Irs Form 8288 2013

What is the Irs Form 8288

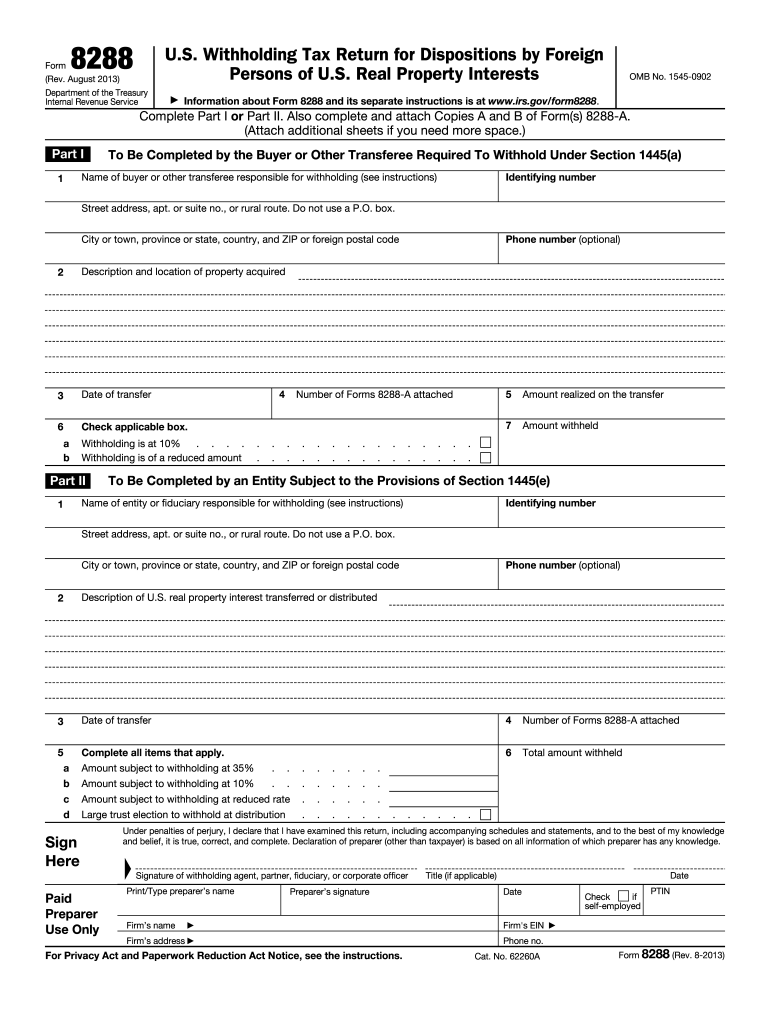

The Irs Form 8288 is a tax form used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized for the withholding tax on dispositions of U.S. real property interests by foreign persons. This form ensures that the IRS collects the appropriate taxes on gains realized from these transactions. It is essential for foreign investors and real estate transactions involving non-resident aliens, as it helps to comply with U.S. tax obligations.

How to use the Irs Form 8288

To use the Irs Form 8288, the seller of the U.S. real property must complete the form accurately. The form requires detailed information about the transaction, including the seller's identification, property details, and the amount realized from the sale. After completing the form, the withholding agent must submit it to the IRS along with the appropriate payment for the withholding tax. It is crucial to ensure that all information is correct to avoid penalties and delays in processing.

Steps to complete the Irs Form 8288

Completing the Irs Form 8288 involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Provide details about the property, including the address and the date of the sale.

- Calculate the amount realized from the sale, including the sale price and any adjustments.

- Determine the withholding tax amount based on the applicable rate.

- Complete the form by filling in all required fields accurately.

- Submit the form to the IRS along with the payment for the withholding tax.

Legal use of the Irs Form 8288

The legal use of the Irs Form 8288 is critical for compliance with U.S. tax laws. This form must be filed when a foreign person disposes of a U.S. real property interest. Failure to file the form or to withhold the correct amount can result in significant penalties. It is important for both the seller and the withholding agent to understand their responsibilities under U.S. tax regulations to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Form 8288 are crucial for compliance. The form must be filed on or before the date of the transfer of the property. Additionally, the payment for the withholding tax must be submitted at the same time. If the deadline is missed, penalties may apply, including interest on unpaid amounts. It is advisable to keep track of these dates to ensure timely filing and payment.

Penalties for Non-Compliance

Non-compliance with the requirements of the Irs Form 8288 can lead to significant penalties. If the form is not filed or if the withholding tax is not paid, the IRS may impose fines and interest on the unpaid amount. Additionally, the withholding agent may be held liable for the tax if the seller fails to pay. Understanding these penalties emphasizes the importance of accurate and timely filing of the form.

Quick guide on how to complete irs form 8288 2013

Prepare Irs Form 8288 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Irs Form 8288 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Irs Form 8288 with ease

- Obtain Irs Form 8288 and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 8288 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8288 2013

Create this form in 5 minutes!

How to create an eSignature for the irs form 8288 2013

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is IRS Form 8288?

IRS Form 8288 is a tax form used by withholding agents to report and pay the tax required under section 1445 for the sale of U.S. real property interests by foreign persons. It is essential for compliance with U.S. tax laws and must be filed when applicable.

-

How does airSlate SignNow help with IRS Form 8288?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and securely send IRS Form 8288. Our solution simplifies the documentation process, ensuring that all necessary forms are completed and stored properly for tax purposes.

-

Is airSlate SignNow cost-effective for processing IRS Form 8288?

Yes, airSlate SignNow is a cost-effective solution for managing IRS Form 8288 as it eliminates the need for printing and physical signatures. Our pricing plans are designed to cater to businesses of all sizes, offering affordable access to essential eSigning features.

-

What features does airSlate SignNow offer for IRS Form 8288?

airSlate SignNow includes features such as customizable templates, secure document storage, and real-time tracking for IRS Form 8288. These features enhance efficiency and provide users with the ability to manage their tax documents effortlessly.

-

Can I integrate airSlate SignNow with other software for IRS Form 8288?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, allowing you to streamline the process of managing IRS Form 8288 alongside other documents. This feature enhances your workflow and improves overall productivity.

-

What benefits does eSigning provide for IRS Form 8288?

eSigning IRS Form 8288 through airSlate SignNow offers numerous benefits, including faster processing times and reduced paperwork. It allows all parties to sign documents remotely, ensuring compliance with IRS requirements without the hassle of physical meetings.

-

Is airSlate SignNow secure for handling IRS Form 8288?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. This ensures that your IRS Form 8288 and other sensitive documents are safeguarded against unauthorized access.

Get more for Irs Form 8288

- Estate planning questionnaire and worksheets florida form

- Document locator and personal information package including burial information form florida

- Florida copy form

- Florida will form

- Injury workers compensation 497303537 form

- Georgia suspension form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497303539 form

- Ga odometer disclosure statement form

Find out other Irs Form 8288

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document