Form 14039 Sp Rev 12 2022

What is the Form 14039?

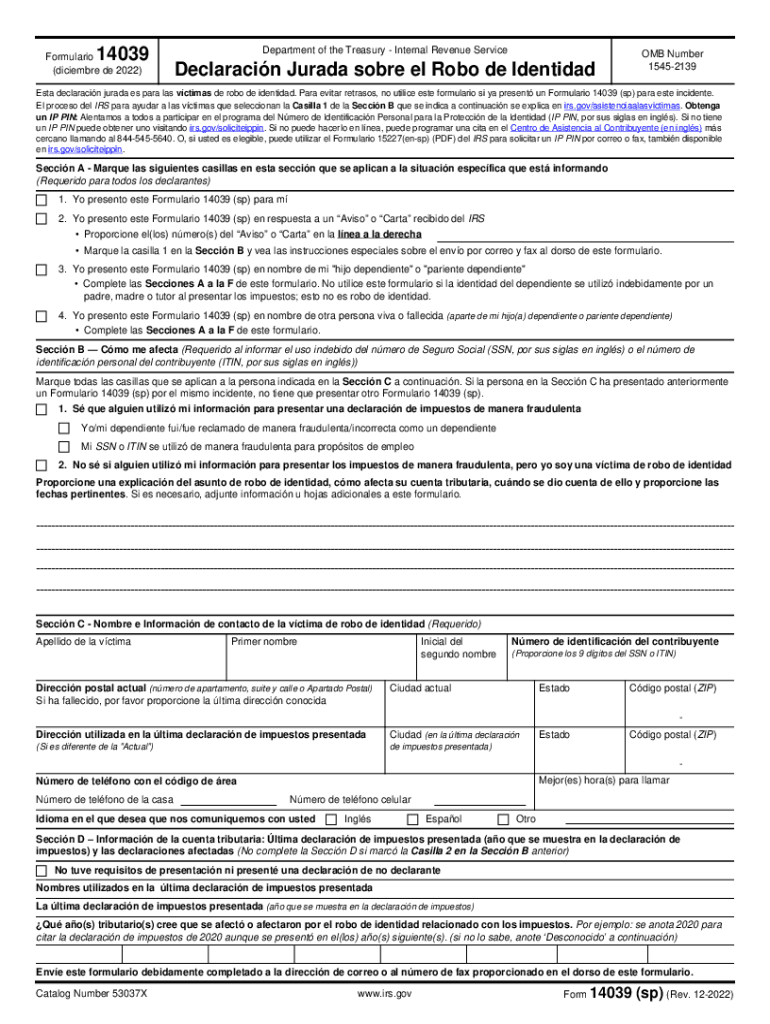

The Form 14039, also known as the Identity Theft Affidavit, is a document used by individuals who believe they are victims of identity theft. This form is essential for reporting unauthorized use of personal information, particularly in relation to tax issues. By submitting this affidavit, taxpayers can alert the IRS to fraudulent activities associated with their Social Security number or other personal identifiers. The completion of this form is a crucial step in protecting oneself from further identity theft and resolving any tax-related issues that may arise from such incidents.

How to Use the Form 14039

Using the Form 14039 involves several key steps. First, individuals must accurately fill out the form, providing detailed information about the identity theft incident. This includes personal identification details, a description of the theft, and any relevant documentation that supports the claim. Once completed, the form should be submitted to the IRS, either online or via mail, depending on the specific instructions provided. It is important to retain a copy of the submitted form and any related documents for personal records and future reference.

Steps to Complete the Form 14039

Completing the Form 14039 requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by downloading the form from the IRS website or accessing it through a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide a detailed explanation of the identity theft incident, including dates and any known fraudulent activities.

- Attach any supporting documents, such as police reports or correspondence related to the identity theft.

- Review the completed form for accuracy before submission.

Legal Use of the Form 14039

The Form 14039 serves a legal purpose in the context of identity theft. When submitted to the IRS, it acts as an official declaration of identity theft, which can help protect taxpayers from liability for fraudulent tax returns filed in their name. The information provided on the form is used by the IRS to investigate and resolve issues related to tax fraud. It is important to ensure that all information is truthful and accurate, as providing false information could lead to legal consequences.

Required Documents for Submission

When submitting the Form 14039, it is essential to include certain documents to support your claim. These may include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any police reports filed regarding the identity theft.

- Correspondence from the IRS or other entities that indicate fraudulent activity.

- Any additional documentation that substantiates your claim of identity theft.

IRS Guidelines for Filing

The IRS provides specific guidelines for filing the Form 14039. It is recommended to submit the form as soon as identity theft is suspected to mitigate potential tax-related issues. The IRS may require additional information or documentation during their investigation, so maintaining open communication is vital. Additionally, taxpayers should monitor their accounts and credit reports regularly for any signs of further identity theft.

Quick guide on how to complete form 14039 sp rev 12 2022

Effortlessly prepare Form 14039 sp Rev 12 on any device

Digital document management has become increasingly popular among organizations and individuals alike. It offers a viable eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form 14039 sp Rev 12 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 14039 sp Rev 12 with ease

- Find Form 14039 sp Rev 12 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Underline important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Form 14039 sp Rev 12 and ensure effective communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14039 sp rev 12 2022

Create this form in 5 minutes!

How to create an eSignature for the form 14039 sp rev 12 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'fillable identity 2016' in airSlate SignNow?

The term 'fillable identity 2016' refers to customizable forms within airSlate SignNow that allow users to capture specific information efficiently. These fillable forms enhance document workflows by making data gathering straightforward and organized. By using this feature, businesses can streamline their processes and ensure accurate information collection.

-

How does airSlate SignNow handle pricing for 'fillable identity 2016'?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes utilizing the 'fillable identity 2016' feature. Each plan is designed to provide comprehensive access to create, manage, and sign fillable forms efficiently. By choosing the right plan, businesses can maximize their return on investment while enjoying signNow savings.

-

What are the key features of 'fillable identity 2016'?

'Fillable identity 2016' provides several features, including customizable templates, real-time collaboration, and automated workflows. This functionality allows users to create tailored forms that meet specific requirements, making it ideal for various industries. Additionally, it ensures a secure and compliant signing process, enhancing the overall user experience.

-

How can 'fillable identity 2016' benefit my business?

Utilizing 'fillable identity 2016' can signNowly improve efficiency and accuracy in document handling. It allows teams to gather necessary data quickly and reduces the risk of human error. Furthermore, implementing this feature fosters better communication among team members and accelerates decision-making processes.

-

Can I integrate 'fillable identity 2016' with other applications?

Yes, airSlate SignNow allows for seamless integration of 'fillable identity 2016' with various third-party applications. This connectivity ensures that your business can synchronize data across platforms, enhancing productivity and workflow automation. Integrating with tools your team already uses boosts overall efficiency and complements your existing processes.

-

Is 'fillable identity 2016' user-friendly?

Absolutely! The 'fillable identity 2016' feature is designed with user experience in mind, making it easy for anyone to create and manage fillable forms. Even those with minimal tech skills can navigate the system effortlessly. This user-friendly interface enables teams to adopt and utilize the tool effectively without extensive training.

-

What kind of support is available for 'fillable identity 2016' users?

airSlate SignNow provides dedicated support for all users incorporating 'fillable identity 2016' into their document workflows. Whether you need assistance with setup, troubleshooting, or advanced features, our support team is available via multiple channels. This ensures you can get the help you need to maximize the benefits of your fillable forms.

Get more for Form 14039 sp Rev 12

- Osha 30 test questions and answers pdf form

- Gauteng department of education database registration forms

- Meddata critical care form

- Bank of america voided check pdf form

- Snap award letter online texas form

- Private investigator contracts forms

- Childrens health questionnaire form

- Seller interview form with updates 06 16 1 doc

Find out other Form 14039 sp Rev 12

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF