Lorain County Homestead Exemption 2021

What is the Lorain County Homestead Exemption

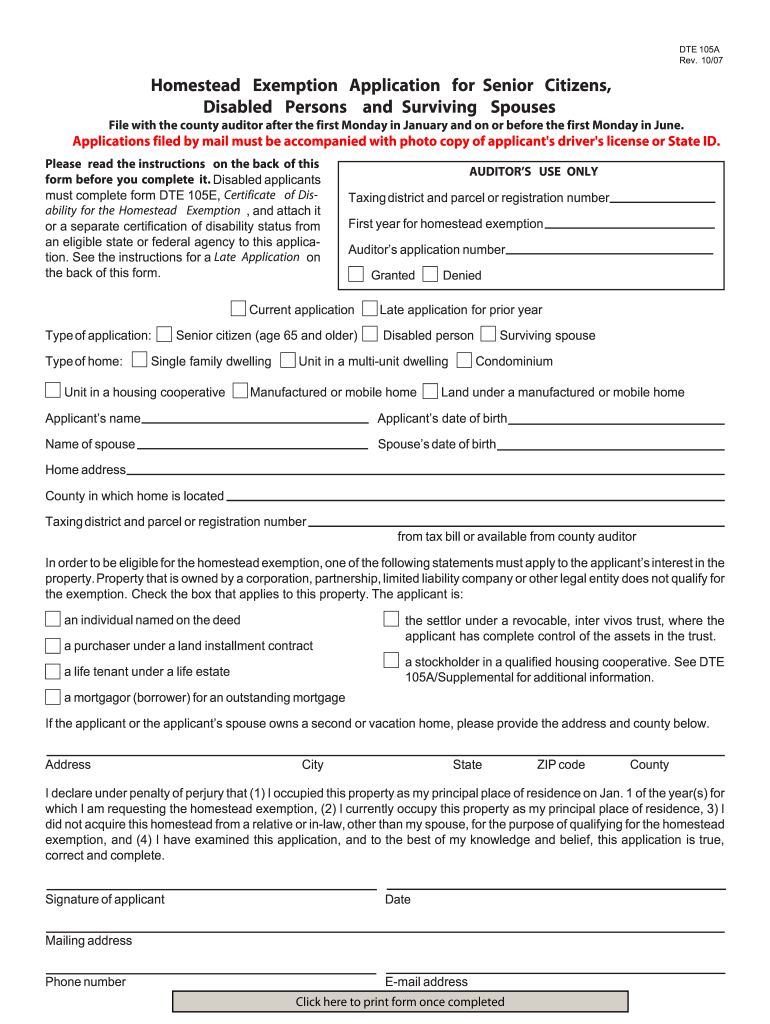

The Lorain County Homestead Exemption is a property tax relief program designed to assist eligible homeowners in reducing their property tax burden. This exemption is available to individuals who meet specific criteria, including age, disability status, and income limitations. By applying for this exemption, qualified homeowners can receive a reduction in the taxable value of their property, thereby lowering their overall property taxes.

Eligibility Criteria

To qualify for the Lorain County Homestead Exemption, applicants must meet certain eligibility requirements. Generally, applicants must be at least sixty-five years old or permanently and totally disabled. Additionally, the applicant's total income must fall below a specified threshold, which is set annually. Homeowners must also occupy the property as their primary residence and cannot have a total property value exceeding the limits defined by the county.

Steps to Complete the Lorain County Homestead Exemption

Completing the Lorain County Homestead Exemption application involves several key steps. First, gather all necessary documentation, including proof of age or disability, income verification, and property details. Next, fill out the application form accurately, ensuring all information is complete. Once the form is filled out, submit it to the appropriate county office, either online, by mail, or in person, depending on the submission options available. It is essential to keep a copy of the submitted application for your records.

Required Documents

When applying for the Lorain County Homestead Exemption, certain documents are required to verify eligibility. These typically include:

- Proof of age or disability, such as a birth certificate or disability award letter

- Income documentation, including tax returns or pay stubs

- Property deed or tax bill to confirm ownership and residency

Having these documents ready will streamline the application process and help ensure that all eligibility criteria are met.

Form Submission Methods

The Lorain County Homestead Exemption application can be submitted through various methods, providing flexibility for applicants. Homeowners can choose to submit their applications online through the county's official website, mail the completed form to the designated county office, or deliver it in person. Each method has its own advantages, so applicants should select the one that best suits their needs and preferences.

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of filing deadlines associated with the Lorain County Homestead Exemption. Typically, applications must be submitted by a specific date each year to be eligible for the following tax year. Staying informed about these deadlines ensures that homeowners do not miss out on potential tax savings. It is advisable to check with the county office for the most current dates and any changes that may occur annually.

Quick guide on how to complete lorain county homestead exemption

Complete Lorain County Homestead Exemption effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly without delays. Manage Lorain County Homestead Exemption on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and electronically sign Lorain County Homestead Exemption without hassle

- Obtain Lorain County Homestead Exemption and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to the computer.

Eliminate concerns about missing or lost files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Lorain County Homestead Exemption and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct lorain county homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the lorain county homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead exemption Lorain County Ohio?

The homestead exemption in Lorain County, Ohio, is a tax relief program that reduces property taxes for qualifying homeowners. This exemption applies to the primary residence of individuals who meet specific criteria, such as age, disability status, or income limits. Understanding this exemption can help you signNowly lower your property tax burden.

-

How do I apply for the homestead exemption Lorain County Ohio?

To apply for the homestead exemption in Lorain County, Ohio, you need to complete an application form available from the county auditor's office. Ensure that you provide the necessary identification and documentation to verify your eligibility. Applications can usually be submitted online, by mail, or in person, making the process accessible and straightforward.

-

What are the eligibility requirements for the homestead exemption Lorain County Ohio?

Eligibility for the homestead exemption in Lorain County, Ohio, generally includes being a homeowner who is at least 65 years old, permanently disabled, or meeting certain income thresholds. Additionally, you must occupy the home as your primary residence. It’s essential to check with the local authorities for any updates or additional criteria.

-

How much can I save with the homestead exemption Lorain County Ohio?

The savings from the homestead exemption in Lorain County, Ohio, depend on the assessed value of your property and local tax rates. Homeowners can receive a reduction in their taxable value, which may translate to hundreds of dollars in savings annually. It is an effective way to manage your household budget more efficiently.

-

Can I combine the homestead exemption Lorain County Ohio with other tax benefits?

Yes, you can combine the homestead exemption in Lorain County, Ohio, with other tax benefits if you qualify for them. Many homeowners utilize additional programs such as veteran's exemptions or energy efficiency incentives alongside the homestead exemption. Always consult with local tax authorities to explore all available benefits.

-

Is there a deadline to apply for the homestead exemption Lorain County Ohio?

Yes, there is a deadline to apply for the homestead exemption in Lorain County, Ohio, which typically falls on the first Monday in June. Meeting this deadline is crucial to receiving the exemption for the current tax year. It is advisable to submit your application as early as possible to avoid any last-minute complications.

-

What types of properties qualify for the homestead exemption Lorain County Ohio?

In Lorain County, Ohio, the homestead exemption applies primarily to residential properties that serve as the homeowner's primary residence. This includes single-family homes, condominiums, and certain manufactured homes. Properties held for commercial use do not qualify for this exemption.

Get more for Lorain County Homestead Exemption

Find out other Lorain County Homestead Exemption

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter