Sbi Gold Loan Application Form PDF

What is the SBI Gold Loan Application Form PDF?

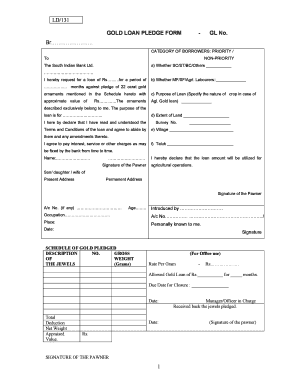

The SBI Gold Loan Application Form PDF is a structured document used by individuals seeking to apply for a gold loan from the State Bank of India (SBI). This form captures essential information about the applicant, including personal details, loan requirements, and the gold being pledged as collateral. The PDF format ensures that the document is easily accessible and can be filled out digitally or printed for manual completion. This form is crucial for initiating the loan process and must be submitted to the bank for processing.

How to Obtain the SBI Gold Loan Application Form PDF

To obtain the SBI Gold Loan Application Form PDF, applicants can visit the official SBI website or contact their nearest SBI branch. The form is typically available for download in the loans section of the website. Alternatively, applicants can request a physical copy directly from the bank's customer service desk. Ensuring that you have the latest version of the form is important, as outdated forms may not be accepted during the application process.

Steps to Complete the SBI Gold Loan Application Form PDF

Completing the SBI Gold Loan Application Form PDF involves several key steps:

- Personal Information: Fill in your name, address, contact details, and identification information.

- Loan Details: Specify the amount of loan required and the purpose for which the loan is being taken.

- Gold Details: Provide information about the gold being pledged, including its weight, purity, and estimated value.

- Signature: Sign the form to authenticate the information provided and confirm your application.

Once completed, the form should be submitted along with any required documents to the bank for processing.

Legal Use of the SBI Gold Loan Application Form PDF

The SBI Gold Loan Application Form PDF serves as a legally binding document once it is signed and submitted. It outlines the terms and conditions of the loan agreement, including the responsibilities of both the borrower and the lender. For the application to be considered valid, it must comply with relevant legal frameworks governing loans and pledges. It is advisable for applicants to familiarize themselves with these regulations to ensure compliance.

Key Elements of the SBI Gold Loan Application Form PDF

The key elements of the SBI Gold Loan Application Form PDF include:

- Applicant Information: Details about the borrower, including name, address, and contact information.

- Loan Amount: The specific amount of money being requested.

- Gold Details: Information about the gold being pledged, including its weight and purity.

- Signature: The applicant's signature, which serves as confirmation of the information provided.

These elements are critical for the bank to assess the application and determine eligibility for the loan.

Form Submission Methods for the SBI Gold Loan Application Form PDF

The SBI Gold Loan Application Form PDF can be submitted through various methods, depending on the applicant's preference:

- Online Submission: Some branches may allow for digital submission through the bank's online portal.

- In-Person Submission: Applicants can visit their nearest SBI branch to submit the completed form along with required documents.

- Mail Submission: In certain cases, applicants may also choose to mail the form to the designated branch.

Choosing the right submission method can help streamline the application process and reduce processing time.

Quick guide on how to complete sbi gold loan application form pdf

Complete Sbi Gold Loan Application Form Pdf seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Sbi Gold Loan Application Form Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented procedure today.

The easiest way to modify and eSign Sbi Gold Loan Application Form Pdf effortlessly

- Find Sbi Gold Loan Application Form Pdf and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced files, frustrating form searching, or errors requiring new documents to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Sbi Gold Loan Application Form Pdf while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sbi gold loan application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gold loan receipt?

A gold loan receipt is a document that serves as proof of a gold loan transaction between the borrower and the lender. It includes essential details such as the amount borrowed, interest rates, and the gold pledged as collateral. This receipt is crucial for both parties, ensuring transparency and accountability throughout the loan process.

-

How can I obtain a gold loan receipt?

You can easily obtain a gold loan receipt by applying for a gold loan with a financial institution that offers this service. Once your loan is approved and disbursed, the lender will provide you with the gold loan receipt, which you should keep safe for future reference and to ensure a smooth repayment process.

-

What information is typically included in a gold loan receipt?

A typical gold loan receipt includes borrower details, the amount of gold pledged, the loan amount approved, interest rate, repayment terms, and the date of issuance. It may also include contact information of the lender and any applicable charges. This information is crucial for helping borrowers understand their loan commitments.

-

Are there any fees associated with obtaining a gold loan receipt?

Most financial institutions do not charge separate fees specifically for the issuance of a gold loan receipt. However, it's essential to review the loan agreement, as some lenders may include fees as part of the overall service costs. Make sure to ask your lender about any potential charges linked to your gold loan receipt.

-

What are the benefits of using a digital gold loan receipt?

A digital gold loan receipt offers numerous benefits, including easier access and storage. It saves time by allowing you to retrieve your receipt from anywhere at any time. Additionally, it reduces the risk of loss or damage associated with physical documents, providing greater peace of mind.

-

Can I eSign my gold loan receipt using airSlate SignNow?

Yes, you can eSign your gold loan receipt using airSlate SignNow. Our platform provides a simple and secure way to eSign documents electronically, ensuring a quick turnaround for your loan processing. This enhances efficiency and convenience for both borrowers and lenders.

-

How does airSlate SignNow integrate with gold loan services?

airSlate SignNow can seamlessly integrate with various gold loan service providers to streamline document management processes. This ensures that borrowers can easily access, eSign, and manage their gold loan receipts alongside other essential documents. Our integrations can enhance workflow efficiency and save time.

Get more for Sbi Gold Loan Application Form Pdf

- Legal last will and testament form for divorced and remarried person with mine yours and ours children new hampshire

- Legal last will and testament form with all property to trust called a pour over will new hampshire

- Written revocation of will new hampshire form

- Last will and testament for other persons new hampshire form

- Notice to beneficiaries of being named in will new hampshire form

- Estate planning questionnaire and worksheets new hampshire form

- Document locator and personal information package including burial information form new hampshire

- Demand to produce copy of will from heir to executor or person in possession of will new hampshire form

Find out other Sbi Gold Loan Application Form Pdf

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe