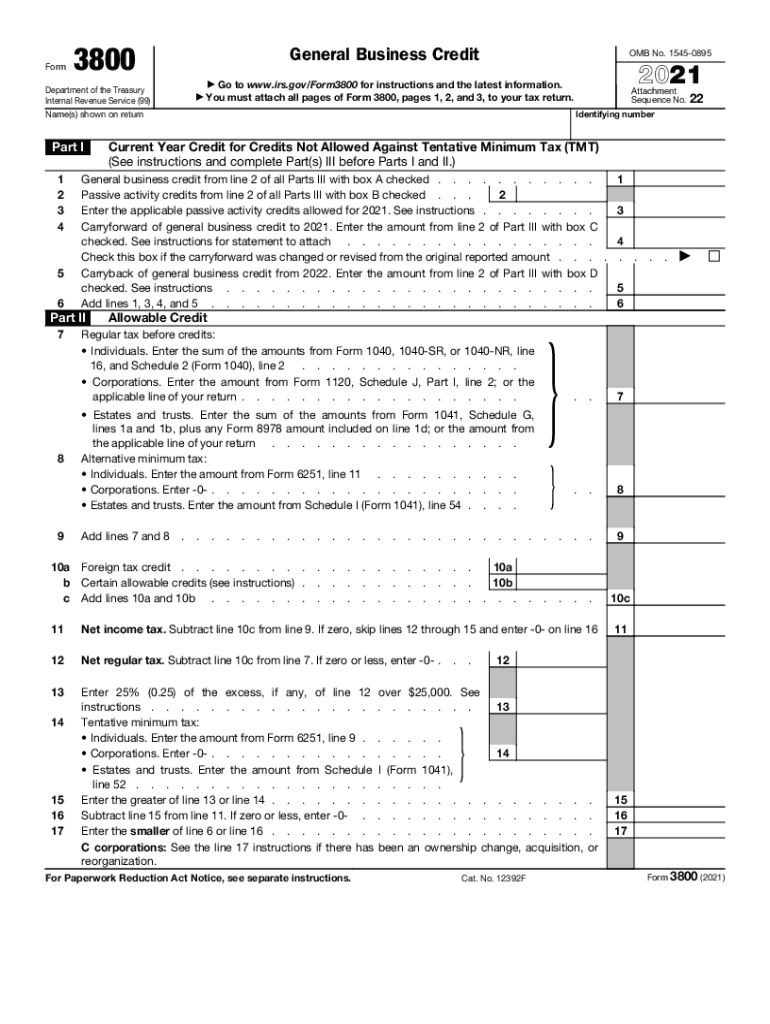

F3800 PDF Form 3800 General Business Credit Department 2021

What is the IRS Form 3800?

The IRS Form 3800, also known as the General Business Credit, is a tax form used by businesses to claim various tax credits. This form consolidates different credits into one application, allowing businesses to maximize their tax benefits. The credits included can range from investment credits to credits for hiring certain types of employees. Understanding the purpose of Form 3800 is essential for businesses looking to reduce their tax liabilities effectively.

Steps to Complete the IRS Form 3800

Completing the IRS Form 3800 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the credits you are claiming. This may include records of qualified expenditures or employee information. Next, fill out each section of the form, ensuring you provide accurate figures for the credits you are eligible for. After completing the form, review it carefully for any errors or omissions before submission. Finally, retain a copy for your records, as it may be needed for future reference or audits.

Eligibility Criteria for Form 3800

To qualify for the credits claimed on Form 3800, businesses must meet specific eligibility criteria. Generally, the business must be operating in the United States and must engage in activities that qualify for the available credits. For instance, certain credits may require the business to have made specific investments or to have hired employees from targeted groups. It is crucial for businesses to review the eligibility requirements for each credit included on the form to ensure compliance and maximize benefits.

IRS Guidelines for Form 3800

The IRS provides detailed guidelines for completing Form 3800, including instructions on which credits can be claimed and how to calculate them. These guidelines outline the necessary documentation and record-keeping requirements. Businesses should familiarize themselves with these instructions to ensure they are correctly claiming credits. Additionally, the IRS updates these guidelines periodically, so staying informed about any changes is essential for accurate filing.

Form Submission Methods for IRS Form 3800

Businesses can submit the IRS Form 3800 through various methods, including online filing, mail, or in-person submission at designated IRS offices. Online filing is often preferred for its speed and convenience, allowing for quicker processing times. When submitting by mail, it is important to send the form to the correct IRS address and to allow sufficient time for processing. In-person submission may be necessary in certain situations, such as when seeking immediate assistance or clarification from IRS representatives.

Penalties for Non-Compliance with Form 3800

Failure to comply with the requirements associated with Form 3800 can result in penalties. These may include fines for inaccurate filings or the denial of claimed credits. It is crucial for businesses to ensure that all information provided is truthful and complete. Additionally, keeping accurate records and documentation can help mitigate the risk of penalties in the event of an audit or review by the IRS.

Quick guide on how to complete f3800pdf form 3800 general business credit department

Complete F3800 pdf Form 3800 General Business Credit Department seamlessly on any device

Digital document management has become increasingly popular among enterprises and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Handle F3800 pdf Form 3800 General Business Credit Department on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and eSign F3800 pdf Form 3800 General Business Credit Department effortlessly

- Obtain F3800 pdf Form 3800 General Business Credit Department and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign F3800 pdf Form 3800 General Business Credit Department and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f3800pdf form 3800 general business credit department

Create this form in 5 minutes!

How to create an eSignature for the f3800pdf form 3800 general business credit department

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What is Form 3800 and how does it relate to airSlate SignNow?

Form 3800 is a crucial document used for claiming various tax credits. airSlate SignNow streamlines the process of sending, signing, and storing Form 3800 digitally, ensuring you can manage important documents efficiently and securely.

-

What features does airSlate SignNow offer for managing Form 3800?

airSlate SignNow offers a variety of features for managing Form 3800, including eSignature capabilities, document templates, and real-time collaboration tools. These features help simplify the preparation and submission process for tax-related documents like Form 3800.

-

Is there a free trial for using airSlate SignNow with Form 3800?

Yes, airSlate SignNow provides a free trial that allows users to explore its features and capabilities, including the management of Form 3800. This trial enables prospective customers to experience how easy it is to eSign and send documents digitally.

-

How does pricing work for airSlate SignNow when using Form 3800?

airSlate SignNow offers flexible pricing plans that cater to different business needs as you manage Form 3800. Pricing typically varies based on the features you require, such as advanced security, integrations, and the number of users in your organization.

-

Can I integrate airSlate SignNow with other applications for Form 3800 management?

Absolutely! airSlate SignNow can seamlessly integrate with various applications, enhancing your workflow when dealing with Form 3800. This includes popular tools like CRM, accounting software, and cloud storage solutions, making document management more efficient.

-

What are the security features of airSlate SignNow for Form 3800?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form 3800. The platform uses advanced encryption protocols, secure access controls, and compliance with industry regulations to ensure your documents are safe.

-

How long does it take to eSign a Form 3800 with airSlate SignNow?

eSigning Form 3800 with airSlate SignNow is quick and efficient. Generally, it takes just a few minutes for all parties to review and sign the document, enhancing productivity and speeding up the processing of your tax documents.

Get more for F3800 pdf Form 3800 General Business Credit Department

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497304562 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497304563 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective 497304564 form

- Hawaii corporation 497304565 form

- Hawaii dissolution form

- Living trust for husband and wife with no children hawaii form

- Living trust single form

- Living trust for individual who is single divorced or widow or widower with children hawaii form

Find out other F3800 pdf Form 3800 General Business Credit Department

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online