Personal Income Tax Forms PA Department of Revenue 2021

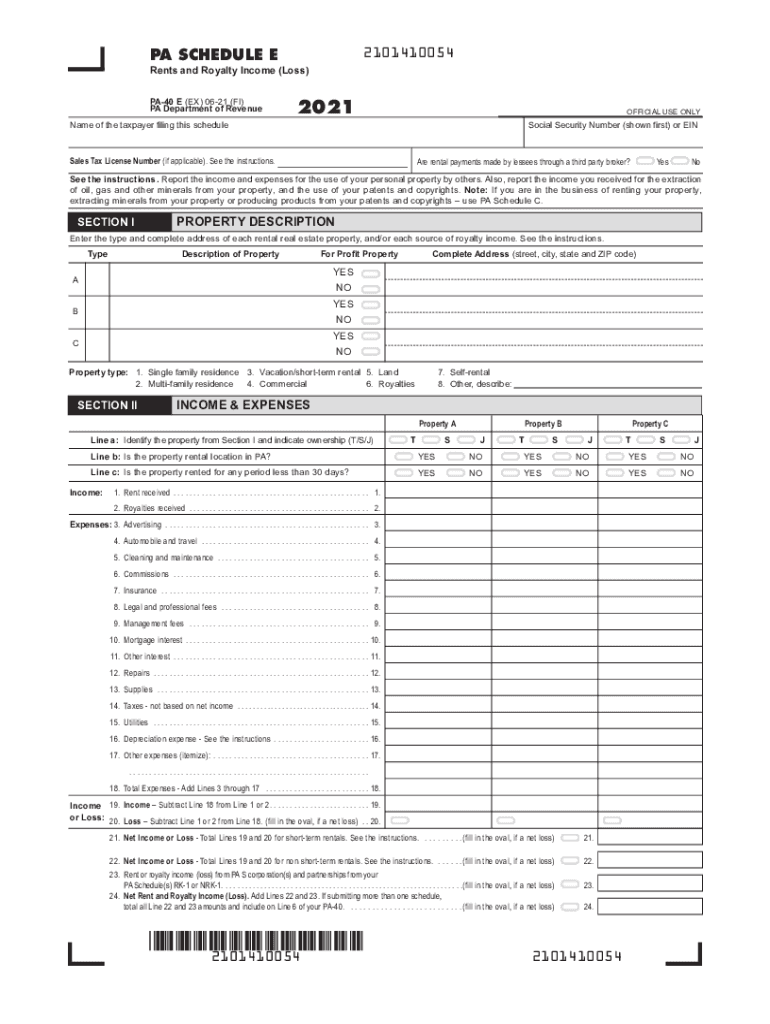

What is the Personal Income Tax Form PA Schedule E?

The Personal Income Tax Form PA Schedule E is a supplemental form used by Pennsylvania residents to report income from various sources, such as rental properties, partnerships, and S corporations. This form is essential for taxpayers who have income that is not reported directly on the main PA-40 form. Understanding the nuances of Schedule E is crucial for accurate tax reporting and compliance with state tax laws.

Steps to Complete the Personal Income Tax Form PA Schedule E

Completing the PA Schedule E involves several key steps to ensure accuracy and compliance:

- Gather necessary documents, including income statements and expense records related to rental properties or partnerships.

- Begin by filling out the top section of the form, which includes your personal information and the tax year.

- Report your income sources in the designated sections, detailing amounts earned from each property or partnership.

- Deduct any allowable expenses related to the income reported, such as maintenance costs or management fees.

- Review the completed form for accuracy before submitting it with your PA-40 tax return.

Legal Use of the Personal Income Tax Form PA Schedule E

The PA Schedule E must be completed in accordance with Pennsylvania state tax laws to be considered legally valid. This includes accurately reporting all income and expenses and ensuring that all figures are supported by appropriate documentation. Failure to comply with these regulations can result in penalties or audits from the Pennsylvania Department of Revenue.

Filing Deadlines for the Personal Income Tax Form PA Schedule E

Filing deadlines for the PA Schedule E typically align with the general Pennsylvania income tax return deadlines. Taxpayers should ensure that their PA-40 and accompanying schedules, including Schedule E, are filed by April 15 of the following year. If additional time is needed, taxpayers may file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Form Submission Methods for the Personal Income Tax Form PA Schedule E

Taxpayers have several options for submitting the PA Schedule E:

- Online Submission: Many taxpayers choose to file electronically using tax preparation software that supports Pennsylvania tax forms.

- Mail: Completed forms can be mailed to the Pennsylvania Department of Revenue. Ensure to use the correct address based on your location.

- In-Person: Some taxpayers may opt to deliver their forms in person at local tax offices, although this is less common.

Key Elements of the Personal Income Tax Form PA Schedule E

Understanding the key elements of the PA Schedule E is vital for accurate completion:

- Income Reporting: Clearly delineate all sources of income, including rental income and distributions from partnerships.

- Expense Deductions: Identify and document all allowable deductions to reduce taxable income.

- Signature and Date: Ensure the form is signed and dated to validate the submission.

Eligibility Criteria for the Personal Income Tax Form PA Schedule E

Eligibility to file the PA Schedule E generally includes Pennsylvania residents who earn income from sources outside of traditional employment. This includes individuals who own rental properties, are partners in a business, or receive income from S corporations. It is essential to review specific eligibility requirements to determine if this form applies to your tax situation.

Quick guide on how to complete 2021 personal income tax forms pa department of revenue

Effortlessly Manage Personal Income Tax Forms PA Department Of Revenue on Any Gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary template and securely keep it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Personal Income Tax Forms PA Department Of Revenue on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to edit and electronically sign Personal Income Tax Forms PA Department Of Revenue seamlessly

- Find Personal Income Tax Forms PA Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Personal Income Tax Forms PA Department Of Revenue and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 personal income tax forms pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2021 personal income tax forms pa department of revenue

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

How to create an e-signature for a PDF on Android OS

People also ask

-

What is the PA Schedule E?

The PA Schedule E is a form required by the Pennsylvania Department of Revenue for reporting income from rental properties, partnerships, and S corporations. Understanding how to properly complete the PA Schedule E can help ensure compliance and optimize your tax benefits.

-

How can airSlate SignNow help with PA Schedule E documentation?

airSlate SignNow simplifies the eSigning and document management process, making it easier to handle the necessary paperwork for your PA Schedule E. Our solution enables you to send, sign, and store your forms securely, ensuring hassle-free submissions.

-

Is there a cost associated with using airSlate SignNow for PA Schedule E?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that can assist with managing PA Schedule E forms, ensuring you find a cost-effective solution that suits your budget.

-

What features does airSlate SignNow offer for PA Schedule E processing?

AirSlate SignNow provides features such as customizable templates, secure storage, and real-time collaboration, which are particularly useful for completing PA Schedule E. These tools streamline the document workflow and enhance productivity for users managing tax-related forms.

-

Can I integrate airSlate SignNow with other software for my PA Schedule E?

Absolutely! AirSlate SignNow offers numerous integrations with popular software and applications, allowing seamless management of your PA Schedule E alongside your existing systems. This ensures you can efficiently handle all your documentation tasks without disruptions.

-

What are the benefits of using airSlate SignNow for PA Schedule E submissions?

Using airSlate SignNow for your PA Schedule E submissions offers signNow benefits, including time savings and enhanced accuracy. Our easy-to-use platform reduces the risk of errors and allows for quicker processing of your tax documents.

-

How secure is my information when using airSlate SignNow for PA Schedule E?

AirSlate SignNow takes security seriously, employing industry-standard encryption and compliance measures to protect your sensitive information while preparing your PA Schedule E. You can trust that your data remains confidential and secure throughout the process.

Get more for Personal Income Tax Forms PA Department Of Revenue

- Subcontractors agreement massachusetts form

- Option to purchase addendum to residential lease lease or rent to own massachusetts form

- Massachusetts prenuptial premarital agreement with financial statements massachusetts form

- Prenuptial agreement massachusetts form

- Amendment to prenuptial or premarital agreement massachusetts form

- Financial statements only in connection with prenuptial premarital agreement massachusetts form

- Revocation of premarital or prenuptial agreement massachusetts form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children massachusetts form

Find out other Personal Income Tax Forms PA Department Of Revenue

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement