Irs Form 8288 2016

What is the Irs Form 8288

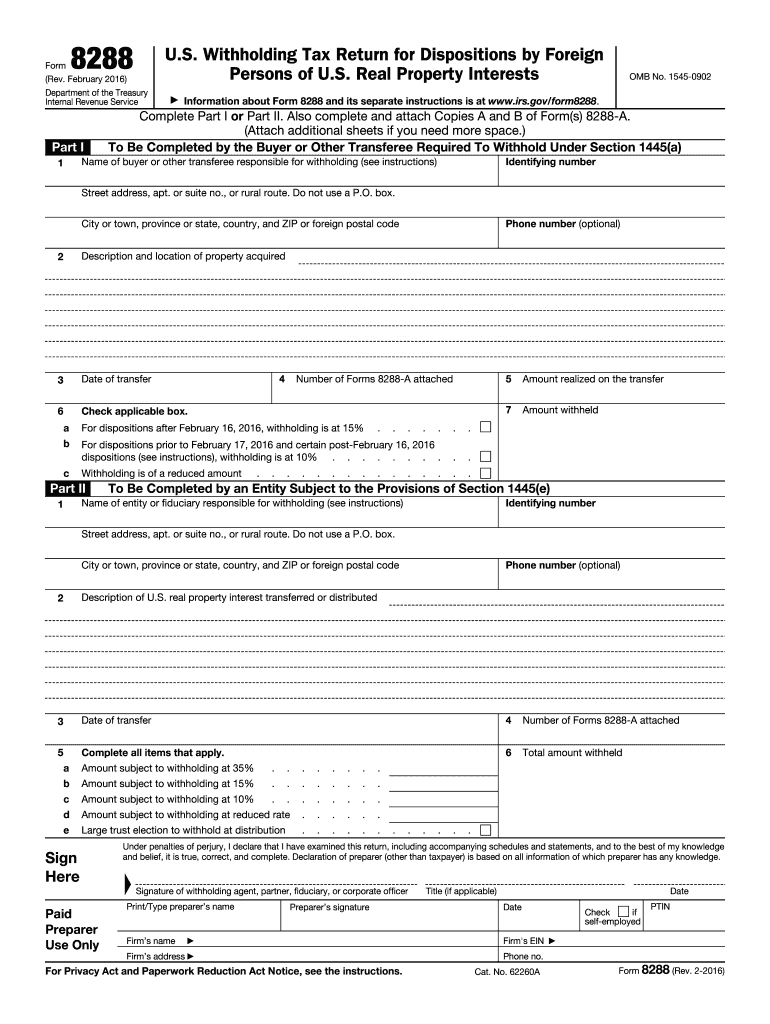

The Irs Form 8288 is a tax form used by the Internal Revenue Service (IRS) in the United States. It is specifically designed for withholding tax on the disposition of U.S. real property interests by foreign persons. This form is essential for ensuring compliance with U.S. tax laws when a foreign individual or entity sells or transfers property located in the United States. The form requires the withholding agent to report the amount withheld and remit it to the IRS, helping to prevent tax evasion by foreign sellers.

How to use the Irs Form 8288

To use the Irs Form 8288, the withholding agent must complete the form accurately and submit it to the IRS. The process involves several key steps:

- Identify the foreign seller and the property being sold.

- Determine the amount of tax to be withheld based on the sale price.

- Complete the form with the necessary information, including the seller's details and the amount withheld.

- Submit the completed form to the IRS along with the payment of the withheld tax.

It is important to ensure that all information is accurate to avoid penalties or delays in processing.

Steps to complete the Irs Form 8288

Completing the Irs Form 8288 involves several detailed steps:

- Gather required information about the seller, the property, and the transaction.

- Calculate the withholding amount based on the sale price, typically at a rate of fifteen percent.

- Fill out the form, ensuring all fields are completed correctly, including the seller's name, address, and tax identification number.

- Attach any necessary documentation, such as a copy of the sales contract.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS and remit the withheld tax payment.

Following these steps carefully helps ensure compliance with IRS regulations.

Legal use of the Irs Form 8288

The legal use of the Irs Form 8288 is crucial for both the withholding agent and the foreign seller. The IRS mandates that this form be filed whenever a foreign person disposes of U.S. real property interests. Failure to comply can result in significant penalties, including the withholding agent being held liable for the tax amount not withheld. Additionally, the foreign seller may face complications in obtaining a tax refund if the form is not filed correctly. Adhering to the legal requirements surrounding this form helps protect all parties involved in the transaction.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Irs Form 8288 is essential to avoid penalties. The form must be filed within twenty days of the date of the sale or transfer of the property. The withheld tax payment is also due at this time. It is advisable to mark your calendar with these important dates to ensure timely compliance. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day.

Required Documents

When completing the Irs Form 8288, several documents may be required to support the information provided. These typically include:

- A copy of the sales contract or agreement.

- Identification documents for the foreign seller, such as a passport or tax identification number.

- Any correspondence related to the transaction that may be relevant.

Having these documents ready can facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete irs form 8288 2016

Prepare Irs Form 8288 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to secure the correct form and safely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents swiftly without delays. Oversee Irs Form 8288 on any platform using airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Irs Form 8288 with ease

- Locate Irs Form 8288 and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Irs Form 8288 while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8288 2016

Create this form in 5 minutes!

How to create an eSignature for the irs form 8288 2016

How to create an electronic signature for the Irs Form 8288 2016 online

How to generate an electronic signature for your Irs Form 8288 2016 in Google Chrome

How to generate an electronic signature for putting it on the Irs Form 8288 2016 in Gmail

How to make an eSignature for the Irs Form 8288 2016 right from your smart phone

How to generate an electronic signature for the Irs Form 8288 2016 on iOS

How to make an electronic signature for the Irs Form 8288 2016 on Android

People also ask

-

What is IRS Form 8288 and when do I need to use it?

IRS Form 8288 is a tax form required for withholding tax on dispositions of U.S. real property interests by foreign persons. You need to use this form when a foreign seller transfers ownership of U.S. real estate, ensuring compliance with U.S. tax obligations.

-

How does airSlate SignNow help with IRS Form 8288?

AirSlate SignNow streamlines the process of completing and signing IRS Form 8288 by allowing you to easily fill out, eSign, and send the document securely. This simplifies compliance and provides a digital trail for all parties involved.

-

Can I integrate airSlate SignNow with other tools for managing IRS Form 8288?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for managing IRS Form 8288. You can connect with popular platforms like Google Drive, Dropbox, and more to ensure efficient document management.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8288?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing our service, you can manage your IRS Form 8288 and other documents without breaking the bank, making it a cost-effective solution.

-

What features does airSlate SignNow provide for completing IRS Form 8288?

AirSlate SignNow includes features like customizable templates, easy eSigning, and automated reminders, all of which are beneficial for handling IRS Form 8288. These tools ensure that the form is completed accurately and on time.

-

How secure is airSlate SignNow when handling IRS Form 8288?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like IRS Form 8288. Our platform uses advanced encryption and secure data storage to protect your information throughout the signing process.

-

Can I track the status of my IRS Form 8288 sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your IRS Form 8288 in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Irs Form 8288

- Boston home center program application and disclosure form

- Pbgc form 10

- Advance notice of reportable events pbgc form

- Agreement to pay individual or 1099 reportable entity departments weber form

- Tax identification request form illinois institute of technology iit

- Twin peaks application form

- Fop moonlighting insurance form

- St3 minnesota form

Find out other Irs Form 8288

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document