Who Files IRS Form 8288 and What is Its PurposeAbout Form 8288, U S Withholding Tax Return for Dispositions ByAbout Form 8288, U 2023-2026

Understanding Form 8288 and Its Purpose

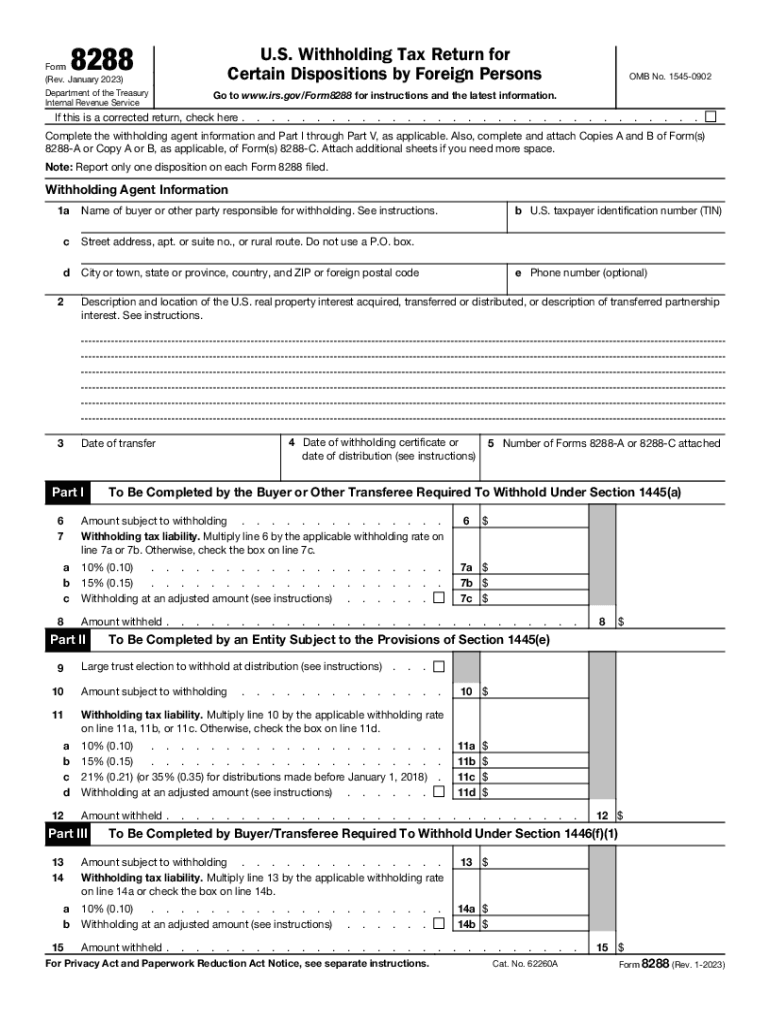

The IRS Form 8288, officially known as the U.S. Withholding Tax Return for Dispositions by Foreign Persons, is essential for reporting and remitting tax withheld on certain dispositions of U.S. real property interests. This form is primarily used by buyers or transferees of U.S. real estate when the seller is a foreign person. The purpose of this form is to ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA), which mandates that a buyer withhold tax on the sale proceeds to cover potential tax liabilities of the foreign seller.

Who Needs to File Form 8288?

Form 8288 must be filed by any buyer or transferee who acquires a U.S. real property interest from a foreign seller. This includes individuals, corporations, partnerships, and other entities. The buyer is responsible for withholding the appropriate tax amount, which is generally set at fifteen percent of the gross sales price. If the buyer fails to withhold the required amount, they may be held liable for the tax, making timely and accurate filing crucial.

Steps to Complete Form 8288

Completing Form 8288 involves several key steps:

- Gather necessary information about the transaction, including the seller's details and the sales price.

- Calculate the withholding amount based on the applicable tax rate.

- Complete the form by providing accurate details in the required sections, including the buyer's and seller's information.

- Submit the form to the IRS along with the withheld tax payment.

- Provide a copy of the form to the seller for their records.

Filing Deadlines for Form 8288

Form 8288 must be filed within twenty days of the date of the transfer of property. It is essential to adhere to this deadline to avoid penalties and interest on unpaid taxes. Additionally, any withheld amounts must be remitted to the IRS by the same deadline to ensure compliance with FIRPTA regulations.

Penalties for Non-Compliance

Failure to file Form 8288 or to withhold the required tax can result in significant penalties. The IRS may impose a penalty equal to the amount that should have been withheld but was not. Additionally, interest may accrue on any unpaid amounts. Therefore, it is important for buyers to understand their responsibilities regarding this form to avoid costly consequences.

Digital vs. Paper Version of Form 8288

Form 8288 is available in both digital and paper formats. The digital version allows for easier completion and submission, especially when using eSignature solutions. Utilizing digital tools can enhance accuracy and streamline the filing process. However, regardless of the format chosen, it is crucial to ensure that all information is complete and accurate before submission to the IRS.

Quick guide on how to complete who files irs form 8288 and what is its purposeabout form 8288 us withholding tax return for dispositions byabout form 8288 us

Prepare Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U on any platform through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U without hassle

- Obtain Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that reason.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Edit and eSign Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct who files irs form 8288 and what is its purposeabout form 8288 us withholding tax return for dispositions byabout form 8288 us

Create this form in 5 minutes!

How to create an eSignature for the who files irs form 8288 and what is its purposeabout form 8288 us withholding tax return for dispositions byabout form 8288 us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8288 and when is it required?

IRS Form 8288 is used to report and remit tax withheld on dispositions of U.S. real property interests by foreign persons. It is required when a foreign entity or individual sells or transfers such properties in the United States. Ensuring proper filing of IRS Form 8288 is crucial for compliance with U.S. tax laws.

-

How can airSlate SignNow help me with IRS Form 8288?

airSlate SignNow provides an easy-to-use platform for eSigning and sending IRS Form 8288 securely. With our solutions, you can quickly fill out, sign, and share the form, ensuring it is submitted accurately and on time. This streamlines the process, reducing the hassle of paperwork for your transactions.

-

What features does airSlate SignNow offer for managing IRS Form 8288?

Our platform includes features such as document templates, real-time tracking, and audit trails specifically for IRS Form 8288. You can create reusable templates for common transactions, monitor the signing process, and maintain compliance with detailed logs of all actions taken. These features enhance efficiency and reliability.

-

Is there a free trial available for airSlate SignNow when handling IRS Form 8288?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's capabilities for managing IRS Form 8288. This trial gives you access to all features, enabling you to evaluate how our solution can streamline your document processes before committing to a subscription.

-

What are the pricing options for airSlate SignNow when working with IRS Form 8288?

airSlate SignNow offers competitive pricing plans tailored for different business needs, including those who frequently handle IRS Form 8288. Our fees are straightforward, with options for monthly or annual subscriptions, allowing you to choose a plan that best fits your document transaction volume and budget.

-

Can I integrate airSlate SignNow with other software for handling IRS Form 8288?

absolutely! airSlate SignNow offers integrations with various third-party applications, making it easy to incorporate IRS Form 8288 into your existing workflows. This ensures that your document management aligns seamlessly with customer relationship management (CRM) systems or accounting software you may already be using.

-

What benefits does airSlate SignNow provide for IRS Form 8288 users?

Using airSlate SignNow for IRS Form 8288 streamlines your signing and submission process, enhances document security, and improves compliance. Additionally, our user-friendly platform allows for quick and efficient handling of paperwork, freeing up time for you and your team to focus on core business functions.

Get more for Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U

Find out other Who Files IRS Form 8288 And What Is Its PurposeAbout Form 8288, U S Withholding Tax Return For Dispositions ByAbout Form 8288, U

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online