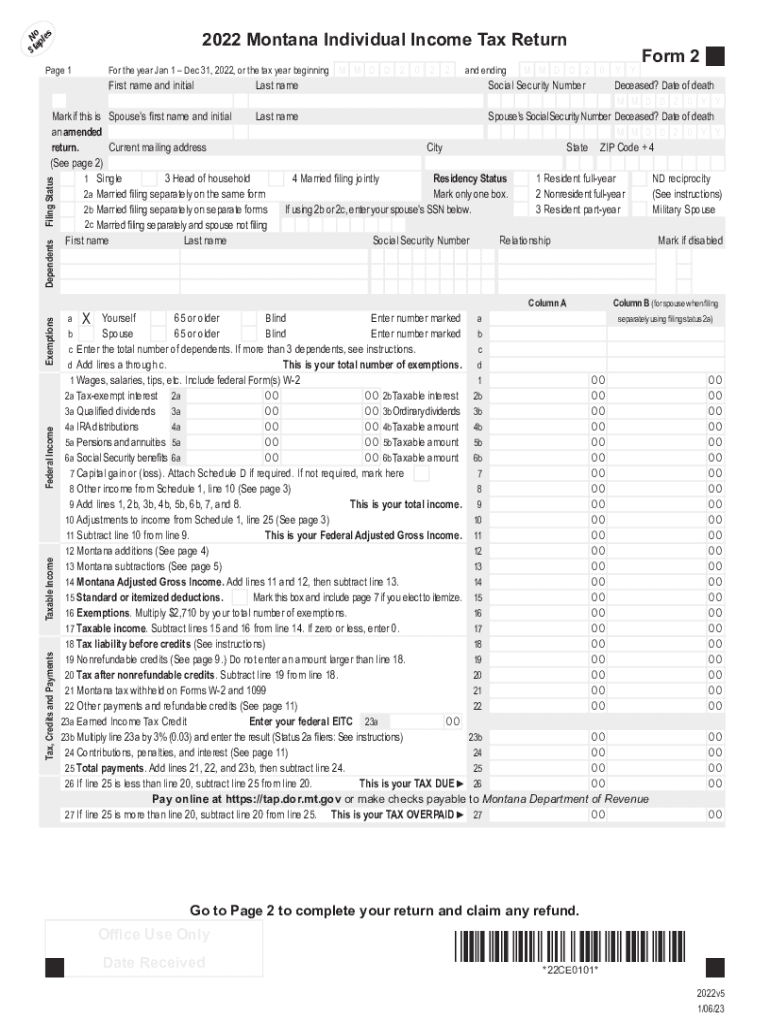

MT Form 2 2022

What is the MT Form 2

The MT Form 2 is a specific document used in various administrative and legal contexts. It is essential for individuals and businesses in the United States to understand its purpose and requirements. This form typically serves as a means for reporting or certifying certain information as mandated by state or federal regulations. Understanding the MT Form 2 is crucial for ensuring compliance and avoiding potential penalties.

How to use the MT Form 2

Using the MT Form 2 involves several straightforward steps. First, ensure that you have the correct version of the form, as outdated versions may not be accepted. Next, gather all necessary information and documentation required to complete the form accurately. It is important to fill out each section carefully, ensuring that all information is correct and up-to-date. Once completed, the form can be submitted through the appropriate channels, whether online, by mail, or in person, depending on the specific requirements.

Steps to complete the MT Form 2

Completing the MT Form 2 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Obtain the latest version of the MT Form 2 from the appropriate source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal or business details accurately.

- Provide any necessary supporting documentation as outlined in the instructions.

- Review the completed form for accuracy before submission.

Legal use of the MT Form 2

The legal use of the MT Form 2 is governed by specific regulations that ensure its validity. For a form to be considered legally binding, it must meet certain criteria, including proper signatures and adherence to relevant laws. It is important to understand these legal frameworks to ensure that the form is executed correctly and can withstand scrutiny in legal or administrative proceedings.

Key elements of the MT Form 2

Several key elements are essential for the MT Form 2 to be valid. These include:

- Accurate identification of the parties involved.

- Clear and complete information in all required sections.

- Proper signatures from all necessary parties.

- Compliance with any specific state or federal regulations that apply.

Filing Deadlines / Important Dates

Filing deadlines for the MT Form 2 can vary based on the specific purpose of the form. It is crucial to be aware of these deadlines to avoid penalties or issues with compliance. Typically, deadlines may align with tax periods, regulatory submissions, or other significant dates relevant to the form's use. Always check the latest guidance to ensure timely submission.

Quick guide on how to complete mt form 2 627260960

Prepare MT Form 2 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed files, allowing you to obtain the necessary document and store it securely online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage MT Form 2 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign MT Form 2 with ease

- Obtain MT Form 2 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign MT Form 2 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mt form 2 627260960

Create this form in 5 minutes!

How to create an eSignature for the mt form 2 627260960

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is MT Form 2 and how does it work?

MT Form 2 is an electronic form management tool within airSlate SignNow that allows users to create, send, and eSign documents efficiently. This feature streamlines the signing process, enabling businesses to manage their forms electronically, reducing paperwork and enhancing productivity.

-

How much does MT Form 2 cost?

Pricing for MT Form 2 varies based on the plan chosen within airSlate SignNow. We offer flexible subscription options that cater to different business sizes and needs, ensuring that you receive a cost-effective solution for your document management.

-

What are the main features of MT Form 2?

MT Form 2 includes features like customizable templates, electronic signatures, document tracking, and secure cloud storage. These functionalities allow businesses to create tailored forms, manage workflow seamlessly, and enhance collaboration with team members.

-

Can MT Form 2 integrate with other applications?

Yes, MT Form 2 integrates seamlessly with various applications such as Google Workspace, Microsoft 365, and CRM systems. This integration helps centralize document management and improves operational efficiency across your entire business.

-

What benefits does MT Form 2 offer for businesses?

MT Form 2 provides multiple benefits including enhanced efficiency in form processing, reduced turnaround times for document signing, and lower administrative costs. By digitizing your forms, you can focus more on core business functions while ensuring compliance and security.

-

Is MT Form 2 user-friendly for non-technical users?

Absolutely! MT Form 2 is designed with an intuitive interface that makes it easy for non-technical users to create and manage forms. With a simple drag-and-drop functionality, anyone can get started quickly without the need for extensive training.

-

How does MT Form 2 ensure document security?

MT Form 2 employs advanced security measures including encryption, secure access controls, and audit trails to ensure document safety. This level of security helps businesses maintain compliance and protect sensitive information during the signing process.

Get more for MT Form 2

- Periodic trends worksheet answers pdf form

- Fedex aim program form

- Notarized request for personal driving and motor vehicle information

- Pythagorean theorem word problems matching worksheet answer key form

- Intraverbal fill ins form

- Apply for electricity online form

- Asphalt paving contract sample form

- 5 team double elimination 101307058 form

Find out other MT Form 2

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template