Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version 2020

Understanding the IRS Form 14039 Affidavit

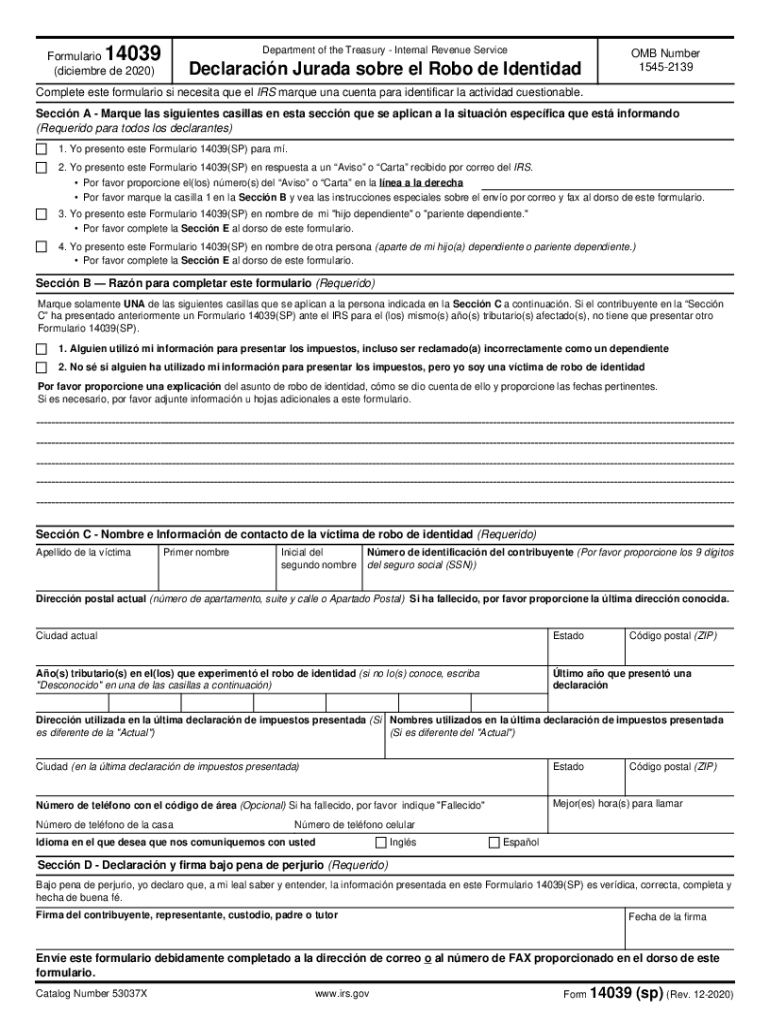

The IRS Form 14039, also known as the Identity Theft Affidavit, is a crucial document for individuals who suspect they have been victims of identity theft. This form allows taxpayers to report identity theft incidents to the IRS, which can help resolve issues related to fraudulent tax returns or accounts. By completing this affidavit, individuals can assert their identity and seek assistance in rectifying any tax-related complications stemming from identity theft.

Steps to Complete the IRS Form 14039

Completing the IRS Form 14039 involves several important steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and Social Security number. Next, clearly describe the nature of the identity theft, detailing any fraudulent activities you have encountered. Be sure to sign and date the form, as this is essential for its validity. After completing the form, submit it to the IRS according to the provided instructions, either online or via mail.

Legal Use of the IRS Form 14039

The IRS Form 14039 serves a significant legal purpose in the context of identity theft. By filing this affidavit, individuals formally notify the IRS of their situation, which can protect them from being held liable for taxes owed on fraudulent returns. It is important to understand that this form is a legal declaration, and providing false information can lead to serious consequences. Therefore, accuracy and honesty are paramount when filling out the affidavit.

Filing Deadlines and Important Dates

When dealing with the IRS Form 14039, it is essential to be aware of any relevant deadlines. While there is no specific deadline for submitting the affidavit itself, it is advisable to file it as soon as you suspect identity theft. Prompt action can help mitigate potential tax complications. Additionally, keep in mind that the IRS may have specific timelines for responding to identity theft claims, so staying informed about these dates can be beneficial.

Form Submission Methods

The IRS Form 14039 can be submitted through various methods, providing flexibility for individuals. You may choose to file the form online through the IRS website or submit it via mail. If opting for the mail submission, ensure that you send it to the correct address as outlined in the form instructions. Each method has its own processing times, so consider your situation when deciding how to submit the form.

Required Documents for Filing

When completing the IRS Form 14039, you may need to provide additional documentation to support your claim. This can include copies of any fraudulent tax returns, notices from the IRS indicating issues with your account, or any other relevant correspondence. Having these documents ready can facilitate the process and help the IRS understand your situation more clearly.

IRS Guidelines for Identity Theft Reporting

The IRS has established specific guidelines for reporting identity theft, which are crucial for individuals filing Form 14039. These guidelines outline the steps to take if you suspect identity theft, including how to protect your personal information and what to do if you receive a notice from the IRS regarding a suspicious tax return. Familiarizing yourself with these guidelines can enhance your understanding of the process and ensure that you are taking the right steps to protect your identity.

Quick guide on how to complete form 14039 sp rev 12 2020 identity theft affidavit spanish version

Effortlessly Prepare Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version on Any Device

The management of documents online has become increasingly popular among organizations and individuals. It serves as an optimal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it in the cloud. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version with Ease

- Find Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14039 sp rev 12 2020 identity theft affidavit spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 14039 sp rev 12 2020 identity theft affidavit spanish version

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is an IRS 14039 Affidavit?

The IRS 14039 Affidavit is a form used to report identity theft to the Internal Revenue Service. Submitting this affidavit helps victims claim their tax-related identity theft and protect their personal information. Understanding the IRS 14039 Affidavit is crucial for anyone who suspects fraudulent activity on their tax account.

-

How can airSlate SignNow help with the IRS 14039 Affidavit?

airSlate SignNow offers a streamlined process for signing and sending the IRS 14039 Affidavit securely. With our easy-to-use interface, users can efficiently complete and eSign the affidavit, ensuring that it is filed promptly. This simplifies the process and reduces the chance of errors or delays.

-

Is there a cost associated with using airSlate SignNow for the IRS 14039 Affidavit?

Yes, airSlate SignNow offers various pricing plans suitable for individuals and businesses. While there may be an associated cost, the benefits of efficiency and security when handling the IRS 14039 Affidavit often outweigh the expense. Consider exploring our plans to find the best fit for your needs.

-

What features make airSlate SignNow ideal for managing the IRS 14039 Affidavit?

Key features of airSlate SignNow include advanced security measures, document tracking, and user-friendly eSigning capabilities. These tools help ensure that your IRS 14039 Affidavit is handled securely and can be easily monitored throughout the signing process. Our platform is designed to enhance user experience and streamline document management.

-

Can I use airSlate SignNow for other IRS forms besides the 14039 Affidavit?

Absolutely! airSlate SignNow supports a range of IRS forms, making it a versatile tool for tax-related document management. Users can easily prepare, sign, and send various IRS forms in addition to the IRS 14039 Affidavit, facilitating smoother tax processing and compliance.

-

What are the benefits of eSigning the IRS 14039 Affidavit online?

eSigning the IRS 14039 Affidavit online saves time and ensures a secure submission process. With airSlate SignNow, users can quickly finalize their documents from anywhere, increasing convenience and reducing paperwork. This approach not only enhances efficiency but also helps protect sensitive information.

-

Does airSlate SignNow integrate with other software I use for tax preparation?

Yes, airSlate SignNow offers integrations with various popular tax preparation software, allowing for seamless document management. This means you can easily incorporate the eSigning process for the IRS 14039 Affidavit into your existing workflow. Integrations help enhance productivity and ensure compliance.

Get more for Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version

Find out other Form 14039 SP Rev 12 Identity Theft Affidavit Spanish Version

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast