Unlawful Activity Addendum 2 4 Power Associates Form

Understanding the unlawful activity addendum 24 power associates form

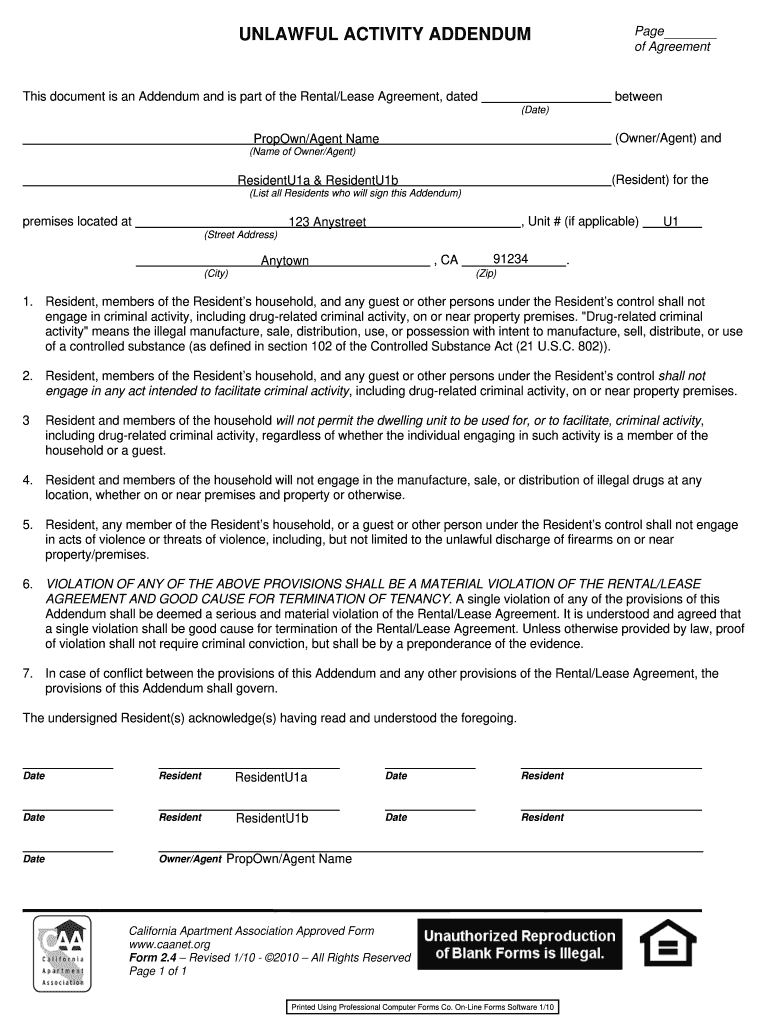

The unlawful activity addendum 24 power associates form is a critical document used in various legal and business contexts. It serves to outline the terms and conditions under which unlawful activities are addressed and managed. This form is particularly relevant for organizations that need to ensure compliance with legal standards while documenting any unlawful activities that may arise in their operations.

By clearly defining the scope of unlawful activities, the form helps protect both the organization and its stakeholders. It is essential for maintaining transparency and accountability, which are vital in today's regulatory environment.

Steps to complete the unlawful activity addendum 24 power associates form

Completing the unlawful activity addendum 24 power associates form requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information: Collect all relevant details about the unlawful activities that need to be documented.

- Fill out the form: Enter the required information accurately, ensuring that all sections are completed.

- Review the document: Double-check for any errors or omissions before finalizing the form.

- Obtain signatures: Ensure that all necessary parties sign the document to validate it.

- Store securely: Keep the completed form in a secure location to protect sensitive information.

Legal use of the unlawful activity addendum 24 power associates form

To ensure the unlawful activity addendum 24 power associates form is legally binding, it must adhere to specific legal standards. This includes compliance with the ESIGN Act, which governs electronic signatures, and other relevant state and federal regulations. The form should be used to document any unlawful activities in a manner that is clear and precise, allowing for proper legal recourse if necessary.

Using the form correctly helps organizations mitigate risks associated with unlawful activities, ensuring that they can respond effectively to any legal challenges that may arise.

Key elements of the unlawful activity addendum 24 power associates form

The unlawful activity addendum 24 power associates form includes several key elements that are crucial for its effectiveness:

- Identification of parties: Clearly state the names and roles of all parties involved.

- Description of unlawful activities: Provide a detailed account of the activities being documented.

- Consequences: Outline the potential repercussions of the unlawful activities for all parties.

- Signatures: Ensure all relevant parties sign to acknowledge their understanding and acceptance of the terms.

How to use the unlawful activity addendum 24 power associates form

Using the unlawful activity addendum 24 power associates form effectively involves several steps. First, ensure that all parties understand the purpose of the form and the implications of the unlawful activities being documented. Next, complete the form with accurate information, paying close attention to detail.

After filling out the form, it is important to review it collectively with all parties involved to ensure clarity and agreement. Once finalized, the form should be securely stored and made accessible to relevant stakeholders for future reference.

Obtaining the unlawful activity addendum 24 power associates form

The unlawful activity addendum 24 power associates form can typically be obtained through legal resources or organizational templates. Many businesses provide access to standard forms on their internal platforms, while legal professionals may offer customized versions tailored to specific needs.

It is advisable to consult with a legal expert to ensure that the form meets all necessary legal requirements and is appropriate for the specific context in which it will be used.

Quick guide on how to complete unlawful activity addendum 24 power associates

Effortlessly prepare Unlawful Activity Addendum 2 4 Power Associates on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Unlawful Activity Addendum 2 4 Power Associates on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Unlawful Activity Addendum 2 4 Power Associates with ease

- Find Unlawful Activity Addendum 2 4 Power Associates and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choice. Modify and eSign Unlawful Activity Addendum 2 4 Power Associates and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should a petitioner fill in Part 5 Household Size of the form I-864 Affidavit of support if he would like to sponsor 2 principal immigrants at the same time? Each family has 4 members.

Each principal beneficiary (and their family) is petitioned with a separate I-130 petition, and each I-130 petition has a separate I-864 Affidavit of Support. Each family’s I-864 does not count the other family in the “family members” in Part 3 (note that it says “Do not include any relative listed on a separate visa petition.”).If the two I-864s are filed at the same time for the two families, then each family’s I-864’s household size (Part 5) would just count the number of people immigrating in that family, which is 4 (item 1), the petitioner (item 2), and the petitioner’s spouse (item 3), dependent children (item 4), and other tax dependents (item 5), if there are any. It would not count anyone from the other family.On the other hand, if one I-864 is filed for one family, and that family has already immigrated before the second I-864 is filed for the other family, then the first family’s members will need to be counted in Part 5 item 6 (people sponsored on Form I-864 who are now lawful permanent residents) for the second family’s I-864.

Create this form in 5 minutes!

How to create an eSignature for the unlawful activity addendum 24 power associates

How to create an electronic signature for your Unlawful Activity Addendum 24 Power Associates in the online mode

How to generate an electronic signature for the Unlawful Activity Addendum 24 Power Associates in Google Chrome

How to create an eSignature for putting it on the Unlawful Activity Addendum 24 Power Associates in Gmail

How to generate an eSignature for the Unlawful Activity Addendum 24 Power Associates straight from your smart phone

How to make an eSignature for the Unlawful Activity Addendum 24 Power Associates on iOS

How to create an electronic signature for the Unlawful Activity Addendum 24 Power Associates on Android OS

People also ask

-

What is pptc 191 and how can it benefit my business?

Pptc 191 is a regulatory framework that helps businesses streamline their document processes. By integrating pptc 191 with airSlate SignNow, you can improve efficiency in document management and e-signatures, allowing for quicker transactions and enhanced compliance.

-

How much does airSlate SignNow cost when using pptc 191?

Pricing for airSlate SignNow varies based on the features you need; however, it remains cost-effective for businesses looking to implement pptc 191. You can choose from various plans, ensuring you get the right features without overspending, especially for compliance-related actions.

-

What features of airSlate SignNow support pptc 191 compliance?

AirSlate SignNow offers several features that align with pptc 191, including secure e-signature options and document templates designed for regulatory adherence. These features simplify the signing process while ensuring that your documents meet the necessary legal requirements.

-

Can I integrate airSlate SignNow with other software while using pptc 191?

Yes, airSlate SignNow supports various integrations with popular software platforms that complement pptc 191. This ability to integrate enhances your existing workflows, ensuring a seamless experience across different tools and improving overall productivity.

-

Is airSlate SignNow user-friendly for implementing pptc 191?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for teams to adopt pptc 191 without extensive training. The intuitive interface allows users to send and sign documents quickly, ensuring compliance is both simple and efficient.

-

What security measures are included in airSlate SignNow for pptc 191?

Security is a primary concern with pptc 191 compliance, and airSlate SignNow addresses this with robust security features. These include encryption of documents, secure access controls, and audit trails, ensuring your sensitive information is protected throughout the sign process.

-

How does airSlate SignNow enhance document management under pptc 191?

AirSlate SignNow enhances document management by providing features that allow for easy tracking, storage, and retrieval of documents compliant with pptc 191. You can automate workflows, reducing errors and improving the efficiency of your document-related tasks.

Get more for Unlawful Activity Addendum 2 4 Power Associates

- Corporate records maintenance package for existing corporations south carolina form

- South carolina limited liability company llc formation package south carolina

- Limited liability company llc operating agreement south carolina form

- Sc llc form

- Sc pllc form

- Renunciation and disclaimer of property received by intestate succession south carolina form

- Notice furnishing 497325540 form

- Quitclaim deed from individual to husband and wife south carolina form

Find out other Unlawful Activity Addendum 2 4 Power Associates

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online