Get the Internal Revenue Service Department of the 2020

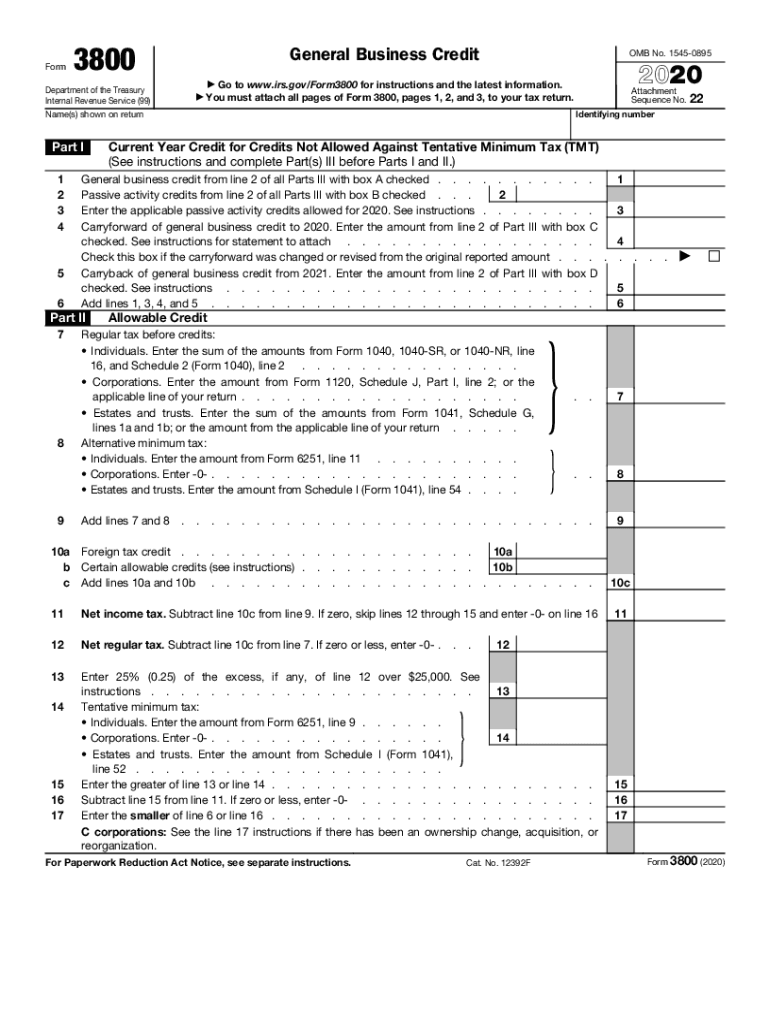

What is the IRS 3800 form?

The IRS 3800 form, officially known as the IRS General Business Credit Form 3800, is a crucial document used by businesses to claim various federal tax credits. This form consolidates multiple credits into one, allowing businesses to offset their tax liabilities. It is particularly important for small businesses and self-employed individuals who may qualify for credits such as the research credit, the work opportunity credit, and others. Understanding the specifics of this form can help businesses maximize their tax benefits while ensuring compliance with IRS regulations.

Steps to complete the IRS 3800 form

Completing the IRS 3800 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the credits you wish to claim. This may include records of qualified expenses, employee information, and other relevant data. Next, carefully fill out the form, starting with your business information and then detailing each credit you are claiming. It is essential to follow the instructions provided by the IRS to avoid errors. After completing the form, review it thoroughly for any mistakes before submission. Finally, submit the form along with your tax return, either electronically or via mail, depending on your filing method.

Legal use of the IRS 3800 form

The IRS 3800 form is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal validity, businesses must adhere to the requirements set forth in the Internal Revenue Code regarding eligibility for the various credits claimed. This includes maintaining proper documentation and records that substantiate the claims made on the form. Additionally, businesses should be aware of the legal implications of filing incorrectly, which could result in penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 3800 form align with the standard tax return deadlines for businesses. Typically, this means that the form must be submitted by the due date of your business tax return, which is usually March 15 for corporations and April 15 for sole proprietors. If you are filing for an extension, you must also file the IRS 3800 form by the extended deadline. It is crucial to stay informed about any changes in deadlines or additional requirements from the IRS to avoid penalties.

Required Documents

To complete the IRS 3800 form, several documents are required to support your claims for the various credits. These may include:

- Records of qualified expenses related to the credits you are claiming.

- Documentation proving eligibility for the credits, such as employee records for the work opportunity credit.

- Previous tax returns for reference and verification of claimed credits.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the IRS regulations when filing the 3800 form can result in significant penalties. These may include fines for inaccuracies, interest on unpaid taxes, and potential audits. Businesses that claim credits without proper documentation or that do not meet eligibility requirements may face additional scrutiny from the IRS. It is essential to ensure that all information provided on the form is accurate and supported by appropriate documentation to avoid these consequences.

Quick guide on how to complete get the internal revenue service department of the

Complete Get The Internal Revenue Service Department Of The effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Get The Internal Revenue Service Department Of The on any device with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and eSign Get The Internal Revenue Service Department Of The with ease

- Find Get The Internal Revenue Service Department Of The and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your adjustments.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to missing or lost files, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Get The Internal Revenue Service Department Of The and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the internal revenue service department of the

Create this form in 5 minutes!

How to create an eSignature for the get the internal revenue service department of the

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What are the key features of airSlate SignNow when signing documents 3800 online?

airSlate SignNow offers a range of essential features for signing documents 3800 online, including customizable templates, secure eSignatures, and real-time tracking. Users can easily create, send, and manage documents, ensuring a streamlined workflow. This comprehensive solution caters to various industries, enhancing productivity and collaboration.

-

How does pricing work for airSlate SignNow for using 3800 online services?

airSlate SignNow provides flexible pricing plans that accommodate different business needs when using 3800 online services. Options range from basic to advanced plans, ensuring affordability without compromising on features. You can choose a plan that fits your budget and allows your team to leverage advanced e-signature capabilities.

-

What are the benefits of using airSlate SignNow to manage documents 3800 online?

Using airSlate SignNow to manage documents 3800 online greatly enhances efficiency and reduces turnaround time. With features like automated reminders and mobile accessibility, businesses can streamline their signing processes. Additionally, the secure environment ensures that all documents remain confidential and compliant.

-

Can I integrate airSlate SignNow with other applications for 3800 online use?

Yes, airSlate SignNow supports a variety of integrations with popular applications, making it easy to use for 3800 online purposes. Whether it's CRM tools, storage services, or productivity platforms, seamlessly connecting these tools enhances your workflow. This integration capability helps businesses maintain consistency across their operations.

-

Is airSlate SignNow suitable for small businesses to handle documents 3800 online?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses looking to handle documents 3800 online. Its cost-effective solutions and user-friendly interface make it accessible for teams without extensive technical expertise. Small businesses can benefit signNowly from the efficiency and savings provided.

-

What security measures does airSlate SignNow implement for signing documents 3800 online?

Security is a top priority at airSlate SignNow, especially when signing documents 3800 online. The platform uses advanced encryption technologies to secure data and comply with industry regulations. Regular audits and secure storage ensure that your documents remain protected throughout the entire signing process.

-

Can I try airSlate SignNow for free before committing to 3800 online usage?

Yes, airSlate SignNow offers a free trial option, allowing users to experience the platform's features for handling documents 3800 online before making a commitment. This trial provides a risk-free opportunity to explore its functionalities and determine if it fits your business needs. Sign up and test how it can streamline your document processes.

Get more for Get The Internal Revenue Service Department Of The

- Personal information directory abundance canada

- Sinp second review form

- Xmc third party consent form xmcentrezca

- Lambeth window order form gentek

- Verification of student illness or injury university of toronto form

- Landlord tenant form region of durham

- Family caregiver benefit forms

- Declaration of mother or sponsor 408644136 form

Find out other Get The Internal Revenue Service Department Of The

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure