Individual E File Declaration for Electronic Filing VA 8453 2020

What is the Individual E File Declaration For Electronic Filing VA 8453

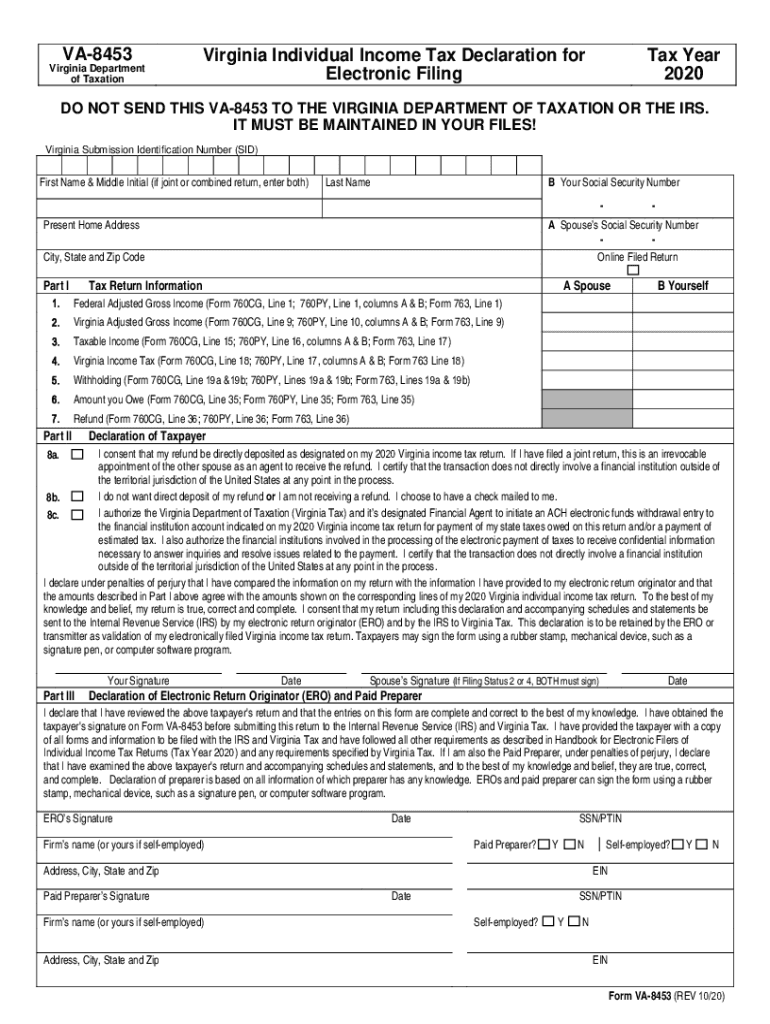

The Individual E File Declaration for Electronic Filing VA 8453 is a form used by taxpayers in the United States to authorize the electronic filing of their individual income tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to its submission via electronic means. The VA 8453 is particularly important for ensuring that the electronic filing process complies with IRS regulations and provides a record of the taxpayer's consent.

How to Use the Individual E File Declaration For Electronic Filing VA 8453

To effectively use the VA 8453, taxpayers should first complete their individual income tax return using approved tax software. Once the return is finalized, the software will prompt users to fill out the VA 8453. This form requires personal information, including the taxpayer's name, Social Security number, and signature. After completing the form, it should be submitted electronically alongside the tax return. It's crucial to ensure that all information is accurate to avoid delays or issues with the IRS.

Steps to Complete the Individual E File Declaration For Electronic Filing VA 8453

Completing the VA 8453 involves several key steps:

- Gather necessary documentation, including your tax return and any supporting documents.

- Access the VA 8453 form through your tax software or the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Review your tax return to ensure all information is correct.

- Sign the form electronically, confirming your consent for the e-filing of your return.

- Submit the VA 8453 along with your electronic tax return.

Legal Use of the Individual E File Declaration For Electronic Filing VA 8453

The VA 8453 is legally binding when completed correctly, as it meets the requirements set forth by the IRS for electronic filing. The form signifies that the taxpayer has reviewed their return and authorizes its submission. Compliance with eSignature regulations, such as the ESIGN Act, ensures that the electronic signature holds the same legal weight as a handwritten signature. This legal framework is essential for protecting both the taxpayer and the integrity of the tax filing process.

Key Elements of the Individual E File Declaration For Electronic Filing VA 8453

Several key elements are essential for the VA 8453:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Signature: An electronic signature is required to validate the form.

- Consent Statement: The form includes a statement confirming that the taxpayer has reviewed the return and agrees to its filing.

- Tax Year: The form specifies the tax year for which the return is being filed.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines associated with the VA 8453. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It's important to check the IRS website for any updates regarding filing deadlines and to ensure that the VA 8453 is submitted on time to avoid penalties.

Quick guide on how to complete individual e file declaration for electronic filing va 8453

Effortlessly Prepare Individual E File Declaration For Electronic Filing VA 8453 on Any Device

The management of documents online has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the desired form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Manage Individual E File Declaration For Electronic Filing VA 8453 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Individual E File Declaration For Electronic Filing VA 8453 with Ease

- Find Individual E File Declaration For Electronic Filing VA 8453 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Individual E File Declaration For Electronic Filing VA 8453 and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual e file declaration for electronic filing va 8453

Create this form in 5 minutes!

How to create an eSignature for the individual e file declaration for electronic filing va 8453

How to generate an e-signature for your PDF document online

How to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the VA 8453 form and how can airSlate SignNow assist with it?

The VA 8453 form is used for submitting electronic signatures for tax-related documents. With airSlate SignNow, users can seamlessly eSign the VA 8453 and manage their documents efficiently, ensuring compliance and reducing processing times.

-

How much does airSlate SignNow cost for managing VA 8453 forms?

airSlate SignNow offers a range of pricing plans to accommodate various business needs. Whether you're a small business or a large organization, there’s an affordable option to manage your VA 8453 forms without compromising on features.

-

What features does airSlate SignNow provide for VA 8453 eSigning?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage, all tailored to streamline the signing process of VA 8453 forms. This ensures that the signing experience is efficient and compliant with regulations.

-

Can I integrate airSlate SignNow with other applications for handling VA 8453 forms?

Yes, airSlate SignNow offers various integrations with popular applications such as CRM systems, document management tools, and online storage platforms to facilitate the handling of VA 8453 forms, enhancing your workflow.

-

What benefits can businesses expect when using airSlate SignNow for VA 8453?

By using airSlate SignNow for VA 8453, businesses can enjoy faster turnaround times, improved document security, and more efficient workflows. The platform’s intuitive interface makes it easy for anyone to send and eSign documents without hassle.

-

Is airSlate SignNow compliant with regulations when processing VA 8453 forms?

Absolutely, airSlate SignNow prioritizes compliance with industry regulations including those related to electronic signatures for VA 8453 forms. This ensures that all your eSigned documents are legally binding and secure.

-

How easy is it to use airSlate SignNow for first-time users handling VA 8453?

airSlate SignNow is designed to be user-friendly, making it simple for first-time users to handle VA 8453 forms and eSign them. Comprehensive tutorials and customer support are available to assist you throughout the process.

Get more for Individual E File Declaration For Electronic Filing VA 8453

- Warning of default on commercial lease arkansas form

- Warning of default on residential lease arkansas form

- Landlord tenant closing statement to reconcile security deposit arkansas form

- Arkansas name change form

- Name change notification form arkansas

- Commercial building or space lease arkansas form

- Ar legal form

- Arkansas temporary form

Find out other Individual E File Declaration For Electronic Filing VA 8453

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe