Individual Income Tax Electronic Filing FAQs Virginia Department of 2016

What is the Individual Income Tax Electronic Filing FAQs Virginia Department Of

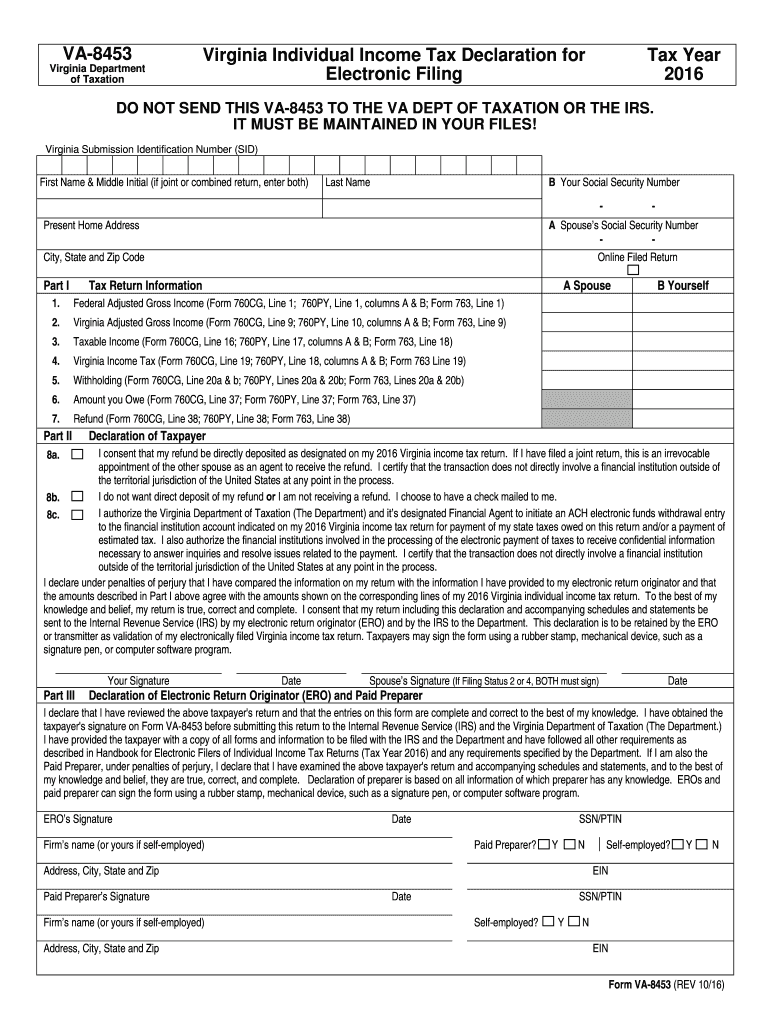

The Individual Income Tax Electronic Filing FAQs Virginia Department Of provides essential information regarding the electronic filing process for individual income tax returns in Virginia. This resource addresses common questions and concerns taxpayers may have when submitting their tax returns electronically. It covers various aspects, including eligibility, required documentation, and the benefits of e-filing, ensuring that individuals understand how to navigate the electronic filing system effectively.

Steps to complete the Individual Income Tax Electronic Filing FAQs Virginia Department Of

Completing the Individual Income Tax Electronic Filing FAQs Virginia Department Of involves several key steps to ensure accurate submission. First, gather all necessary documents, such as W-2 forms, 1099s, and any other relevant financial information. Next, choose an approved e-filing method, which may include using tax software or a tax professional. After filling out the required forms, review all entries for accuracy to avoid errors. Finally, submit the electronic return and retain a copy for your records, along with any confirmation of submission.

Legal use of the Individual Income Tax Electronic Filing FAQs Virginia Department Of

The legal use of the Individual Income Tax Electronic Filing FAQs Virginia Department Of is governed by federal and state tax laws. Taxpayers must ensure that their electronic submissions comply with the guidelines set forth by the IRS and the Virginia Department of Taxation. This includes using authorized e-signature solutions, adhering to filing deadlines, and maintaining accurate records. Understanding these legal requirements helps individuals avoid penalties and ensures that their tax filings are valid.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Electronic Filing FAQs Virginia Department Of are crucial for taxpayers to observe. Generally, individual income tax returns must be filed by May 1 for the previous tax year. However, taxpayers can request an extension, which typically extends the deadline to November 1. It is important to keep track of these dates to avoid late filing penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Individual Income Tax Electronic Filing FAQs Virginia Department Of, taxpayers must gather several required documents. This includes W-2 forms from employers, 1099 forms for additional income, receipts for deductible expenses, and any other relevant financial records. Having these documents organized and readily available streamlines the e-filing process and ensures that all necessary information is included in the tax return.

IRS Guidelines

The IRS provides specific guidelines for the electronic filing of individual income tax returns, which are crucial for compliance. These guidelines outline the types of forms that can be filed electronically, the use of e-signatures, and the security measures that must be in place to protect taxpayer information. Familiarity with these guidelines helps individuals ensure that their electronic submissions meet all federal requirements, reducing the risk of errors and potential audits.

Examples of using the Individual Income Tax Electronic Filing FAQs Virginia Department Of

Examples of using the Individual Income Tax Electronic Filing FAQs Virginia Department Of can illustrate the practical application of the information provided. For instance, a self-employed individual may refer to the FAQs to understand how to report business income and expenses accurately. Similarly, a student might find guidance on claiming education credits. These examples demonstrate how the FAQs can assist various taxpayers in navigating their unique tax situations effectively.

Quick guide on how to complete individual income tax electronic filing faqs virginia department of

Your assistance manual on preparing your Individual Income Tax Electronic Filing FAQs Virginia Department Of

If you're wondering how to complete and submit your Individual Income Tax Electronic Filing FAQs Virginia Department Of, here are some brief guidelines to simplify tax declaration.

To begin, you only need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to edit, draft, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures while going back to modify responses as necessary. Optimize your tax processing with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finish your Individual Income Tax Electronic Filing FAQs Virginia Department Of in a matter of minutes:

- Create your account and start handling PDFs in moments.

- Access our catalog to find any IRS tax form; browse through versions and schedules.

- Click Acquire form to open your Individual Income Tax Electronic Filing FAQs Virginia Department Of in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Take advantage of this manual to electronically submit your taxes with airSlate SignNow. Be aware that filing on paper can lead to increased return errors and delayed reimbursements. Naturally, before e-filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax electronic filing faqs virginia department of

FAQs

-

How do I fill exemptions for section 10, 17, 24 while filing income tax on the Department of Income Tax website?

While filing income tax return, you have to remove exemptions under section 10 & 17 from gross salary - Income under the head salary. Deduction under section 24(b) which is interest on housing loan should be shown as negative amount in the return under the head income from house property.Hope this helps

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

If Income Tax Department India is capable of detecting tax evasion, instead an individual filing returns, why can't the IT Department itself tell how much the tax due for each and every individual?

Population of India : 1.3 billion.Population under tax bracket: 5–7% i.e. around 90 million.No. of People who actually file ITR: 28.7 million.No. of People who actually pay taxes: 12.5 million.Number of Employees in Income Tax: 46000 only.India is so diversified that each tax payer, whether Individual or Company, has dozens of deductions, exemptions and source of income.No staff strength or computer Algorithm is able to handle and process the outcome of permutation-combination of this data. Not yet.And even if it is possible, the effort, machinery and cost involved will make it highly unviable. It's like there is a possibility of achieving better performance than Six-Sigma but it's not worth the effort.That's why govt is forced to trust people and use its machinery wherever they smell something fishy.Note: Data given in answer is not exact and sourced from Google.Thanks for reading.For any correction, comment. Don't like it, downvote. Thanks again.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How can I make a computation of income while filing an income tax return (ITR)? Is it mandatory? Is it submitted to the Income Tax Department?

It is not mandatory to prepare the computation as such as it's not submitted to the income tax department.It, however, serves as a ready reference while you file ITR & as you rightly said, we can always refer it later to see what income & taxes did we file.A general computation of income would contain the following:General details like : assessee name, PAN, date of birth, father's name, assessment year for which it is being preparedIncome details: we list all the sources of income that we haveExemption & deductions: Along with income, we also list the exemptions and deductions to arrive at total taxable incomeFinally we compute tax & interest (if any)Trust this clarifies your queryMessage me for any assistance at abhinandansethia90@gmail.comHappy reading!

Create this form in 5 minutes!

How to create an eSignature for the individual income tax electronic filing faqs virginia department of

How to make an eSignature for your Individual Income Tax Electronic Filing Faqs Virginia Department Of in the online mode

How to make an electronic signature for the Individual Income Tax Electronic Filing Faqs Virginia Department Of in Chrome

How to generate an electronic signature for putting it on the Individual Income Tax Electronic Filing Faqs Virginia Department Of in Gmail

How to create an eSignature for the Individual Income Tax Electronic Filing Faqs Virginia Department Of right from your mobile device

How to generate an electronic signature for the Individual Income Tax Electronic Filing Faqs Virginia Department Of on iOS devices

How to create an electronic signature for the Individual Income Tax Electronic Filing Faqs Virginia Department Of on Android devices

People also ask

-

What is Individual Income Tax Electronic Filing?

Individual Income Tax Electronic Filing is a method of submitting your tax returns to the Virginia Department Of electronically. This process allows taxpayers to file their returns quickly and securely, reducing the need for paper forms and in-person visits.

-

How does airSlate SignNow facilitate Individual Income Tax Electronic Filing?

airSlate SignNow simplifies the Individual Income Tax Electronic Filing process by providing a user-friendly interface for completing and signing tax documents. With our solution, you can easily fill out your tax forms, eSign, and submit them directly to the Virginia Department Of without hassle.

-

What are the costs associated with Individual Income Tax Electronic Filing?

The costs for Individual Income Tax Electronic Filing can vary based on the chosen service. With airSlate SignNow, we offer affordable pricing plans that cater to both individual filers and businesses, ensuring you get cost-effective access to our eSigning capabilities.

-

What features does airSlate SignNow offer for tax filing?

airSlate SignNow offers a range of features tailored for Individual Income Tax Electronic Filing, such as secure eSigning, document storage, and real-time tracking. These features enhance the filing experience and ensure that your documents are handled with care and efficiency.

-

Is airSlate SignNow compliant with Virginia Department Of regulations?

Yes, airSlate SignNow adheres strictly to the regulations set by the Virginia Department Of for Individual Income Tax Electronic Filing. Our platform ensures that all submissions meet legal standards, providing you with peace of mind during tax season.

-

Can I use airSlate SignNow for prior year’s tax filings?

Absolutely! airSlate SignNow allows you to access and complete Individual Income Tax Electronic Filing for prior years. Just ensure you have the correct forms and information ready, and our platform will guide you through the process seamlessly.

-

What integrations does airSlate SignNow offer for tax professionals?

airSlate SignNow integrates with various accounting and tax software, enhancing the Individual Income Tax Electronic Filing experience for tax professionals. These integrations streamline workflows and reduce the time spent on filing and managing documents with the Virginia Department Of.

Get more for Individual Income Tax Electronic Filing FAQs Virginia Department Of

Find out other Individual Income Tax Electronic Filing FAQs Virginia Department Of

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template