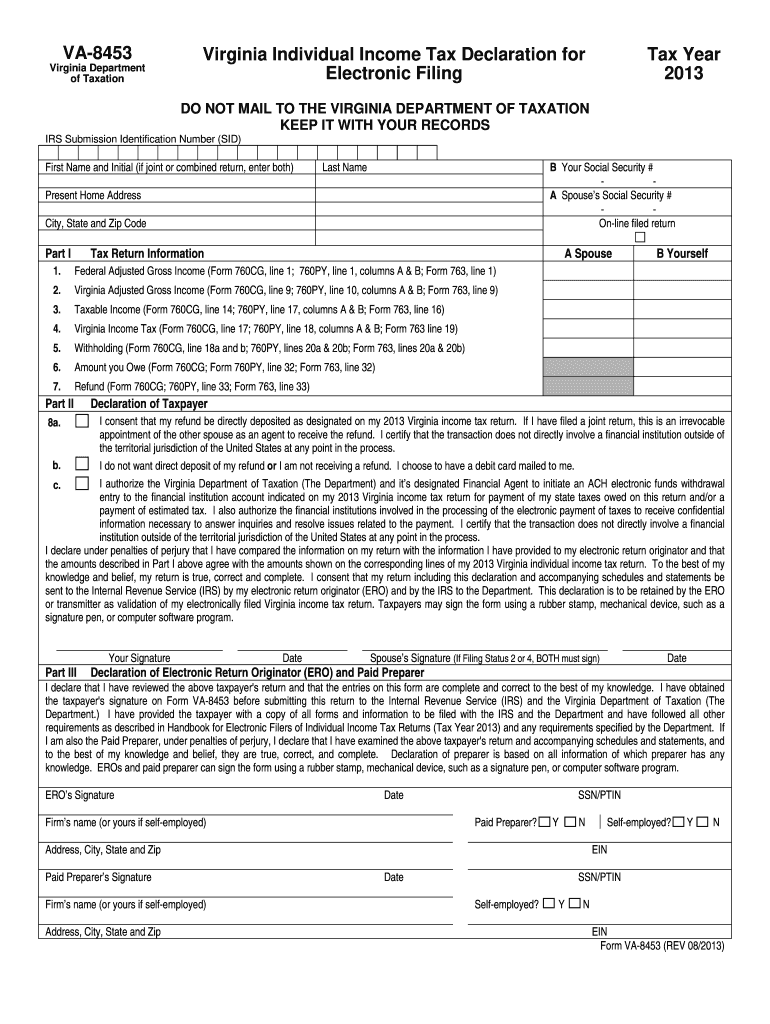

The Form VA 8453 is a crucial document used by taxpayers in Virginia to authenticate their electronic income tax returns. This form serves as a declaration of the taxpayer's intent to file electronically and provides necessary information to the Virginia Department of Taxation. By submitting this form, individuals confirm that the information provided in their electronic return is accurate and complete. The VA 8453 also allows for the use of electronic signatures, streamlining the filing process while ensuring compliance with state regulations.

Steps to complete the Form VA 8453 Virginia Department Of Taxation Tax Virginia

Completing the Form VA 8453 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your Social Security number, filing status, and income details. Next, access the form through the Virginia Department of Taxation website or a trusted tax preparation software. Fill in the required fields carefully, making sure to double-check all entries for accuracy. Once completed, sign the form electronically, which validates your submission. Finally, submit the form along with your electronic tax return to the Virginia Department of Taxation to complete the filing process.

How to obtain the Form VA 8453 Virginia Department Of Taxation Tax Virginia

The Form VA 8453 can be easily obtained from the Virginia Department of Taxation's official website. Navigate to the forms section, where you can find the VA 8453 available for download. Alternatively, if you are using tax preparation software, the form is often integrated into the filing process, allowing for seamless completion and submission. Ensure you have the latest version of the form to comply with current tax regulations.

Legal use of the Form VA 8453 Virginia Department Of Taxation Tax Virginia

The legal use of the Form VA 8453 is essential for ensuring that electronic tax returns are filed in accordance with Virginia state law. This form acts as a legal declaration that the taxpayer has reviewed their return and that the information provided is truthful. By signing the form electronically, taxpayers are legally binding themselves to the accuracy of their submission, which is crucial for compliance with both state and federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form VA 8453 align with the overall income tax filing deadlines set by the Virginia Department of Taxation. Typically, individual income tax returns are due by May 1st of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific deadlines for estimated tax payments, to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form VA 8453 can be submitted through various methods to accommodate different taxpayer preferences. The most efficient method is electronic submission, which allows taxpayers to file their returns and the VA 8453 simultaneously through approved tax preparation software. Alternatively, taxpayers may choose to print the form and submit it by mail to the Virginia Department of Taxation. In-person submissions are also accepted at designated tax offices, although electronic filing is encouraged for its speed and convenience.

Quick guide on how to complete form va 8453 virginia department of taxation tax virginia

Your assistance manual on how to prepare your Form VA 8453 Virginia Department Of Taxation Tax Virginia

If you’re curious about how to generate and file your Form VA 8453 Virginia Department Of Taxation Tax Virginia, here are several brief instructions on how to simplify the tax filing process.

To start, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, produce, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust responses as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and intuitive sharing capabilities.

Follow the steps below to complete your Form VA 8453 Virginia Department Of Taxation Tax Virginia in no time:

- Create your account and begin handling PDFs quickly.

- Utilize our library to find any IRS tax document; browse through variations and schedules.

- Click Obtain form to access your Form VA 8453 Virginia Department Of Taxation Tax Virginia in our editor.

- Complete the mandatory fields with your details (text, figures, checkmarks).

- Employ the Signing Tool to affix your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing manually can lead to return errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for filing guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct form va 8453 virginia department of taxation tax virginia

FAQs

-

How does a Virginia LLC transfer a machine which is out of the normal line of business to another Virginia LLC without incurring sales tax?

Bill of Sale and record it appropriately on the Books.

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

How do you help someone go from nothing as a homeless person in and out of jail to a steady life? Geographically either Akron, Ohio or Virginia Beach, VA

Every person story is different. So, the best approach would be to ask the person kindly what are their sopecific setbacks?I can give a broad outline, depending on the categories most homeless fall into: My experience shown that regardless of the causes, the adequate unconditional housing is the primary absolute step for the individual.If the person's issue is psychiatric,a) they need housing where they feel safe. Typically, guns, violence, aggressive behaviours, references to violence, should not be present. Minimal intrusion is the key concept. no sex. A small deatched house project were there are alone is the Best. Kindness, no humiliation, no ordering around, no authority figure, no government involvement/ intrusion, etc.b) once the housing is established, there is a rest and rehab process. They shouldn't be struggling to have their means of living provided.c) now time is skill sharpening and education. They need to be able to go back to school or simply earn certificaties as such which allows them to get a means of earning which they are interested to pursue.D) find a means of living that can be done remotely, and minimal travel.You have to understand, aside from why the reason, specifically in US, society has no sense of caring and supporting the homeless, so they need considerable private secluded space. Little things triggers them to abandon their housing. A relationship factor would actually give the individual an attachment worthy of sticking to the situation, and signNowly/detrimentallly improve, if not revamp their life. Psychiatrict individuals are nonetheless very intelligent. They need trust and support and a customized planned way to do things others.2. If the issue is due to a dependency factor, I personally think the issue is much easier.3. If the issue is a criminal background, education and job placement is the foremost4. If the issue is physically inability, housing, and a customized job that enables them to earn is important.5. If the person is old, housing, and proper means of quality life.This was a simplified approach. Everyone's nature of poverty and homelessness is different and unique. The individual would be the best reference.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the form va 8453 virginia department of taxation tax virginia

How to make an eSignature for the Form Va 8453 Virginia Department Of Taxation Tax Virginia online

How to make an eSignature for your Form Va 8453 Virginia Department Of Taxation Tax Virginia in Google Chrome

How to make an electronic signature for putting it on the Form Va 8453 Virginia Department Of Taxation Tax Virginia in Gmail

How to make an electronic signature for the Form Va 8453 Virginia Department Of Taxation Tax Virginia right from your smartphone

How to create an electronic signature for the Form Va 8453 Virginia Department Of Taxation Tax Virginia on iOS devices

How to generate an eSignature for the Form Va 8453 Virginia Department Of Taxation Tax Virginia on Android

People also ask

-

What is the Form VA 8453 for the Virginia Department of Taxation?

The Form VA 8453 is a crucial document used for submitting your Virginia state tax returns electronically. It verifies that your return has been filed and serves as a signature to authorize the submission. Understanding how to complete this form is essential for anyone looking to file their taxes in Virginia.

-

How can airSlate SignNow help with the Form VA 8453 for the Virginia Department of Taxation?

airSlate SignNow streamlines the process of signing and submitting the Form VA 8453 for the Virginia Department of Taxation. By using our platform, users can easily eSign the form and ensure that it is submitted securely and efficiently. This not only speeds up the filing process but also ensures compliance with state regulations.

-

Are there any costs associated with using airSlate SignNow for filing Form VA 8453?

airSlate SignNow offers affordable pricing plans designed to suit various business needs. Users can take advantage of our cost-effective solutions to easily manage the eSigning of Form VA 8453 for the Virginia Department of Taxation. With no hidden fees, customers can budget effectively while ensuring they have access to essential tax filing features.

-

What features does airSlate SignNow offer for managing tax forms like Form VA 8453?

airSlate SignNow provides a user-friendly interface combined with powerful features to manage tax forms like Form VA 8453. Key features include eSigning, secure document storage, and tracking capabilities that ensure your submission to the Virginia Department of Taxation is seamless. These tools empower users to handle their tax documentation efficiently.

-

Is airSlate SignNow secure for submitting Form VA 8453 to the Virginia Department of Taxation?

Yes, airSlate SignNow prioritizes security, ensuring that your Form VA 8453 is submitted safely to the Virginia Department of Taxation. Our platform utilizes advanced encryption technology to protect sensitive data and provides compliant practices to keep your information secure. Trust our solution for secure eSigning.

-

Can I integrate airSlate SignNow with other software for filing Form VA 8453?

Absolutely! airSlate SignNow supports numerous integrations with popular accounting and tax software platforms, making it easy to streamline the filing of Form VA 8453 for the Virginia Department of Taxation. This compatibility enhances your workflow, allowing seamless data transfer and improved efficiency.

-

What are the benefits of using airSlate SignNow for eSigning Form VA 8453?

Using airSlate SignNow for eSigning Form VA 8453 offers several benefits, including increased efficiency, reduced errors, and faster processing times. Our platform eliminates the need for printing, signing, and scanning, enabling a more organized approach to tax filing. Experience a hassle-free way to manage your Virginia tax forms.

Get more for Form VA 8453 Virginia Department Of Taxation Tax Virginia

Find out other Form VA 8453 Virginia Department Of Taxation Tax Virginia

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now