Form 3800 Instructions How to Fill Out the General Business 2022

Understanding Form 3800 Instructions

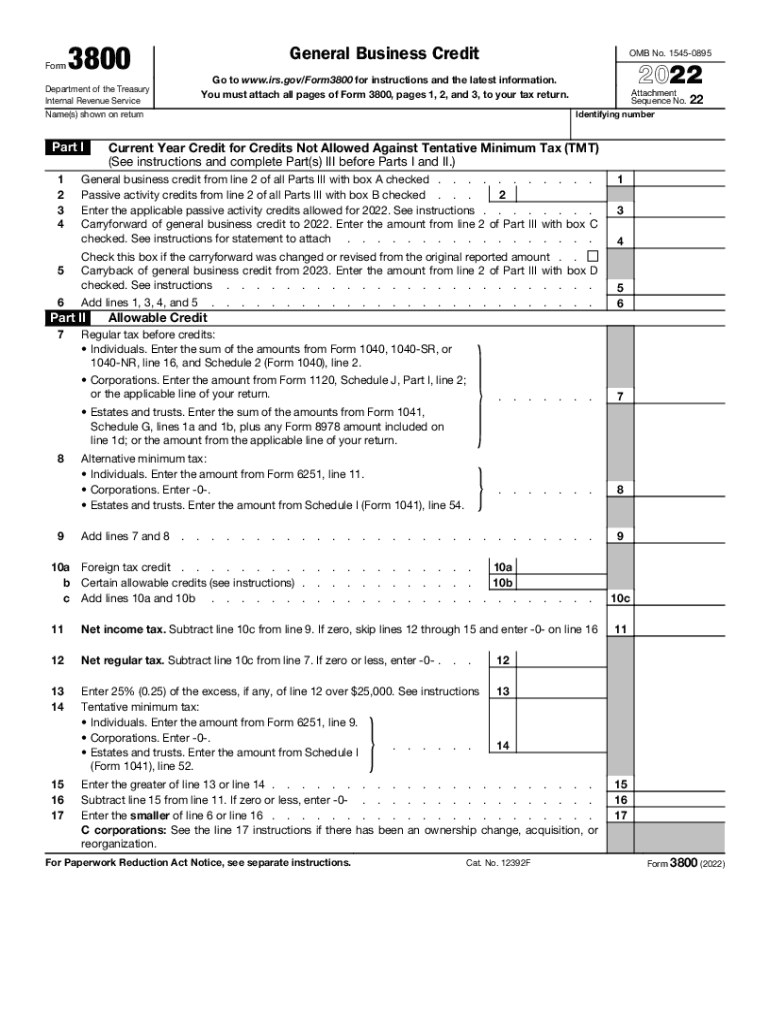

The Form 3800, officially known as the General Business Credit, is a crucial document for businesses seeking to claim various tax credits. This form consolidates multiple credits into one, simplifying the filing process for taxpayers. It is primarily used by corporations and partnerships to report their eligibility for specific tax benefits, which can significantly reduce their tax liability. Understanding the instructions for Form 3800 is essential for ensuring accurate completion and compliance with IRS regulations.

Steps to Complete the Form 3800

Filling out Form 3800 requires careful attention to detail. Here are the key steps to ensure proper completion:

- Gather necessary documentation, including records of all credits you are eligible to claim.

- Begin with Part I, where you will list the various credits you are claiming.

- Complete Part II to calculate the total amount of credits you can apply against your tax liability.

- Ensure that all calculations are accurate and that you have included any required supporting documentation.

- Review the entire form for completeness before submission.

Legal Use of Form 3800

Form 3800 must be completed and submitted in accordance with IRS guidelines to be considered legally valid. The form serves as a declaration of the taxpayer's intent to claim specific credits, and any inaccuracies or omissions can lead to penalties or disqualification from receiving the credits. It is essential to follow the instructions closely and ensure that all claims are substantiated with appropriate documentation.

Filing Deadlines and Important Dates

Timely filing of Form 3800 is crucial for taxpayers. The form should be submitted along with your annual tax return, typically due on April fifteenth for most businesses. Extensions may be available, but it is important to check the IRS guidelines for specific dates and any changes that may occur in a given tax year. Missing the deadline can result in lost credits and potential penalties.

Required Documents for Form 3800

To complete Form 3800 accurately, you will need several supporting documents, including:

- Records of all business activities that qualify for tax credits.

- Documentation of any prior year credits that may affect your current claim.

- Financial statements that support your eligibility for the credits listed.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Eligibility Criteria for Form 3800

Eligibility for the credits claimed on Form 3800 varies based on the specific credit types. Generally, businesses must meet certain criteria, such as:

- Being in operation during the tax year for which credits are claimed.

- Meeting specific industry requirements related to the credits.

- Having sufficient tax liability to utilize the credits effectively.

It is essential to review the eligibility criteria for each credit listed on the form to ensure compliance and maximize potential benefits.

Quick guide on how to complete form 3800 instructions how to fill out the general business

Prepare Form 3800 Instructions How To Fill Out The General Business effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly and without interruptions. Manage Form 3800 Instructions How To Fill Out The General Business on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 3800 Instructions How To Fill Out The General Business with ease

- Find Form 3800 Instructions How To Fill Out The General Business and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your changes.

- Select how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 3800 Instructions How To Fill Out The General Business and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3800 instructions how to fill out the general business

Create this form in 5 minutes!

How to create an eSignature for the form 3800 instructions how to fill out the general business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling form 3800 instructions?

airSlate SignNow offers a range of features that simplify the management of form 3800 instructions. Users can easily upload, edit, and share documents while ensuring that all signatures are legally binding. The platform also includes templates specifically for form 3800 instructions, making it easy to streamline your workflow.

-

How does airSlate SignNow ensure the security of my form 3800 instructions?

Security is a priority for airSlate SignNow when it comes to handling form 3800 instructions. The platform uses advanced encryption technologies to protect sensitive data, along with audit trails and user authentication to ensure that only authorized individuals can access or modify your documents.

-

Is there a trial available for testing the airSlate SignNow features related to form 3800 instructions?

Yes, airSlate SignNow offers a free trial that allows prospective users to explore its features, including those related to form 3800 instructions. This trial gives you a firsthand experience of how the platform can streamline your document management processes before committing to a paid plan.

-

What pricing plans does airSlate SignNow offer for clients who need to manage form 3800 instructions?

airSlate SignNow provides various pricing plans suited to different business needs, including those specifically needing to handle form 3800 instructions. Each plan provides flexible options to accommodate both small businesses and larger enterprises, along with the features required for efficient document signing and management.

-

Can I integrate airSlate SignNow with other software to manage form 3800 instructions?

Absolutely, airSlate SignNow offers seamless integrations with various third-party applications, which can enhance the management of form 3800 instructions. These integrations help you streamline workflows by connecting with your existing tools, ensuring a more efficient process when sending and signing documents.

-

What are the main benefits of using airSlate SignNow for form 3800 instructions?

Using airSlate SignNow for form 3800 instructions can signNowly improve efficiency and reduce the turnaround time for document management. The platform's user-friendly interface allows for quicker completion of documents and ensures compliance with legal standards, providing peace of mind for users.

-

How can I get support for issues related to form 3800 instructions on airSlate SignNow?

airSlate SignNow offers robust customer support to assist users with any issues related to form 3800 instructions. You can contact the support team via chat, email, or phone, and access a comprehensive knowledge base filled with articles and FAQs for self-help.

Get more for Form 3800 Instructions How To Fill Out The General Business

- Anthem prior authorization form pdf 24372576

- Dd 1750 example filled out form

- Abkc registration 478923020 form

- Sag aftra information sheet and application short film

- Wa certificate of fact form

- Motor vehicle services arizona department of transportation form

- Eligibility requirements follow all instructions form

- Dotuninsuredmotorist dot wi gov form

Find out other Form 3800 Instructions How To Fill Out The General Business

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now