Form 8288, U S Withholding Tax Return for Dispositions by IRS Gov 2017

What is the Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

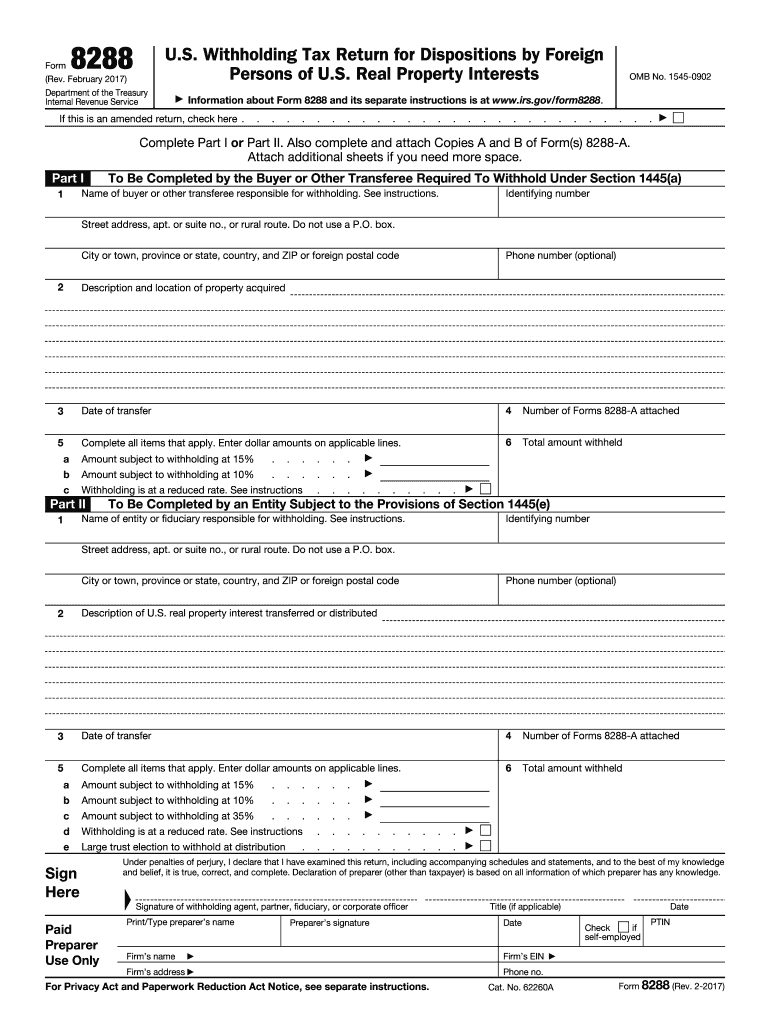

The Form 8288 is a tax document used by the Internal Revenue Service (IRS) for reporting and collecting withholding tax on dispositions of U.S. real property interests by foreign persons. This form is essential for ensuring compliance with U.S. tax laws, as it helps the IRS track taxes owed on property transactions involving non-resident aliens or foreign entities. The withholding tax applies to the gross amount realized from the sale, and the form must be filed by the buyer or transferee of the property.

How to use the Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

Using Form 8288 involves several steps to ensure accurate reporting and compliance with tax regulations. The buyer or transferee must complete the form, providing details about the transaction, including the seller's information, the property involved, and the amount of withholding tax calculated. After completing the form, it must be submitted to the IRS along with the appropriate payment. It's important to retain copies for personal records and to ensure that all information is accurate to avoid penalties.

Steps to complete the Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

Completing Form 8288 requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the IRS website or through authorized sources.

- Fill in the required information, including the buyer's and seller's names, addresses, and taxpayer identification numbers.

- Provide details about the property, including its address and the date of the transaction.

- Calculate the withholding tax based on the sale price and applicable rates.

- Sign and date the form to certify its accuracy.

- Submit the completed form and payment to the IRS by the specified deadline.

Legal use of the Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

The legal use of Form 8288 is crucial for compliance with U.S. tax laws. It serves as a formal declaration of the withholding tax obligation related to the sale of U.S. real property by foreign persons. Proper completion and timely submission of this form help avoid legal issues, including penalties for non-compliance. Understanding the legal implications of the form ensures that both buyers and sellers fulfill their tax responsibilities under U.S. law.

Filing Deadlines / Important Dates

Filing deadlines for Form 8288 are critical to avoid penalties. The form must be submitted to the IRS within twenty days of the date of the property transfer. Additionally, any payment of the withholding tax is due at the same time as the form submission. Keeping track of these important dates is essential for compliance and to ensure that the transaction proceeds smoothly without legal complications.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 8288 can result in significant penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, if the withholding tax is not paid, the buyer may become liable for the tax amount, along with interest and additional penalties. Understanding these consequences emphasizes the importance of timely and accurate submission of the form.

Quick guide on how to complete form 8288 us withholding tax return for dispositions by irsgov

Effortlessly prepare Form 8288, U S Withholding Tax Return For Dispositions By IRS gov on any device

Online document management has become widely accepted by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 8288, U S Withholding Tax Return For Dispositions By IRS gov using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Form 8288, U S Withholding Tax Return For Dispositions By IRS gov with ease

- Find Form 8288, U S Withholding Tax Return For Dispositions By IRS gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8288, U S Withholding Tax Return For Dispositions By IRS gov and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8288 us withholding tax return for dispositions by irsgov

Create this form in 5 minutes!

How to create an eSignature for the form 8288 us withholding tax return for dispositions by irsgov

How to create an electronic signature for the Form 8288 Us Withholding Tax Return For Dispositions By Irsgov online

How to create an eSignature for your Form 8288 Us Withholding Tax Return For Dispositions By Irsgov in Google Chrome

How to generate an electronic signature for signing the Form 8288 Us Withholding Tax Return For Dispositions By Irsgov in Gmail

How to create an eSignature for the Form 8288 Us Withholding Tax Return For Dispositions By Irsgov straight from your smart phone

How to make an electronic signature for the Form 8288 Us Withholding Tax Return For Dispositions By Irsgov on iOS

How to create an electronic signature for the Form 8288 Us Withholding Tax Return For Dispositions By Irsgov on Android OS

People also ask

-

What is Form 8288, U S Withholding Tax Return For Dispositions By IRS gov.?

Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. is a tax form used by the IRS to report the tax withheld on the disposition of U.S. real property interests. It's essential for foreign investors or sellers to ensure they comply with U.S. tax laws. Completing this form correctly helps avoid penalties associated with improper withholding.

-

How can airSlate SignNow assist with Form 8288, U S Withholding Tax Return For Dispositions By IRS gov.?

airSlate SignNow offers a streamlined solution for electronically signing and sending important documents like Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. Our platform provides templates and an easy-to-use interface to expedite the completion and submission of tax forms, ensuring you stay compliant with IRS requirements.

-

What are the pricing options for using airSlate SignNow to manage Form 8288?

airSlate SignNow provides various pricing plans to accommodate different business needs, ensuring you can efficiently manage Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. Plans are structured to be cost-effective while offering the necessary features for document management and electronic signing. Visit our pricing page for detailed options.

-

What features does airSlate SignNow offer for handling tax forms?

Key features of airSlate SignNow include customizable templates, secure electronic signatures, and document tracking. These features ensure that handling Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. is efficient and secure. The platform also supports cloud storage and sharing capabilities for easy access.

-

Is airSlate SignNow compliant with IRS regulations for tax forms?

Yes, airSlate SignNow is designed to comply with IRS regulations, making it a reliable choice for managing Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. Our service ensures that all electronic signatures are legally binding and that your documents meet the necessary requirements for submission to the IRS.

-

Can I integrate airSlate SignNow with other financial software for processing Form 8288?

Absolutely! airSlate SignNow offers integrations with popular financial and accounting software, making it easy to import and export data related to Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. This feature streamlines your workflow and enhances productivity when handling tax-related tasks.

-

What are the benefits of using airSlate SignNow for sending Form 8288?

Using airSlate SignNow to send Form 8288, U S Withholding Tax Return For Dispositions By IRS gov. offers numerous benefits, including improved speed and efficiency in document processing. Additionally, our secure platform ensures your sensitive information is protected, while the easy-to-use interface makes managing your forms less stressful.

Get more for Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

Find out other Form 8288, U S Withholding Tax Return For Dispositions By IRS gov

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form