PA Schedule E Rents and Royalty Income Loss PA 40 E FormsPublications 2022

What is the PA Schedule E for Rents and Royalty Income?

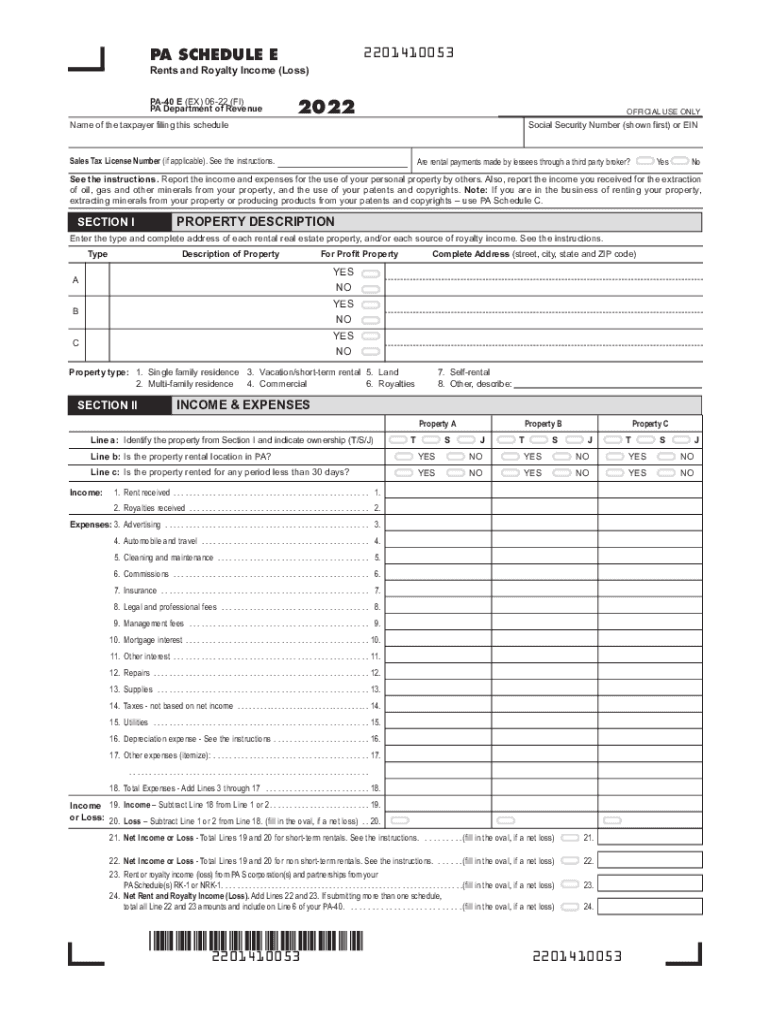

The PA Schedule E, also known as the Rents and Royalty Income form, is a crucial document for Pennsylvania taxpayers who earn income from rental properties or royalties. This form allows individuals to report income and losses associated with real estate rentals, as well as royalties from intellectual property. Understanding the PA Schedule E is essential for accurately filing state taxes and ensuring compliance with Pennsylvania tax laws.

Steps to Complete the PA Schedule E

Completing the PA Schedule E involves several steps to ensure accurate reporting of rental and royalty income. Begin by gathering all relevant financial documents, including rental agreements, income statements, and expense receipts. Next, fill out the form by entering total income received from rentals and royalties. Deduct any allowable expenses, such as repairs, maintenance, and property management fees. Finally, review the completed form for accuracy before submission.

Legal Use of the PA Schedule E

The PA Schedule E is legally recognized for reporting rental and royalty income in Pennsylvania. To ensure its legal validity, taxpayers must adhere to state regulations regarding income reporting and documentation. Properly completing this form not only fulfills tax obligations but also protects taxpayers in case of audits or inquiries from the Pennsylvania Department of Revenue.

Filing Deadlines for the PA Schedule E

Taxpayers must be aware of the filing deadlines associated with the PA Schedule E. Typically, the deadline aligns with the federal tax filing date, which is usually April fifteenth. However, if additional time is needed, taxpayers can file for an extension, allowing them to submit their forms by October fifteenth. It is important to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents for the PA Schedule E

To complete the PA Schedule E accurately, certain documents are required. These include:

- Rental agreements

- Income statements from tenants

- Receipts for all related expenses

- Property tax statements

- Documentation of any royalties received

Having these documents readily available will facilitate a smoother filing process and ensure compliance with state regulations.

Examples of Using the PA Schedule E

Taxpayers can benefit from understanding practical examples of using the PA Schedule E. For instance, an individual renting out a single-family home would report the total rental income received and deduct expenses such as mortgage interest, property taxes, and maintenance costs. Similarly, someone receiving royalties from a book would report the income and deduct related expenses, such as publishing costs. These examples illustrate the versatility of the form in various income scenarios.

Quick guide on how to complete 2022 pa schedule e rents and royalty income loss pa 40 e formspublications

Effortlessly complete PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications with ease

- Obtain PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your alterations.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 pa schedule e rents and royalty income loss pa 40 e formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2022 pa schedule e rents and royalty income loss pa 40 e formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa 40 2019 form and how is it used with airSlate SignNow?

The pa 40 2019 form is a tax document used to report personal income in Pennsylvania. With airSlate SignNow, users can easily send, sign, and manage the pa 40 2019 form electronically, making the process more efficient and secure.

-

How does airSlate SignNow ensure the security of my pa 40 2019 documents?

airSlate SignNow prioritizes security by implementing advanced encryption and secure server storage for all documents, including the pa 40 2019 form. This ensures that sensitive information is protected throughout the signing process.

-

What features does airSlate SignNow offer for managing the pa 40 2019 form?

Features such as customizable templates, real-time tracking, and automatic reminders help streamline the management of the pa 40 2019 form. Additionally, airSlate SignNow allows users to collaborate with team members directly within the platform.

-

Is there a mobile app for signing the pa 40 2019 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to sign the pa 40 2019 form from any device. This flexibility ensures that you can complete your document signing on the go.

-

How much does it cost to use airSlate SignNow for the pa 40 2019?

airSlate SignNow offers various pricing plans that are affordable and cater to different business needs. Users can choose a plan that fits their budget while ensuring they have the necessary features for completing the pa 40 2019 form.

-

Can I integrate airSlate SignNow with other software for the pa 40 2019?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enabling users to manage their workflows better when dealing with the pa 40 2019 form. This integration enhances productivity by connecting your existing tools.

-

What are the benefits of using airSlate SignNow for the pa 40 2019?

Using airSlate SignNow for the pa 40 2019 form simplifies the signing process, saving time and reducing paperwork. The platform's user-friendly interface also ensures that even those unfamiliar with digital signing can easily navigate and complete their documents.

Get more for PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

- Certificate of purchase sample form

- Peru visa application form pdf

- Application for regular pioneer service s 205 form

- Recibo justificante de pago lanbide form

- Sa002 form

- Blank po form

- Zoning verification permit ministerial meteorological testing met facility form

- Self exclusion form cgcc 037 rev 0511 california gambling cgcc ca

Find out other PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form