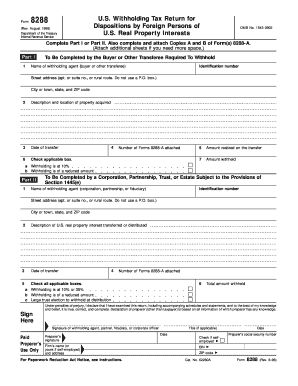

Form 8288 Rev August U S Withholding Tax Return for Dispositions by Foreign Persons of U S Real Property Interests 1998

What is the Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

The Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests is a tax document required by the Internal Revenue Service (IRS). It is specifically designed for foreign individuals or entities that dispose of U.S. real property interests. This form ensures that the appropriate withholding tax is collected on the sale or transfer of such properties, as foreign sellers may not be subject to the same tax obligations as U.S. citizens. The form must be filed by the buyer or transferee, who is responsible for withholding the tax and submitting the form to the IRS.

How to use the Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

Using the Form 8288 involves several steps to ensure compliance with IRS regulations. First, the buyer or transferee must determine if the seller is a foreign person. If so, the buyer must withhold a percentage of the sales price, typically fifteen percent, as specified by IRS guidelines. The buyer will then fill out the Form 8288, providing details about the transaction, including the seller's information, property details, and the amount withheld. Once completed, the form must be submitted to the IRS along with the withheld tax payment.

Steps to complete the Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

Completing the Form 8288 requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the transaction, including the seller's name, address, and taxpayer identification number.

- Determine the sales price of the property and calculate the withholding amount based on the applicable percentage.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS along with the payment for the withheld tax.

Legal use of the Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

The legal use of the Form 8288 is crucial for compliance with U.S. tax laws. Filing this form is not only a requirement but also serves to protect the buyer from potential penalties associated with failure to withhold taxes. Proper completion and timely submission of the form help ensure that the IRS receives the correct withholding amount, thereby fulfilling the buyer's tax obligations. Failure to file or incorrect filing may result in significant penalties for both the buyer and the seller.

Filing Deadlines / Important Dates

Timeliness is essential when dealing with the Form 8288. The form must be filed with the IRS within twenty days of the date of the property transfer. It is important to keep track of these deadlines to avoid penalties. Additionally, the withheld tax payment must be submitted along with the form. If the deadline falls on a weekend or holiday, it is advisable to file the form and payment on the preceding business day to ensure compliance.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 8288 can lead to significant penalties. If the buyer fails to withhold the required tax or does not file the form on time, the IRS may impose penalties that can amount to a percentage of the tax that should have been withheld. Furthermore, the buyer may be held liable for the unpaid tax, which emphasizes the importance of understanding and adhering to the filing requirements of this form.

Quick guide on how to complete form 8288 rev august 1998 us withholding tax return for dispositions by foreign persons of us real property interests

Complete Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests effortlessly

- Find Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests and then click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8288 rev august 1998 us withholding tax return for dispositions by foreign persons of us real property interests

Create this form in 5 minutes!

How to create an eSignature for the form 8288 rev august 1998 us withholding tax return for dispositions by foreign persons of us real property interests

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests?

Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests is a tax form required for foreign persons disposing of U.S. real property interests. This form ensures compliance with U.S. tax laws and helps foreign sellers report the sale proceeds correctly.

-

How can airSlate SignNow assist with completing Form 8288?

airSlate SignNow provides a user-friendly platform where you can easily eSign and send Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. Our solution simplifies the process, allowing you to complete forms quickly and securely, ensuring all necessary information is properly captured.

-

What are the costs associated with using airSlate SignNow for Form 8288?

Pricing for airSlate SignNow is competitive and depends on the plan you choose. Our plans are designed to be cost-effective, providing users with all the necessary tools to manage documents, including Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests, without breaking the bank.

-

Does airSlate SignNow offer any features specifically for tax forms like Form 8288?

Yes, airSlate SignNow includes features specifically designed to streamline the handling of tax forms, including Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. These features include templates, reminders, and secure storage, making it easier to manage and submit important documents.

-

Can I integrate airSlate SignNow with other software for managing Form 8288?

Absolutely! airSlate SignNow offers various integrations with popular software, allowing you to streamline your workflow when managing Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. By integrating with your existing tools, you can enhance your document management processes efficiently.

-

What are the benefits of using airSlate SignNow for international transactions involving Form 8288?

Using airSlate SignNow for international transactions simplifies the process of handling Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests. It ensures compliance, reduces the risk of errors, and provides an efficient way to collect signatures, making transactions faster and more reliable.

-

Is it secure to use airSlate SignNow for submitting Form 8288?

Yes, security is a top priority for airSlate SignNow. When submitting Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests, your data is protected with advanced encryption protocols, ensuring that sensitive information remains safe during the signing and submission process.

Get more for Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

- Il lease form

- Salary verification form for potential lease illinois

- Illinois agreement tenant form

- Illinois default 497306282 form

- Landlord tenant lease co signer agreement illinois form

- Application for sublease illinois form

- Inventory and condition of leased premises for pre lease and post lease illinois form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out illinois form

Find out other Form 8288 Rev August U S Withholding Tax Return For Dispositions By Foreign Persons Of U S Real Property Interests

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT