PA Schedule E Rents and Royalty Income Loss PA 40 E FormsPublications 2020

Understanding the PA Schedule E for Rents and Royalty Income

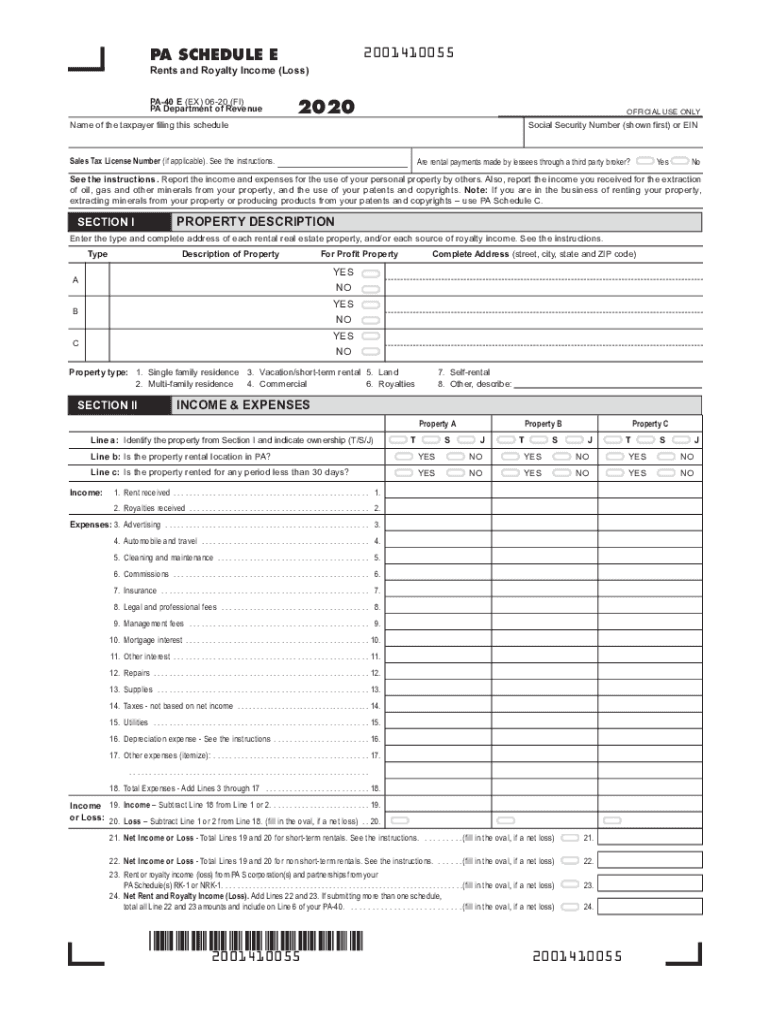

The PA Schedule E, also known as the PA-40 E, is a crucial form for individuals reporting rents and royalty income in Pennsylvania. This form allows taxpayers to detail income derived from rental properties, royalties, and other similar sources. It is essential for ensuring accurate reporting of income on your Pennsylvania tax return. The form is designed to capture specific details about the income and any associated losses, providing a clear picture for tax authorities.

Steps to Complete the PA Schedule E

Completing the PA Schedule E involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your rental and royalty income. This includes rental agreements, income statements, and any relevant expense records. Next, fill out the form by entering your total income from rents and royalties. Be sure to include any allowable deductions, such as maintenance costs or property taxes, which can help reduce your taxable income. Finally, review the completed form for accuracy before submitting it with your PA-40 tax return.

Filing Deadlines for the PA Schedule E

It is important to be aware of the filing deadlines associated with the PA Schedule E. Typically, the deadline for submitting your Pennsylvania state tax return, including the PA Schedule E, aligns with the federal tax deadline. For most taxpayers, this means the forms are due on April 15 of each year. However, if you require additional time, you may file for an extension, but ensure that any taxes owed are paid by the original deadline to avoid penalties.

Legal Use of the PA Schedule E

The PA Schedule E is legally recognized for reporting income from rental properties and royalties in Pennsylvania. To ensure that your submission is compliant, it is crucial to adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes accurately reporting all income and losses associated with your rental activities. Failure to comply with these regulations can result in penalties or additional scrutiny from tax authorities.

Required Documents for the PA Schedule E

When preparing to fill out the PA Schedule E, it is essential to gather all required documents. Key documents include:

- Rental agreements and leases

- Income statements from rental properties

- Records of expenses related to property maintenance

- Any 1099 forms received for royalty income

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Examples of Using the PA Schedule E

There are various scenarios in which the PA Schedule E is utilized. For instance, if you own a rental property and receive monthly rent payments, you would report this income on the PA Schedule E. Similarly, if you receive royalties from intellectual property or other sources, those earnings should also be included. Each example highlights the importance of accurately reporting all income types to ensure compliance with Pennsylvania tax laws.

Quick guide on how to complete 2020 pa schedule e rents and royalty income loss pa 40 e formspublications

Prepare PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly, without any holdups. Manage PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centered procedure today.

How to modify and eSign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications effortlessly

- Obtain PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with the tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 pa schedule e rents and royalty income loss pa 40 e formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2020 pa schedule e rents and royalty income loss pa 40 e formspublications

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What are the key features of the airSlate SignNow platform for managing 2018 pa schedule instructions?

airSlate SignNow offers a comprehensive suite of features to streamline the processing of 2018 pa schedule instructions. These include customizable templates, real-time collaboration, and robust electronic signature capabilities, ensuring a smooth workflow for your documents.

-

How does airSlate SignNow help businesses comply with 2018 pa schedule instructions?

By utilizing airSlate SignNow, businesses can ensure compliance with 2018 pa schedule instructions through secure document handling and electronic signatures that meet legal standards. The software allows for easy tracking and auditing of signed documents, providing peace of mind.

-

What is the pricing structure for airSlate SignNow when dealing with 2018 pa schedule instructions?

airSlate SignNow offers flexible pricing plans to accommodate various business needs while managing 2018 pa schedule instructions. Plans range from basic to advanced, with features that scale according to your requirements, making it both cost-effective and efficient.

-

Can airSlate SignNow integrate with other applications for better handling of 2018 pa schedule instructions?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing the management of 2018 pa schedule instructions. This allows users to connect with popular tools like Salesforce, Google Drive, and Office 365 for a streamlined experience.

-

Is training available for understanding 2018 pa schedule instructions in airSlate SignNow?

airSlate SignNow provides various training resources, including tutorials and webinars, to help users understand 2018 pa schedule instructions. These resources ensure you leverage the platform's capabilities for efficient document management.

-

What customer support options are available for assistance with 2018 pa schedule instructions?

airSlate SignNow offers robust customer support options for users working with 2018 pa schedule instructions. Support is available via live chat, email, and phone, ensuring you get the help you need promptly.

-

Can I access airSlate SignNow on mobile devices for 2018 pa schedule instructions?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage 2018 pa schedule instructions on the go. The mobile app provides a user-friendly experience for sending and signing documents anytime, anywhere.

Get more for PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

Find out other PA Schedule E Rents And Royalty Income Loss PA 40 E FormsPublications

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now