Flex Save Form

What is the Flex Save

The Flex Save is a financial claim option designed to assist individuals in managing their healthcare and dependent care expenses. This program allows eligible participants to set aside pre-tax dollars for eligible expenses, reducing their taxable income. By utilizing the Flex Save, users can effectively budget for out-of-pocket costs associated with medical treatments, childcare, and other qualifying expenditures. Understanding the Flex Save is crucial for maximizing benefits and ensuring compliance with relevant regulations.

How to use the Flex Save

Using the Flex Save involves a straightforward process that begins with enrollment. Participants must first determine their eligibility and choose an appropriate contribution amount for the plan year. Once enrolled, individuals can submit claims for reimbursement by providing necessary documentation, such as receipts or invoices, that detail the expenses incurred. Claims can typically be submitted online, through a mobile app, or via mail. It is essential to keep track of eligible expenses and submit claims promptly to avoid losing any benefits.

Steps to complete the Flex Save

Completing the Flex Save involves several key steps:

- Enrollment: Sign up for the Flex Save program during the designated enrollment period.

- Determine Contribution: Decide on the amount to contribute based on anticipated expenses.

- Track Expenses: Keep detailed records of eligible expenses throughout the year.

- Submit Claims: File claims for reimbursement with the required documentation.

- Receive Reimbursement: Obtain funds for approved claims, typically through direct deposit or check.

Legal use of the Flex Save

The legal use of the Flex Save is governed by specific regulations that outline eligible expenses and contribution limits. It is important for participants to familiarize themselves with these rules to ensure compliance. The Flex Save must be used solely for qualified medical and dependent care expenses as defined by the Internal Revenue Service (IRS). Misuse of funds or failure to adhere to guidelines can result in penalties or loss of tax benefits.

Eligibility Criteria

To qualify for the Flex Save, individuals must meet certain eligibility criteria, which may vary by employer or plan provider. Generally, participants must be employees of a company that offers the Flex Save program. Additionally, they must be enrolled in a qualifying health plan and may need to provide documentation to verify their dependent care needs. It is advisable to review specific eligibility requirements with the plan administrator to ensure compliance.

Required Documents

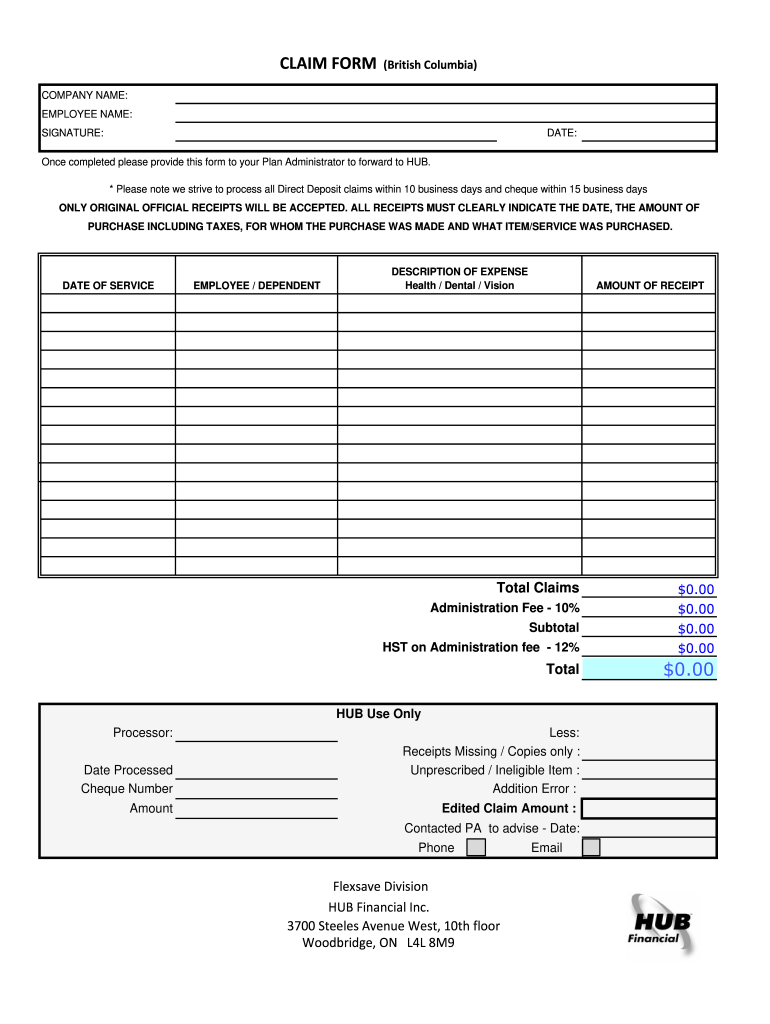

When submitting claims for the Flex Save, participants must provide specific documentation to support their requests. Required documents typically include:

- Receipts: Detailed receipts for all eligible expenses, showing the date, amount, and nature of the service.

- Invoices: Invoices from service providers that outline the services rendered.

- Dependent Care Documentation: Proof of care arrangements for dependents, if applicable.

Ensuring that all documentation is accurate and complete will facilitate a smoother claims process.

Quick guide on how to complete flex save

Easily Prepare Flex Save on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without hold-ups. Handle Flex Save on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The Simplest Method to Edit and eSign Flex Save Effortlessly

- Obtain Flex Save and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, the burden of searching for forms, or the mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Flex Save to guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flex save

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canada financial claim?

A Canada financial claim refers to requests for compensation or reimbursement made by individuals or businesses to governmental or financial institutions in Canada. These claims can include various types of financial losses, ensuring that stakeholders can recover funds appropriately. Understanding this process is essential for those seeking to navigate their financial rights efficiently.

-

How can airSlate SignNow help with Canada financial claims?

airSlate SignNow provides an intuitive platform for managing documents related to Canada financial claims efficiently. Users can eSign and send essential forms quickly, reducing the time spent on paperwork. This streamlined process enhances the likelihood of successful claims and improves overall productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs, ensuring cost-effectiveness for managing Canada financial claims. Plans typically include features for document collaboration, eSigning, and integrations. By selecting the appropriate plan, businesses can maximize their investment while simplifying their claims process.

-

Are there any specific features for Canada financial claims?

Yes, airSlate SignNow includes features tailored to facilitate Canada financial claims, such as customizable templates, audit trails, and secure cloud storage. These features ensure that all documents related to your claims are organized and legally binding. Enhanced tracking and reporting also help users stay informed about the status of their claims.

-

Can I integrate airSlate SignNow with other applications for Canada financial claims?

Absolutely! airSlate SignNow seamlessly integrates with various applications that are useful for managing Canada financial claims. Integrations with tools like CRM systems, accounting software, and cloud storage services help streamline workflows, enhancing productivity and improving data accuracy.

-

What benefits does airSlate SignNow provide for handling Canada financial claims?

Using airSlate SignNow for Canada financial claims provides numerous benefits, including faster document turnaround times and improved security. The platform reduces the need for physical paperwork, leading to cost savings on printing and mailing. Additionally, users can access signed documents from anywhere, ensuring timely submissions for claims.

-

Is there customer support available for Canada financial claim processes?

Yes, airSlate SignNow offers robust customer support to assist users with Canada financial claim processes. Their support team is available to answer questions about the platform and provide guidance on using its features effectively. Comprehensive resources, including tutorials and FAQs, further empower users in managing their claims.

Get more for Flex Save

Find out other Flex Save

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement