About Form 3800, General Business Credit 2023

What is Form 3800, General Business Credit

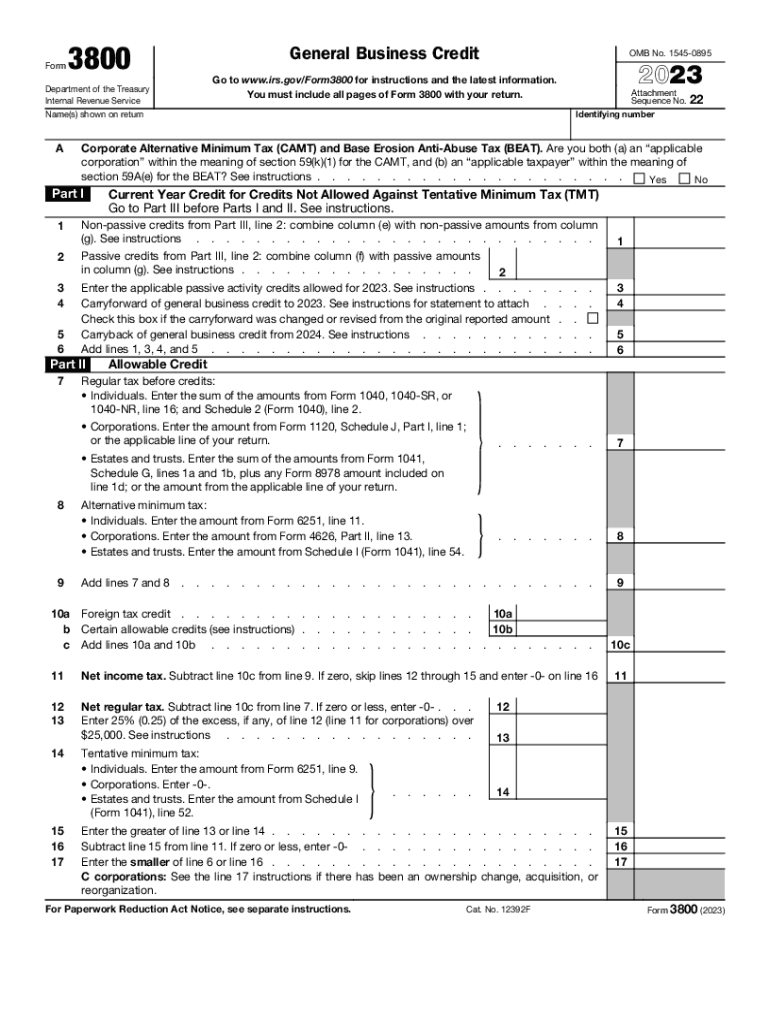

Form 3800, also known as the General Business Credit, is a tax form used by businesses to claim various tax credits. This form consolidates multiple credits into one, allowing businesses to reduce their tax liability effectively. The credits included can vary, but they often cover areas such as investment, research and development, and other business activities that the IRS incentivizes. Understanding how to utilize this form can significantly benefit businesses looking to maximize their tax savings.

Steps to Complete Form 3800

Completing Form 3800 involves several key steps:

- Gather necessary information about your business and the specific credits you are claiming.

- Complete the required sections of the form, ensuring that all information is accurate and up-to-date.

- Calculate the total credits available to you based on the activities and investments made during the tax year.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with your tax return to the IRS.

Eligibility Criteria for Form 3800

To qualify for the credits claimed on Form 3800, businesses must meet specific eligibility criteria. Generally, the business must be a qualified entity engaged in an eligible activity that qualifies for tax credits. Common examples include:

- Investments in qualified property.

- Research and development expenditures.

- Specific hiring incentives for employees from targeted groups.

Each credit has its own set of requirements, so it is essential to review the IRS guidelines related to each credit claimed.

IRS Guidelines for Form 3800

The IRS provides detailed guidelines for completing Form 3800, including instructions on how to calculate and claim each credit. It is important to follow these guidelines closely to ensure compliance and avoid any potential penalties. Key points include:

- Understanding the specific credits available under the General Business Credit.

- Maintaining accurate records of all qualifying expenses and investments.

- Filing the form within the applicable deadlines to ensure credits are applied for the correct tax year.

Filing Deadlines for Form 3800

Filing deadlines for Form 3800 align with the standard tax return deadlines. Typically, businesses must submit their tax returns by April fifteenth of the following year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is crucial to adhere to these deadlines to avoid late penalties and ensure that all credits are accounted for in a timely manner.

Form Submission Methods for Form 3800

Businesses can submit Form 3800 through various methods, including:

- Electronically, as part of an e-filed tax return.

- By mail, sending the completed form along with the tax return to the appropriate IRS address.

- In-person at designated IRS offices, although this method is less common.

Choosing the right submission method can help ensure that the form is processed efficiently.

Quick guide on how to complete about form 3800 general business credit

Effortlessly Prepare About Form 3800, General Business Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle About Form 3800, General Business Credit on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and Electronically Sign About Form 3800, General Business Credit with Ease

- Retrieve About Form 3800, General Business Credit and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and select the Done button to save your modifications.

- Decide how you wish to send your form via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign About Form 3800, General Business Credit and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 3800 general business credit

Create this form in 5 minutes!

How to create an eSignature for the about form 3800 general business credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the pricing options for airSlate SignNow 3800?

airSlate SignNow offers flexible pricing plans that start at just $3800 annually for businesses. This competitive pricing allows organizations of all sizes to access premium eSigning features without breaking the bank. Customers can also opt for monthly subscriptions depending on their needs.

-

What features does airSlate SignNow 3800 provide?

With airSlate SignNow 3800, users gain access to a comprehensive suite of eSignature tools, including automated workflows, customizable templates, and real-time tracking. These features enhance the signing experience, making it more efficient for both senders and signers. Additionally, advanced security measures ensure that all documents are securely managed.

-

How can airSlate SignNow 3800 benefit my business?

airSlate SignNow 3800 empowers businesses by streamlining the document signing process, reducing the turnaround time for contracts and agreements. By eliminating the need for physical signatures, it saves time and resources, allowing teams to focus on more strategic tasks. Businesses can expect increased productivity and faster closure rates.

-

Is airSlate SignNow 3800 easy to integrate with other tools?

Yes, airSlate SignNow 3800 integrates seamlessly with various business applications like Salesforce, Google Drive, and others. This makes it easy for organizations to streamline their workflows and improve collaboration across platforms. The integration process is user-friendly and requires minimal technical expertise.

-

What kind of customer support is available for airSlate SignNow 3800 users?

Customers using airSlate SignNow 3800 have access to dedicated support through various channels, including live chat, email, and phone support. Additionally, a rich library of resources, including tutorials and FAQs, is available to help users maximize their experience. This ensures that any issues can be resolved quickly.

-

Can airSlate SignNow 3800 help with compliance and security?

Absolutely! airSlate SignNow 3800 puts a strong emphasis on compliance and security, meeting all major regulations such as GDPR and HIPAA. The platform provides advanced encryption and audit trails to ensure that all eSigned documents are secure and legally binding. This is crucial for businesses needing to maintain compliance in sensitive industries.

-

Are there any mobile capabilities with airSlate SignNow 3800?

Yes, airSlate SignNow 3800 is fully optimized for mobile devices, allowing users to send and sign documents on-the-go. This convenience enhances productivity, as users can manage their eSigning tasks anytime and anywhere. The mobile app is user-friendly and designed to meet the needs of busy professionals.

Get more for About Form 3800, General Business Credit

- Pressure test plan form pressure systems

- Standard product information

- Residential claim for food and medicine spoilage 2015 2019 form

- Btelesearchb inc instructions po box 673 name ssn 1 form

- Postal address 22037 hamburg form

- A member of the malca amit group of companies form

- Ikea centennial form

- Clt cra ltr consumer report request 100314 v1docx form

Find out other About Form 3800, General Business Credit

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe