Form 3800 How to Fill Out the General Business Credit Tax 2024

What is the Form 3800?

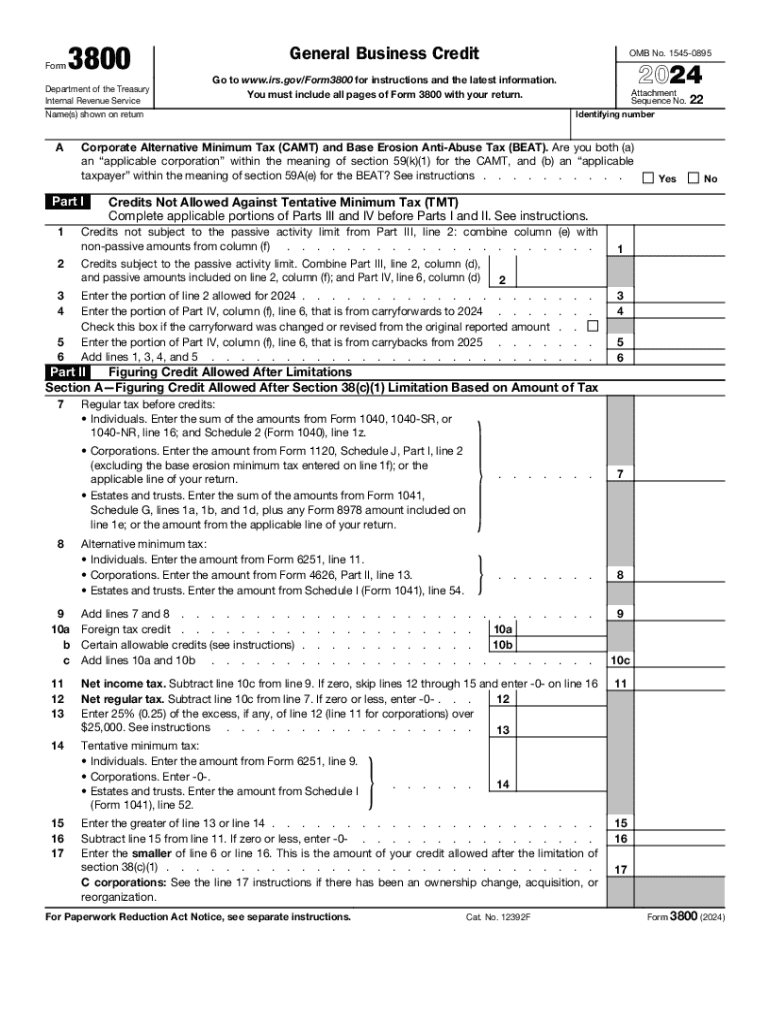

The 2020 Form 3800, also known as the General Business Credit, is a tax form used by businesses to report various tax credits. This form consolidates multiple credits into one, allowing businesses to claim credits for activities such as investment in research and development, hiring employees from targeted groups, and other qualifying expenditures. The form is essential for businesses looking to reduce their tax liability and maximize their financial benefits under U.S. tax law.

How to Fill Out the Form 3800

Filling out the 2020 Form 3800 requires careful attention to detail. Start by gathering all relevant information regarding the credits you are claiming. The form consists of several parts, each corresponding to different types of credits. Ensure you accurately complete each section, providing the necessary calculations and documentation. It is advisable to refer to the IRS instructions for Form 3800 to understand the specific requirements for each credit type.

Steps to Complete the Form 3800

To complete the 2020 Form 3800, follow these steps:

- Gather all necessary documentation related to the credits you are claiming.

- Fill out the identification section with your business information.

- Complete each part of the form, ensuring you provide accurate calculations for each credit.

- Attach any required schedules or forms that support your claims.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form 3800

Eligibility for the credits reported on the 2020 Form 3800 varies depending on the specific credit being claimed. Generally, businesses must meet certain criteria related to their activities, expenditures, or employee hiring practices. For example, some credits may require that the business operates in specific industries or that the credit is related to particular investments. It is crucial to review the eligibility requirements for each credit to ensure compliance.

IRS Guidelines for Using Form 3800

The IRS provides detailed guidelines for using the 2020 Form 3800. These guidelines outline the types of credits available, the calculation methods, and the necessary documentation for each credit. Businesses should familiarize themselves with these guidelines to ensure they are claiming credits correctly and to avoid potential penalties for non-compliance. The IRS instructions for Form 3800 are an essential resource for understanding these requirements.

Filing Deadlines for Form 3800

Filing deadlines for the 2020 Form 3800 align with the general tax filing deadlines for businesses. Typically, businesses must file their tax returns by April 15 of the following year. However, if you are filing for an extension, be sure to check the specific deadlines that apply to your situation. Timely submission is crucial to ensure that you can claim the credits for the tax year.

Create this form in 5 minutes or less

Find and fill out the correct form 3800 how to fill out the general business credit tax

Create this form in 5 minutes!

How to create an eSignature for the form 3800 how to fill out the general business credit tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the rules for carryover of tax credits?

An unused credit is a carryback to each of the 3 taxable years preceding the unused credit year and a carryover to each of the 7 taxable years succeeding the unused credit year. An unused credit must be carried first to the earliest of those 10 taxable years.

-

What are the limitations on the R&D tax credit?

R&D credit limitation A taxpayer can't both deduct research costs and claim a research credit for the same expenditure; there is no double tax benefit. Under I.R.C. §280C, a taxpayer must reduce the research expenditure deduction otherwise allowable by the amount of the research credit claimed.

-

How do you calculate the general business credit?

Steps to determine the claimable general business tax credit Step 1: Calculate 25% of net regular tax liability that exceeds $25,000. ... Step 2: Identify the greater value. ... Step 3: Subtract the greater value from net income tax to identify the credit.

-

How far back can you claim R&D tax credits?

Is there an R&D claim deadline — and how far back can I claim R&D credits? You have two years after the end of your accounting period to claim R&D Tax Relief. That is, two years after your research and development work took place.

-

What is a 3800 form on 1040?

What Is Form 3800. Form 3800 is used to calculate the sum of your general business tax credits available in a single tax year, including any credits carried over from previous years. If you are a startup that plans to claim one of the general business tax credits for your small business, you must file IRS Form 3800.

-

Can R&D credit be carried back?

Likewise, there's also a carryback. An R&D credit carryback may be used if an organization has suffered considerable losses in one year and would rather deduct from a previous year's profits.

-

Can you carry back R&D losses?

Carry back the loss. If the company made a taxable profit in previous periods the loss can be carried back to offset against previous taxable profits, this would provide a tax refund at the prevailing Corporation Tax rate of that period, currently 19%.

-

Can R&D credits be carried back?

In most situations, a company who has qualified research expenses but no income can carryforward the credit to offset tax liabilities on future profit. Any unused R&D credits will carry forward for up to 20 years. In addition to carryforwards, the research tax credit can also be carried back one year.

Get more for Form 3800 How To Fill Out The General Business Credit Tax

- Sentinel brand products form

- Sc8453 form

- Stormi giovanni suffixes ible and able pearson education answers form

- Gastatetax form

- 57 1 13 form of quitclaim deed effect 1 a conveyance of land le utah

- Worksheet punnett square reviewmr form

- Application for salvage title or non repairable certificate form

- Instructions mcs150comb no 21260013 expiration form

Find out other Form 3800 How To Fill Out The General Business Credit Tax

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself