PA Schedule E Rents and Royalty Income Loss PA 40 E FormsPublications 2017

What is the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

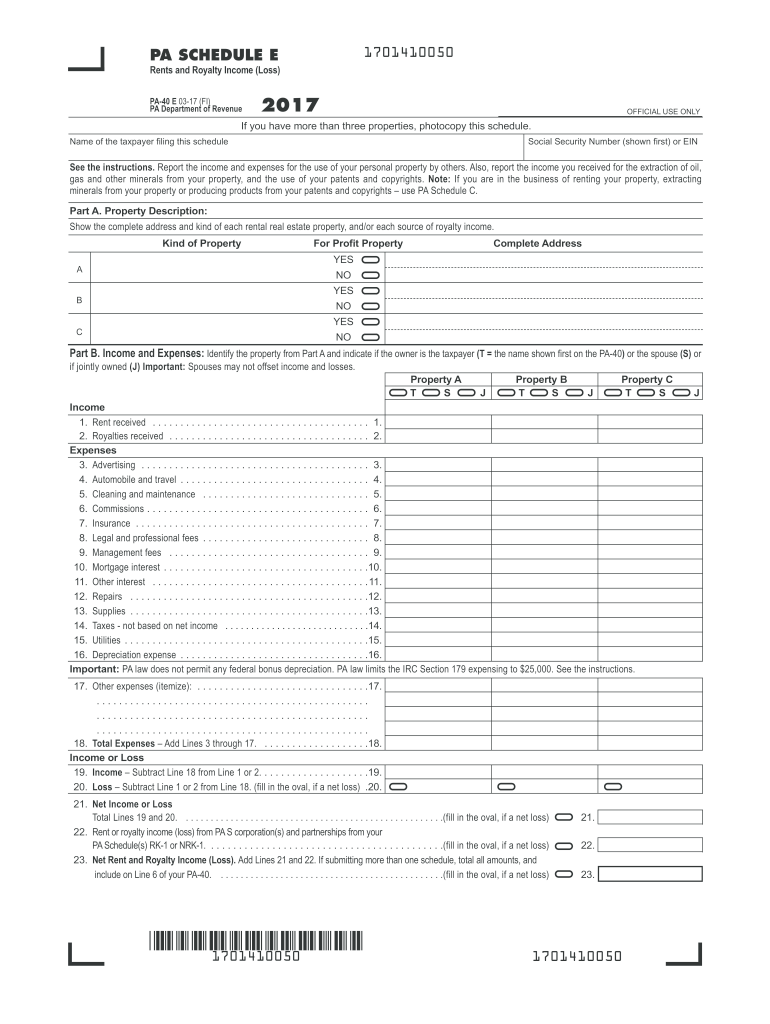

The PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications is a tax form used by individuals and businesses in Pennsylvania to report income and losses from rental properties and royalties. This form is essential for taxpayers who earn income from real estate rentals, partnerships, or other sources of royalty income. By accurately completing this form, taxpayers can ensure compliance with state tax regulations and potentially reduce their taxable income through reported losses.

Steps to complete the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

Completing the PA Schedule E involves several key steps:

- Gather all necessary financial documents related to rental income and expenses.

- Begin by entering your personal information, including your name and Social Security number.

- List all rental properties and corresponding income. Include details such as property address and total rental income received.

- Document any expenses associated with each property, such as repairs, maintenance, and management fees.

- Calculate the net income or loss for each property by subtracting total expenses from total income.

- Transfer the total net income or loss to the appropriate section of your PA tax return.

Legal use of the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

The PA Schedule E is legally recognized as a valid document for reporting rental and royalty income in Pennsylvania. To ensure its legal standing, it must be completed accurately and submitted by the designated filing deadline. Compliance with state tax laws is crucial, as failure to report income or inaccuracies can lead to penalties. Utilizing electronic signature solutions can further enhance the legal validity of your submission, ensuring that all parties involved in the signing process are verified and authenticated.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines related to the PA Schedule E. Generally, the filing deadline coincides with the federal income tax deadline, typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific extensions or changes that may apply to Pennsylvania state taxes. Timely submission is essential to avoid penalties and interest on unpaid taxes.

Examples of using the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

Several scenarios illustrate the use of the PA Schedule E:

- A landlord renting out a residential property must report rental income and any associated expenses, such as property management fees and maintenance costs.

- An individual receiving royalties from a book or music must document the income received and any expenses related to the production or promotion of the work.

- A partnership that owns rental properties will need to report its share of income and losses on the PA Schedule E, ensuring that each partner's tax obligations are accurately reflected.

Required Documents

To complete the PA Schedule E, the following documents are typically required:

- Records of rental income received, including lease agreements and payment receipts.

- Documentation of all expenses related to rental properties, such as invoices for repairs, utility bills, and property management contracts.

- Previous tax returns, if applicable, to ensure consistency in reporting income and losses.

Quick guide on how to complete 2017 pa schedule e rents and royalty income loss pa 40 e formspublications

Accomplish PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications effortlessly on any device

Web-based document administration has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can discover the correct format and securely save it online. airSlate SignNow provides all the resources necessary to generate, modify, and eSign your papers swiftly and without delays. Manage PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

The most efficient method to modify and eSign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications with ease

- Obtain PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details carefully and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Modify and eSign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 pa schedule e rents and royalty income loss pa 40 e formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2017 pa schedule e rents and royalty income loss pa 40 e formspublications

How to make an eSignature for the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications online

How to generate an eSignature for the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications in Google Chrome

How to make an electronic signature for signing the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications in Gmail

How to make an eSignature for the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications from your smart phone

How to create an eSignature for the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications on iOS devices

How to create an electronic signature for the 2017 Pa Schedule E Rents And Royalty Income Loss Pa 40 E Formspublications on Android devices

People also ask

-

What is the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

The PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications is a specific form used by Pennsylvania residents to report rental and royalty income. It plays a crucial role in accurately calculating taxable income and ensures compliance with Pennsylvania tax laws.

-

How can airSlate SignNow assist with completing the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

airSlate SignNow offers an easy-to-use platform that allows you to eSign and send your PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications electronically. This streamlines the process, reduces paperwork, and eliminates the hassle of in-person signatures.

-

What features does airSlate SignNow provide for managing documents like the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

airSlate SignNow comes with features such as document templates, real-time tracking, and customizable workflows. These tools enhance the management of important documents, including the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications, making your filing process more efficient.

-

Is airSlate SignNow cost-effective for small businesses needing the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With affordable pricing plans, you can easily manage and eSign your PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications without breaking the bank.

-

What are the benefits of using airSlate SignNow for the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

Using airSlate SignNow provides signNow benefits, including reduced turnaround times and enhanced security for your documents. By using our platform for your PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications, you can ensure compliance and keep your sensitive information secure.

-

Can I integrate airSlate SignNow with other software for handling the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software like CRM tools and accounting systems. This ensures that you can efficiently manage your PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications alongside other important business operations.

-

What support options are available for using airSlate SignNow with the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications?

airSlate SignNow provides comprehensive support options, including live chat, email support, and an extensive knowledge base. If you have questions about the PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications or need assistance, our support team is here to help.

Get more for PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

Find out other PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online